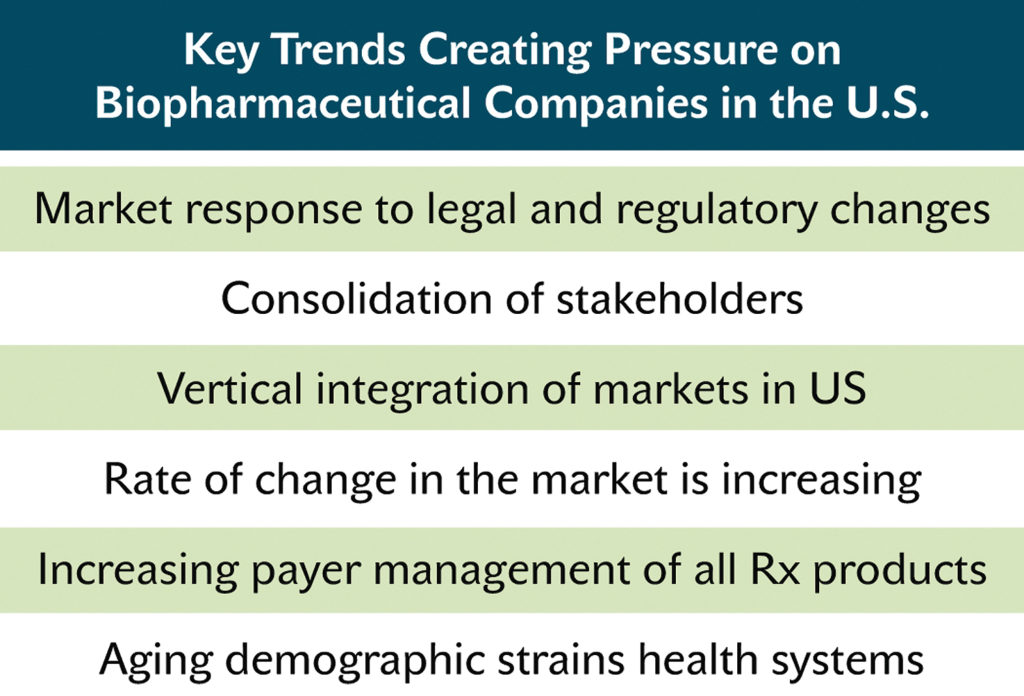

Change is inevitable in any industry, but the rate of change in the pharmaceutical industry is particularly disruptive to business as usual. Product portfolios are migrating from mass-market blockbuster drugs to highly specialized therapies targeted to relatively small patient populations. Reimbursement is becoming increasingly complex and successful commercialization means addressing multiple stakeholders before a prescription is even written. Vertical integrations in major metropolitan areas are shutting out traditional sales rep/physician interaction. Plus consumers are facing high-deductible health plans and demanding greater value from their medications.

This rapidly changing environment is even more difficult to navigate for a successful industry with a track record of being slow to embrace change. Yet this seismic shift in healthcare, from one of supply to that of demand-led, necessitates a new commercialization vision that addresses the long term. Efficiency and effectiveness are the goals as the pressure mounts within pharma to maintain or improve ROI by optimizing its investment.

A Transforming Landscape Impacts Commercialization

Power is shifting in the current healthcare landscape, impacting the pharmaceutical industry in ways not before envisioned. For example, payers, health systems, and patients are now dictating terms that were previously always physician driven. What are three key drivers of these changes and how do they impact the commercialization process?

1. One need only look to the extensive changes in product and service portfolios to see a significant change catalyst. The loss of blockbuster primary drugs, and the need to address legal and regulatory pressures, has forced many companies to look at mergers and acquisitions to grow their portfolios. Although these moves might offer pathways into treatments and medicines not previously held, these new specialized treatments and therapies require a far different commercialization process to reach the market.

For example, a pharmaceutical company might now look to offer a combination of medical, nutritional, and exercise professionals, as well as direct communication channels with its patients, to deliver better patient outcomes in some chronic diseases, rather than attempt to reach hard-pressed primary healthcare providers.

2. Another significant driver of change is pricing. Not only is there movement to tie reimbursement directly to patient outcome, exacerbated by an aging demographic, but pharmaceutical companies must now manage an increasingly complex process to achieve placement on formularies that patients can afford to access. Having the bandwidth to negotiate market access with multiple stakeholders is a necessity. However, this only goes so far in the commercialization process, as having the medicine available for prescribing is not enough. The industry now needs to make sure the treatment is used properly to improve patient outcomes, requiring medical staff training and patient support programs to aid adherence

3. The change in the number and types of stakeholders the industry must now consider in its commercialization process is staggering. Yet, if pharma fails to address each, it risks losses it can ill afford. As a result, pharma must now have communication plans that resonate with a diverse range of stakeholders including multiple private and government payers and healthcare practitioners ranging from hospitals, integrated delivery networks (IDNs), physician groups, and pharmacists. In addition, patients, patient caregivers, and their support groups must be part of the communication mix. All have a role to play in bringing the therapy to market and achieving positive outcome.

Complicate this outreach with the increasing reliance on the ever-changing, 24-7 digital channels of communication, and it becomes quickly apparent that achieving commercialization success across a portfolio using existing resources is no longer viable.

Shifting the Focus in This Time of Flux

Shifting the Focus in This Time of Flux

Despite the enormity of the diversity of change facing the industry, solutions are being put in place throughout the industry in this time of flux that will form the basis of commercialization success in the long term. The key will be to remain nimble as the healthcare industry continues to shake out.

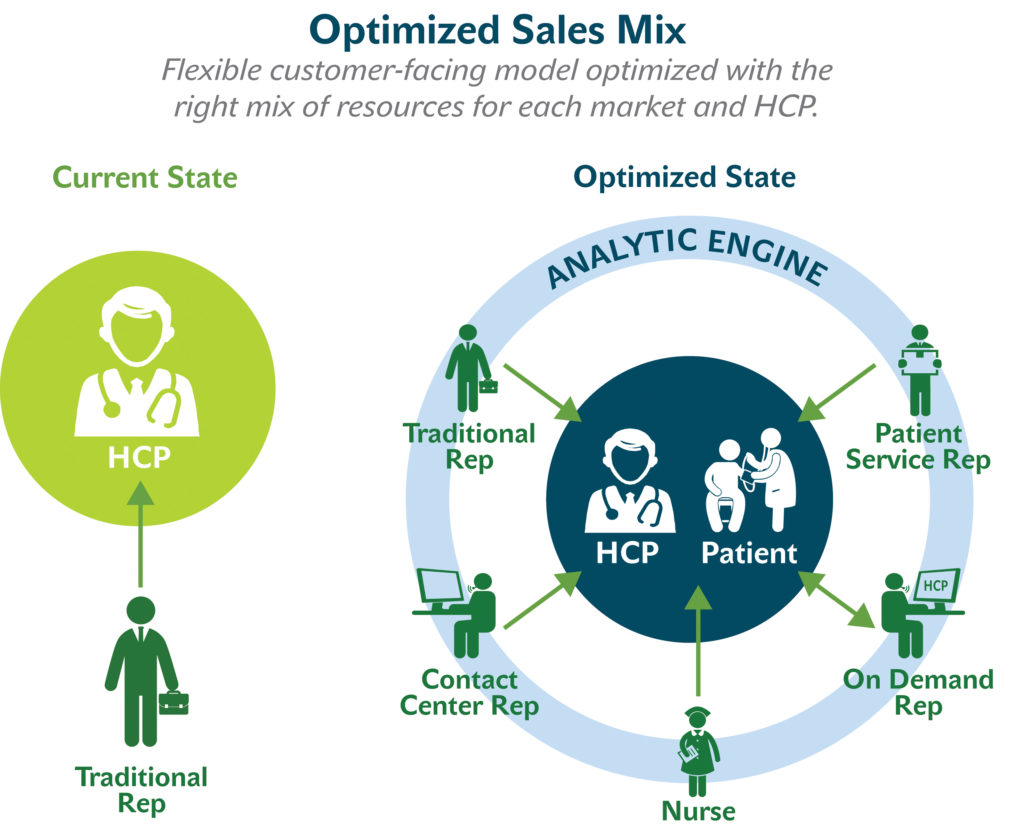

Much has been written over the past few years about the changing selling model. Companies experience both success and failure as they seek optimum solutions. What the industry has learned from this ever-evolving model is that flexible, scalable, custom-tailored field engagements are key—and having them at lower cost is even better.

Each territory may require its own unique approach depending on disease frequency, payers, the type of healthcare systems, difficulties with traditional physician access within specific disease modalities, and the list goes on.

Key account managers may need to oversee contact and medical science liaisons to drive the scientific messaging, while customer service teams handle product sample and literature drops. Certain therapies may require patient support, such as nurse educators deployed to help the patient understand and adhere to their medication. These nurses might also be used to educate office staff on the treatment and how to profile patients properly. Market access representatives may also interact with sales representatives to keep them apprised of formulary changes. Outbound contact centers may be used in hard-to-reach geographies or to cover white space, while inbound centers may serve the physician with on-demand e-details and product support.

Using these various sales teams efficiently is key to long-term success, but to keep outreach manageable and cost-effective, companies have to tackle the issue of data. We can move forward with a plan optimizing territory segmentation and targeting only by tapping the data from an analytic engine that accounts for physician channel and level preferences for communication.

Perhaps the most impactful shift in focus: Becoming patient centric. Patient centricity is the anthem to which we all march, but truly engaging with the patient requires a process of listening and interacting, often before the patient is even diagnosed. To be effective with patients, one should develop patient support programs (PSPs) that take into consideration all the players within today’s healthcare delivery model: The patient and caregiver, physician, specialty pharmacy, reimbursement support, MSL and/or sales rep, the payer and nurse educator, and all of this within a financial and global construct. The goal in each PSP should be to contain costs by improving adherence, reducing readmissions, and achieving better outcomes.

Enabling Change through Strategic Partnerships

Enabling Change through Strategic Partnerships

With all of these factors in play, pharmaceutical companies must look to design comprehensive, multi-disciplinary offers. In many instances, it may be more efficient and effective to align with a strategic partner who already has established expertise in these areas and can provide flexible, and if necessary, short-term assistance to reach a targeted market. Contract sales organizations (CSOs) are often called upon to provide that partnership and offer potential risk management.

While the pharmaceutical industry was reacting to and transforming from the shifting healthcare landscape, CSOs also were evolving from providers of mirrored sales teams to offering multichannel, data-based solutions. In order to survive, CSOs began a shift from transactional client relationships to strategic partnerships. Recognizing the need to stay ahead, they are investing heavily in digital platforms, contact centers, and multiple levels of representatives with face-to-face selling experience. Further, the savviest organizations are utilizing data and analytics to optimize the selling mix that may include call center reps, nurses, traditional field-based reps, MSLs, and others. As a result they stand poised to leverage their expertise and partner with the industry to enable change.

Three Key Elements that Drive CSO Engagement

In 2017, Ashfield held an Advisory Board session with leading pharmaceutical companies to explore the perceived value CSOs currently bring to the table and how the industry sees this partnership evolving in the future. The Advisory Board was unanimous in determining that “speed, flexibility, and risk mitigation are the primary drivers for engaging with CSOs. Today’s CSOs enable their clients to be agile, deploying staff more quickly on urgent projects and realizing more opportunities. They also provide the ability to cut costs rapidly, without liability, when a new product doesn’t sell to expectation.”

However, moving from commoditized services to strategic partnership requires a long-term approach from both the CSO and client. The Advisory Board considered the characteristics of such a scenario to be:

“We believe the most significant factor dictating the breadth of the strategic partnership will center on the CSO’s ability to deliver data-driven solutions through a strategic optimization lens. As mentioned earlier, having an analytic engine to optimize the sales mix will be a “must-have” in the future vision. It should deliver a flexible customer-facing model optimized with the right mix of resources for each market and HCP.”

“We believe the most significant factor dictating the breadth of the strategic partnership will center on the CSO’s ability to deliver data-driven solutions through a strategic optimization lens. As mentioned earlier, having an analytic engine to optimize the sales mix will be a “must-have” in the future vision. It should deliver a flexible customer-facing model optimized with the right mix of resources for each market and HCP.”

When used in partnership with a CSO, such analytics could drive the sales plan but also determine such refinements as where white space geographies are located and how to staff them with the optimal resource mix; performing HCP-level targeting analytics to identify low-value HCPs that could be profitably targeted by CSO reps, but not by pharma reps; or rapidly determining HCPs most impacted by formulary changes and redeploy resources against them.

In Conclusion

As a result of all these extensive and transformative changes, the pharmaceutical industry must evolve its core strategies to meet these multi-faceted challenges in order to achieve commercial success in the long term. Addressing sales models, patient support, and effectively using data analytics will put the industry on firm footing in the future. Contract sales organizations employing a mix of resources and channels to address brand and access challenges are well-positioned to provide new commercial models to the sector, thereby enhancing their customers’ product offerings and enabling them to focus on their core capabilities in drug development.