Payers (Aetna, BCBS, Humana, etc.) are very aware of the power they hold over companies marketing products as well as how much the company’s value increases when its new product is added to the formulary. Payers also recognize the impact a preferred position on the formulary will have on a new product’s future success. It’s a major point of leverage.

Many people and companies believe payers only care about money, but that isn’t the whole truth. In fact, payers resent pharma’s continuing efforts to introduce new products that have marginal benefit to patients and physicians while then expecting them to not negotiate heavily on price. To better understand what payers want and what factors into their decisions, it is time pharma takes an inside look into the minds of payers. More specifically, the Medical Directors who sit on the formulary committees and have tremendous influence over whether a plan needs to add a new product.

It’s the Medical Directors who determine whether the new product is a game changer, a meaningful improvement versus products already being used, or a me-too with some slight advantages. Their assessments have been very predictive of how the plan will respond as far as access and price pressure, but also, how the product ultimately performs in the market. They have a lot they must consider.

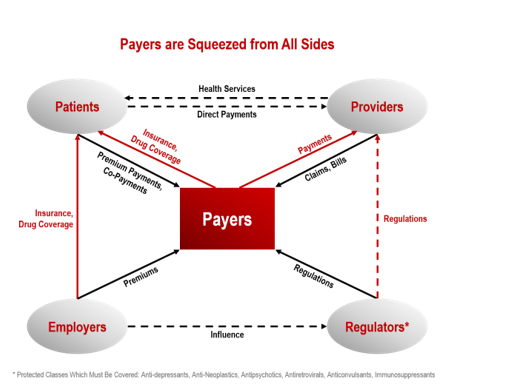

Payers are Being Squeezed from All Sides

Payers are under tremendous pressure to balance quality of care with cost. Managed care. Two words that describe the goals and objectives payers attempt to achieve. It isn’t easy.

Think about the world of healthcare from the lens of the payer’s Medical Director. They are squeezed from all sides. Every year, a number of new products are introduced and companies want them added to the formulary. Companies with products already on the market jockey to be added to the formulary or for less restrictive access. Patients want the newest and most effective therapies, to be able to choose which physician to see, and pay as low a premium as possible. Physicians want to prescribe the most effective therapies without having to go through any paperwork or follow any pre-set algorithms. Employers want to keep their premium costs down and regulators require that certain drugs must be reimbursed.

The New Product Evaluation Process

The New Product Evaluation Process

Medical Directors are increasingly using a detailed and disciplined process to decide the value of a new product to the plan, whether to add the product, and the level of access necessary to achieve the objectives of providing quality care to its members. Just as with any presentation, a strong first impression can work wonders.

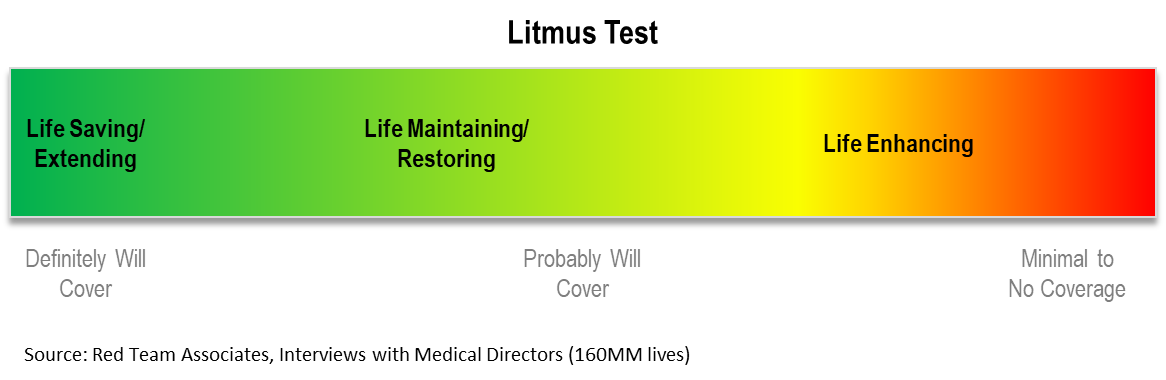

Stage 1: The Litmus Test: Should We Add This to the Plan?

Medical Directors tend to divide products into three broad groups based on the unmet need the product addresses: 1) Life Saving/Extending, 2) Life Maintaining/Restoring, and 3) Life Enhancing. They then drill down to assess the number of patients that will be affected, the strength of the new product’s value proposition, and the impact on cost to determine whether the new product offers enough clinical value to justify adding it to the plan’s formulary.

What Unmet Need Does the New Product Address?

What Unmet Need Does the New Product Address?

- Is the product Life Saving or Life Extending?

- Does the product restore or improve a patient’s ability to function?

- Does the product enhance a patient’s quality of life?

- Who is impacted? Patient? Caregivers? Family? Plan? Employers?

How Many Patients in the Plan are Affected?

- How many patients have the disease/condition?

- How are these patients currently being treated?

- What outcomes do current treatments deliver?

What is the Product’s Value Proposition?

- How does the new product impact the patients who suffer from the condition?

- Does the product solve the problem? Is it a meaningful better solution than what’s currently used?

- How strong is the evidence supporting the value proposition?

- Clinical trial data? Real-world evidence? Longitudinal analysis?

- Number of patients studied? Degree of severity?

- Comparison versus the current standard of care?

- How does the new product impact the current treatment algorithm?

- How strong will physician/patient demand be for the new product?

- What are the consequences of not offering or providing immediate or unrestricted access to the new product?

- What are the downside risks associated with making the new product available?

What is the Relative Cost of the New Product?

- What is the direct cost? What is the average annual cost per patient?

- If the product replaces the current treatment, what is the cost differential?

- If the product is an addition to current treatment, how much cost is added?

- Will the drug be covered by Medicare? Medicaid?

- What impact will the new product have on patient adherence?

- What costs or other expenses will the new product reduce or eliminate?

Bottom line: Does the New Product Offer Enough Clinical Value to Justify Adding It to the Plan’s Formulary?

Stage 2: Product Impact Assessments

The litmus test only sets the stage. Assuming a Medical Director believes the new product offers enough value to add to the formulary, payers still have an increasingly more rigorous process, which usually involves both the Medical Directors as well as the Pharmacy Directors and their teams of analysts.

Just as companies prepare dossiers and perform detailed economic analyses to support a new product’s value and price, the payers have also increased the rigor and discipline with which they evaluate the impact of a new product on their patients. This has especially become the case with new products for rare diseases where the WAC (wholesale acquisition cost) price may be very high, or new products that will affect a lot of members in the plan.

For example, in one large plan, the Senior Medical Director told me, “I have 30 analysts who monitor therapeutic category pipelines so we know what important new products are nearing approval. Where possible, we also follow what the companies developing these new products are publishing or telling investors so we know how much financial leverage we have.”

A Medical Director of one of the largest plans was gracious enough to map out his process in great detail:

1. When a company files with the FDA, we start following the drug in a monthly pipeline report and update it with any publicly available information.

2. Once approved, we do a preliminary review of safety, effectiveness, and impact on standard of care within the population studied in the clinical trial. Increasingly, we’re doing predictive modeling of actual utilization and what we anticipate the total incremental cost will be to the plan.

3. Once the new product is launched, assuming we believe the new product offers real clinical value to patients, we’re increasingly implementing an interim policy that says “for one-year physicians have to use standard of care post-launch just to make sure the new product has no safety issues that weren’t apparent in the pivotal study.” The drug is still available by appeal and we track the number of physician appeals.

4. One-year post-launch, we’ll create the formal policy of coverage or non-coverage with a prior authorization (PA) or step edit. How we arrive at our decision uses an 8-element grid or template:

I. Peer review published literature post launch

II. Proprietary rating agencies we pay for such as Hayes, Milliman, ECRI, , MD Consult

III. Check CMS and Medicaid policy toward reimbursement of the product

IV. Check what other payers are doing

V. Check any national organization guidelines

VI. Check the appeal history as a barometer of physician demand

VII. Check any value proposition reports from ICER

VIII. Then the decision is made as to what type of access we will provide longer term.

Stage 3: Access and Price Negotiation

In contrast to the Medical Director, the goal of the Pharmacy Director is to provide appropriate, affordable, and accessible prescription drug benefit coverage. Their lens is focused on good enough versus ideal therapy. Think Toyota versus Ferrari. Both get you to the desired destination, but one does so at a considerably lower cost.

The tools in a managed care organization’s (MCO) benefit coverage programs keep expanding as life sciences companies and plans continue to search for ways to make the highest quality of patient care accessible and affordable. These include:

- Negotiating contracts with pharmaceutical manufacturers to obtain lower net drug prices. Rebates have become the most common mechanism that pharmaceutical manufacturers use to provide lower pricing. The dollar amount of the rebate increases as the price of the new product increases, and the percentage of the rebate increases when there are multiple alternative therapies.

- Negotiating contracts with pharmaceutical manufacturers based on therapeutic outcomes

- Negotiating volume discounts and implementing maximum allowable cost (MAC) pricing with retail and mail order pharmacies

- Working with prescribers to ensure they are prescribing drugs appropriately

- Promoting the use of appropriate generic products wherever possible

- Implementing disease management and medication therapy management programs designed to improve the quality and efficiency of patient care while controlling cost

Moving Forward: From Détente to Collaboration

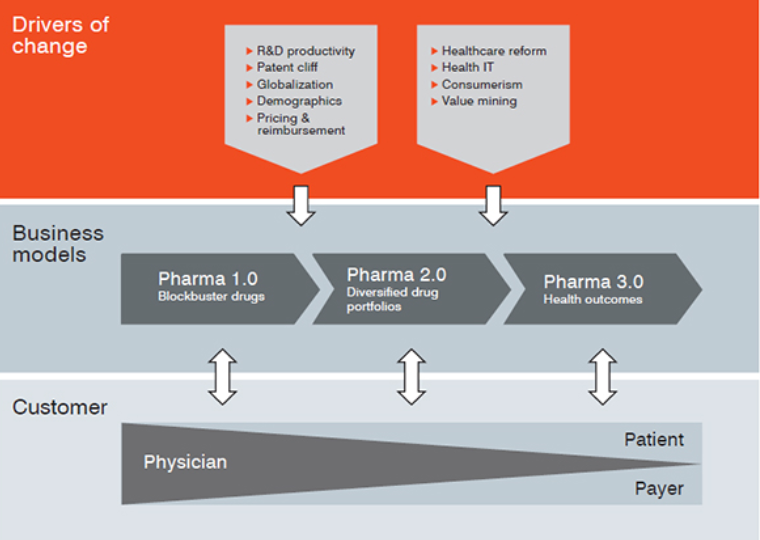

Payers are keenly aware that if access becomes too restrictive and price pressure on life sciences companies too great, innovation will suffer. Thus, they recognize the need to evolve from an adversarial relationship to one of collaboration.

That means bringing payer input earlier into product development so that meaningful clinical endpoints and comparators can be established. What’s clear is that payers want life sciences companies to be successful, but not because of coupons they offer patients or DTC advertising, but by developing new products with clear and compelling differentiation.