In many markets around the world, but particularly in Europe, there have always been post-regulatory hurdles for pharmaceutical companies to achieve their price and access ambitions. In most of the developed markets, there are rigorous health technology assessment (HTA) processes that ascribe a particular benefit to a drug in the context of current therapeutic options. This benefit, derived from a variety of methodologies, is then related to a price. This last step is often a matter of negotiation, and not necessarily as formulaic a process as the HTA. The HTA takes many forms, and no market uses identical processes.

In Germany, the benefit is relative to a comparator that the payer sees as an appropriate clinical comparator. In the UK, the benefit follows a formal cost-effectiveness assessment that expresses the benefit in a cost per quality adjusted life year. In, Italy the clinical assessment is also supplemented by a consideration of the overall budget impact. Regardless of the methodology, after negotiations what is produced is a “value-based” price. Surely, this is a satisfactory endpoint to all involved, and clinicians, patients, and the healthcare systems that support them will access the drug without restriction.

A Solution for Patients May be a Problem for Payers

A value-based price for an assessed innovative drug should, by definition, deliver effective treatment at an appropriate cost. However, payers at all levels—national, regional, and local—still perceive a level of clinical and financial risk associated with some innovative medicines. There are many reasons for this, but mainly relate to clinical and financial uncertainty, i.e., how the drug performs and the associated costs in the real world.

Ensuring the drug gets to only those who benefit most may be important to both getting the best outcomes for patients at a manageable cost. In the spirit of sharing some of these risks, over the last two decades, different forms of contracting have been used. Often referred to as “innovative” contracts, managed-entry agreements, or value-based agreements among many other names, these are essentially any agreements that require a negotiation over and above a simple discount.

To give a flavor for what constitutes these contracts, and what they are designed to achieve, let’s go through several examples, but before here are the critical questions to consider: If national value-based price and access processes are rigorous, consistently applied, and have been refined over many years across a variety of medicines and therapeutic areas, what is the need to further manage risk? Are payers adding an additional hurdle to proving value, that should already have been incorporated into drug assessments?

Innovative Agreement Types and Examples

To provide in-depth insights into the types of individual agreements that have been used over the last two decades in Europe, we’ve categorized them into three main types:

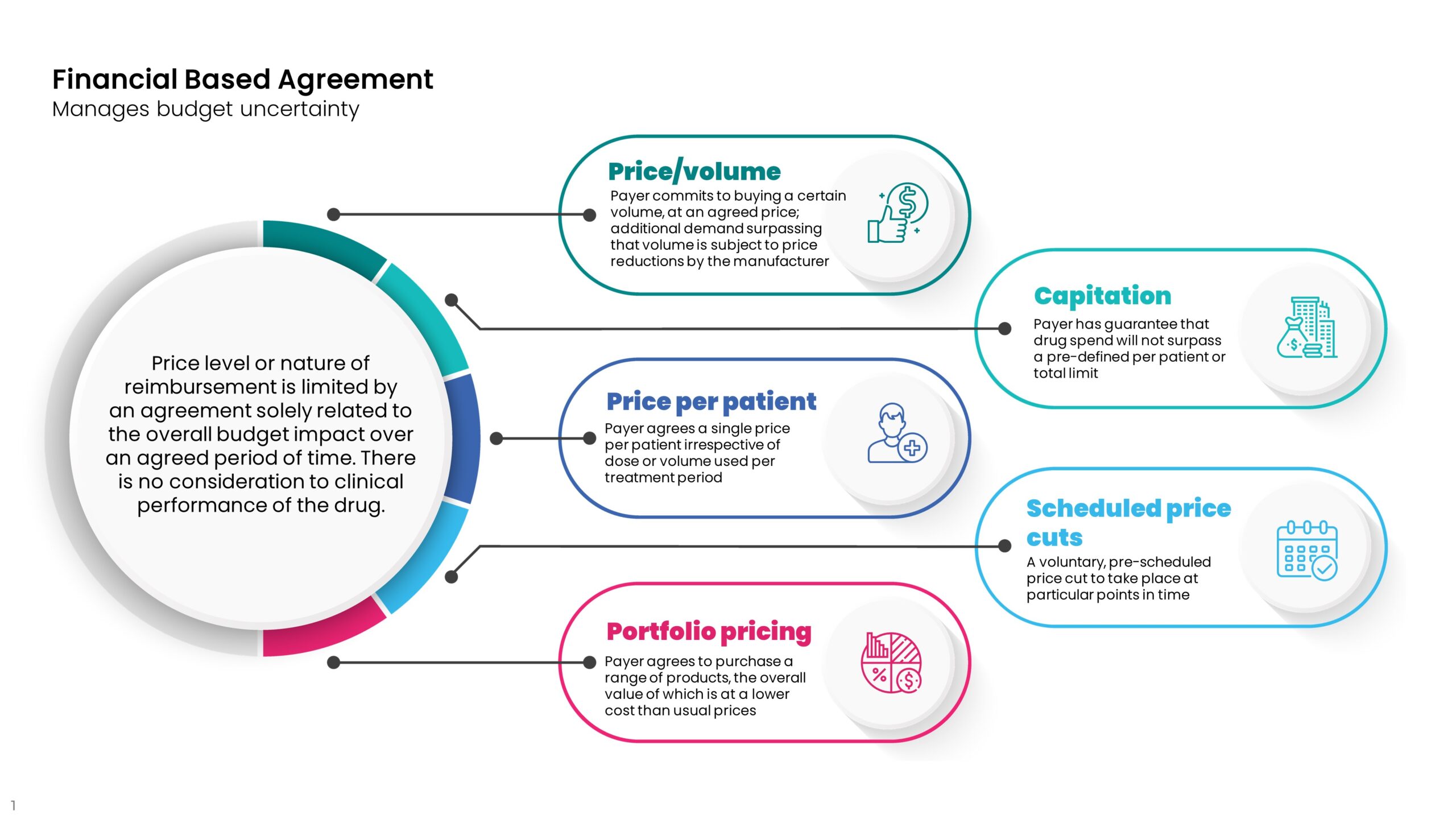

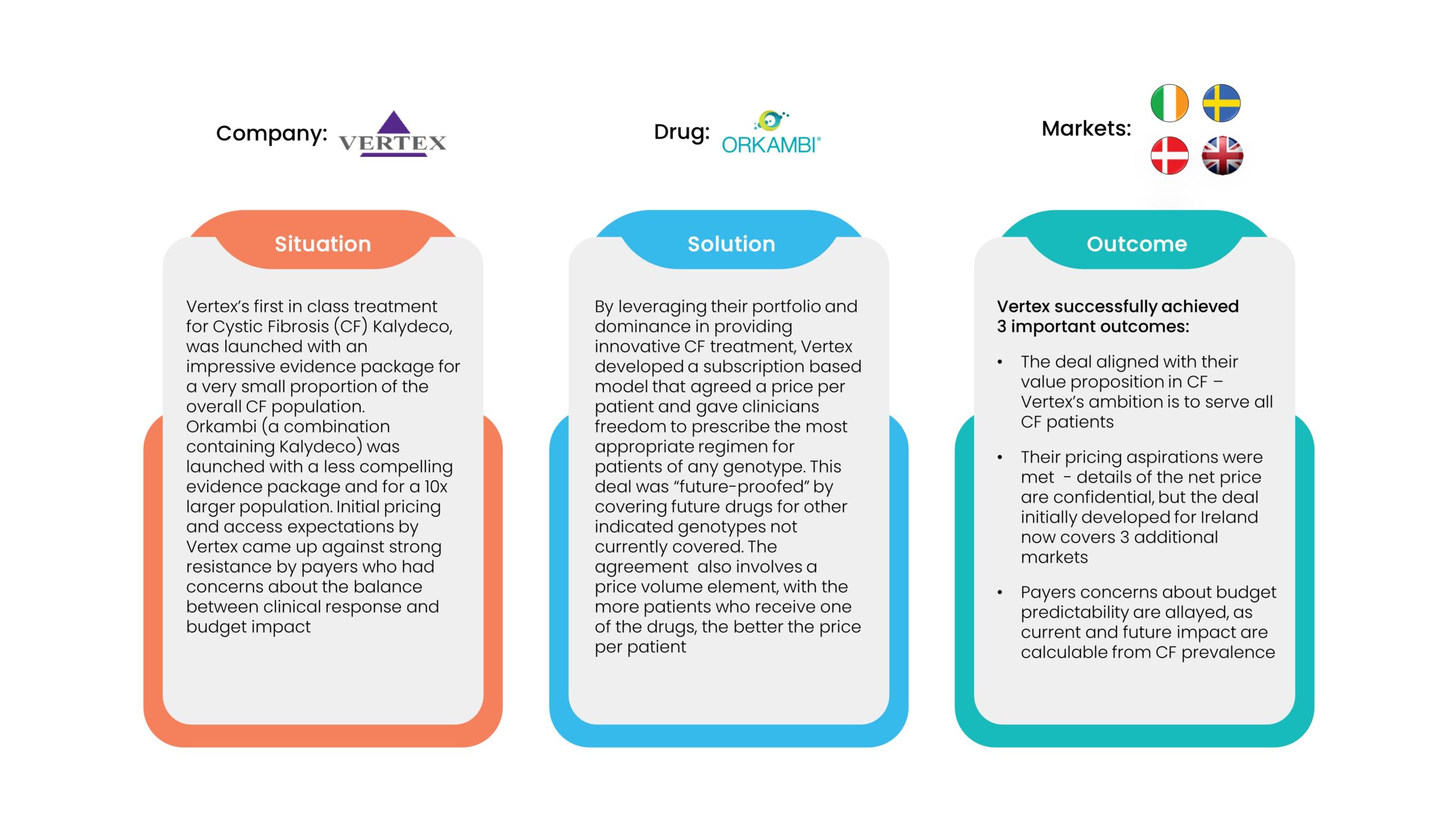

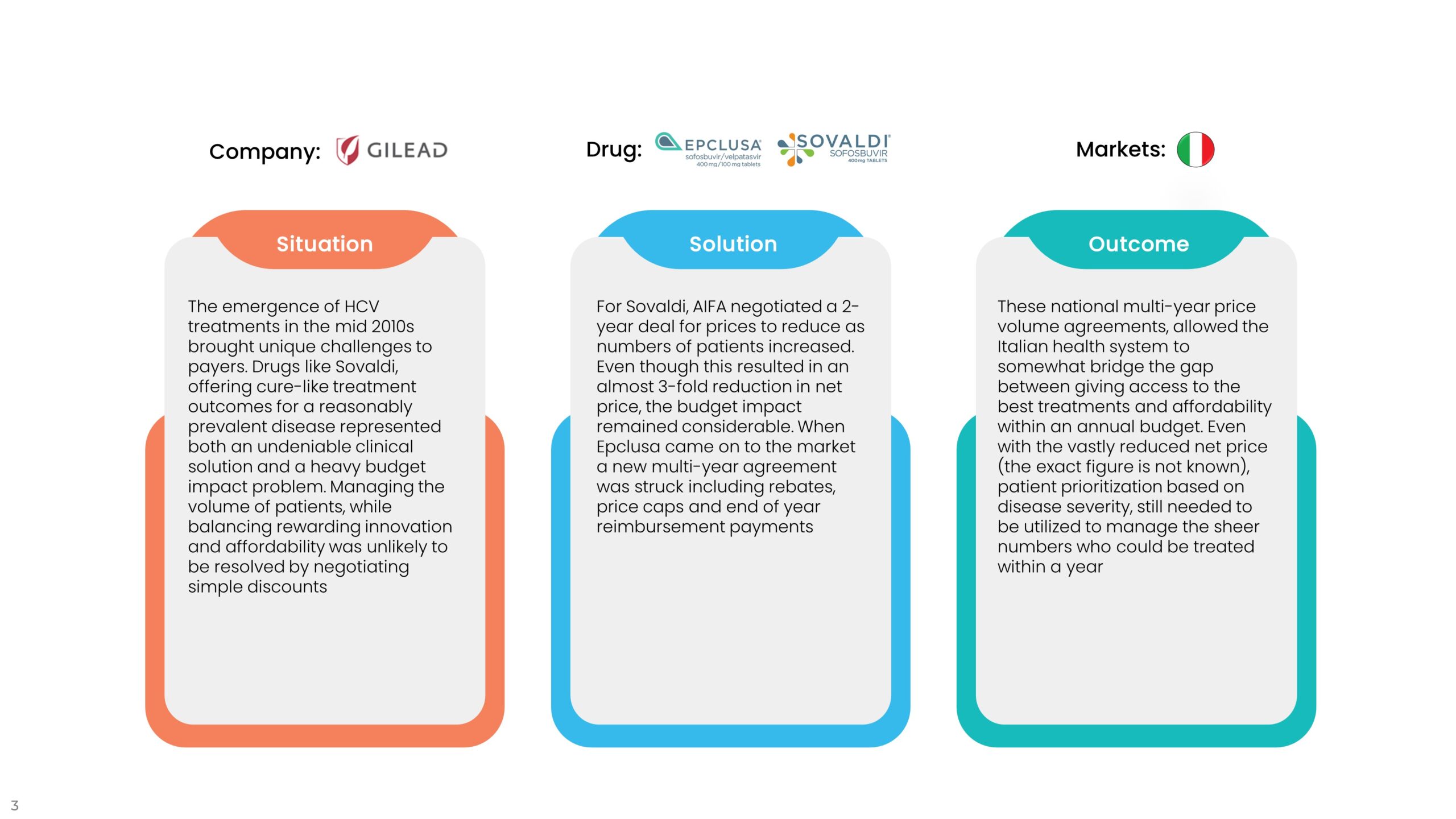

1. Financial Agreements

Financial agreements distinguish themselves from “simple discounts” in two main ways.

Financial agreements distinguish themselves from “simple discounts” in two main ways.

- The agreement is likely to require specific contract terms such as entry/exit criteria, data monitoring requirements, and exit clauses.

- The payer will need to be much more active and accountable during the negotiation and lifetime of the contract.

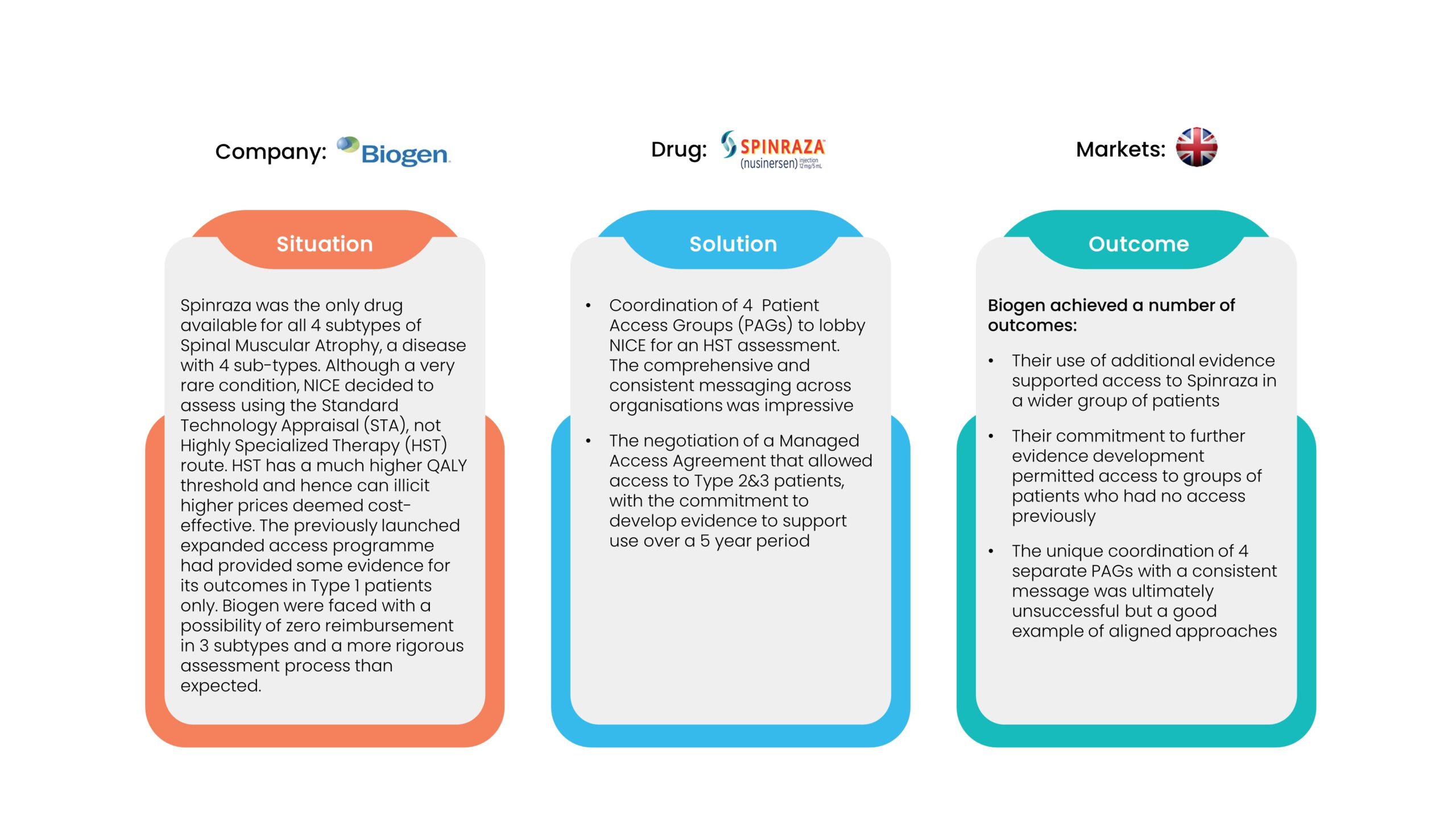

As such, the benefits need to bring more than a simple discount would, such as budget predictability and/or a shift of risk to the company and away from the payer. The examples shown below, demonstrate that financial agreements aren’t necessarily simple to negotiate or easy to implement, but can go a long way to achieving better access and improved outcomes for patients. However, inevitable delays to the time to first patients treated and questions of sustainability still remain. Returning to the question we raised earlier, could delays to access have been much reduced if pricing and access processes incorporated some of these nuances and additional slow and costly negotiations were not needed? And did the companies take an unfair double hit on the value-based price of their drugs?

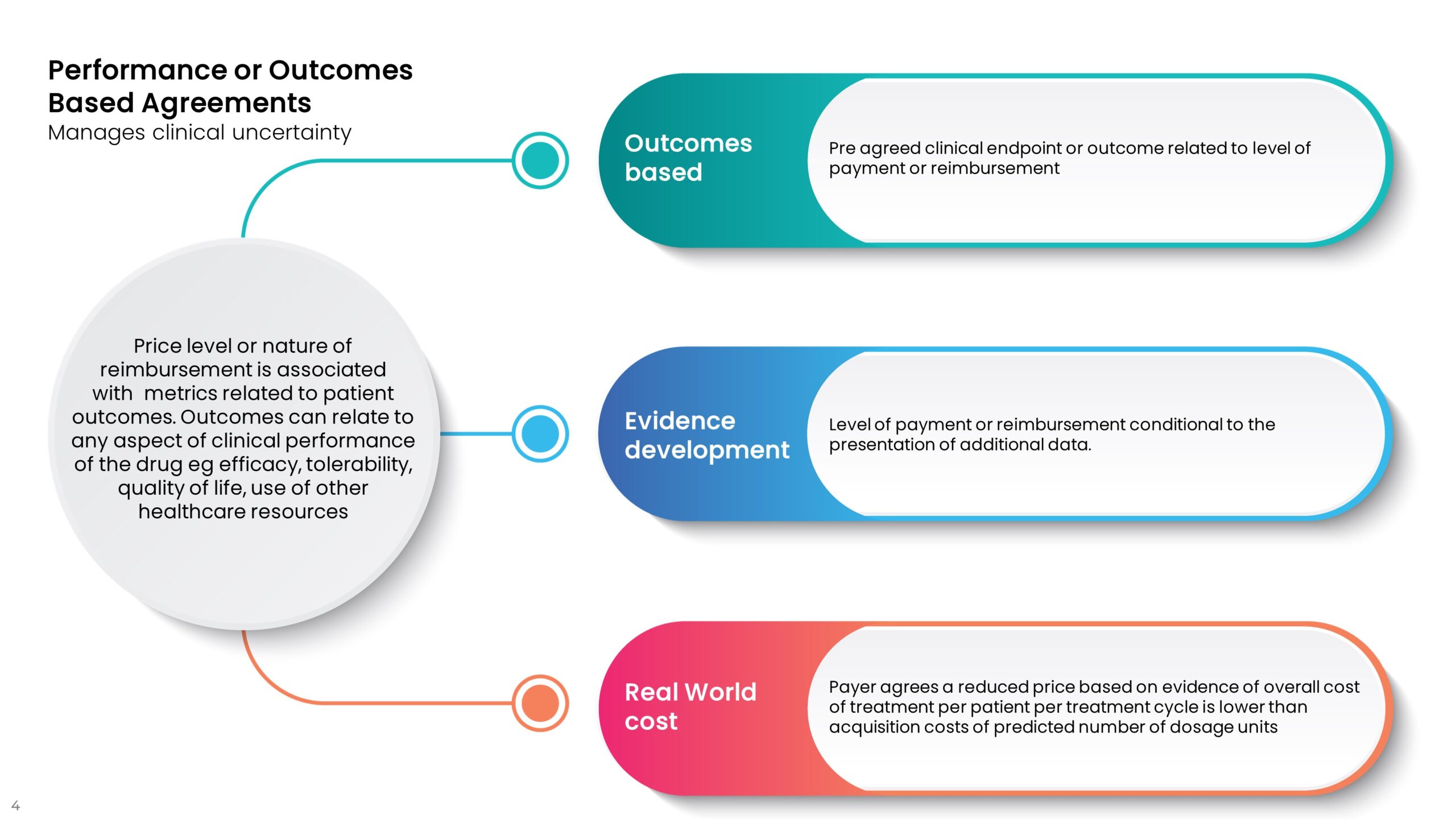

2. Performance Agreements

2. Performance Agreements

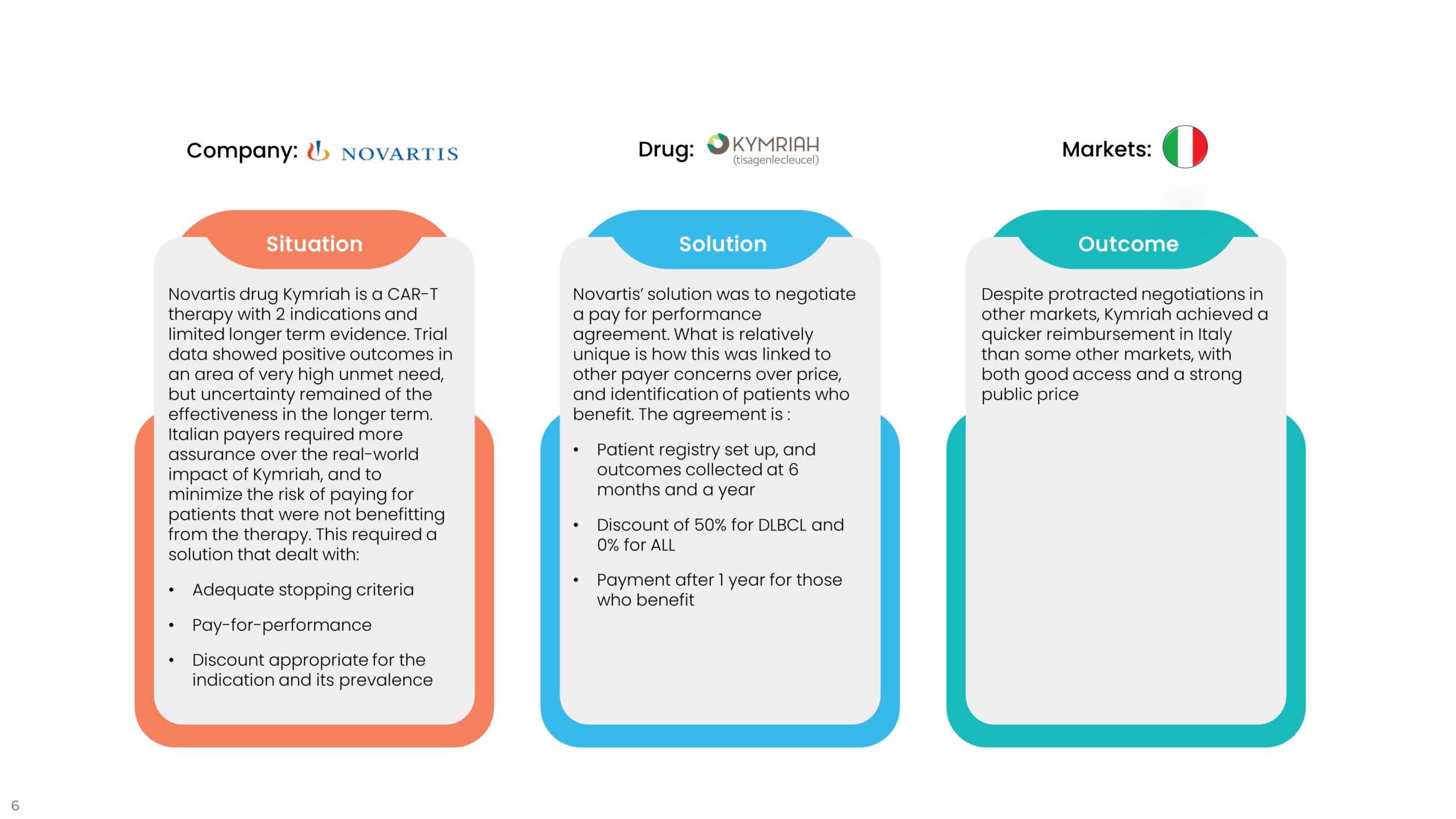

Performance agreements are designed to reduce the costs associated with clinical uncertainty and potential under-performance or lack of superior performance of a new drug versus current treatments. These agreements tend to be designed to ensure that real-world performance matches the level of outcomes in trials, not always the primary outcome. If a drug promises to get patients out of hospital quicker or reduce the need for other drugs or the cost of side effect management, the agreement can be tied to these reduced healthcare utilization costs. The examples below are typical of this sort of agreement.

Performance agreements are designed to reduce the costs associated with clinical uncertainty and potential under-performance or lack of superior performance of a new drug versus current treatments. These agreements tend to be designed to ensure that real-world performance matches the level of outcomes in trials, not always the primary outcome. If a drug promises to get patients out of hospital quicker or reduce the need for other drugs or the cost of side effect management, the agreement can be tied to these reduced healthcare utilization costs. The examples below are typical of this sort of agreement.

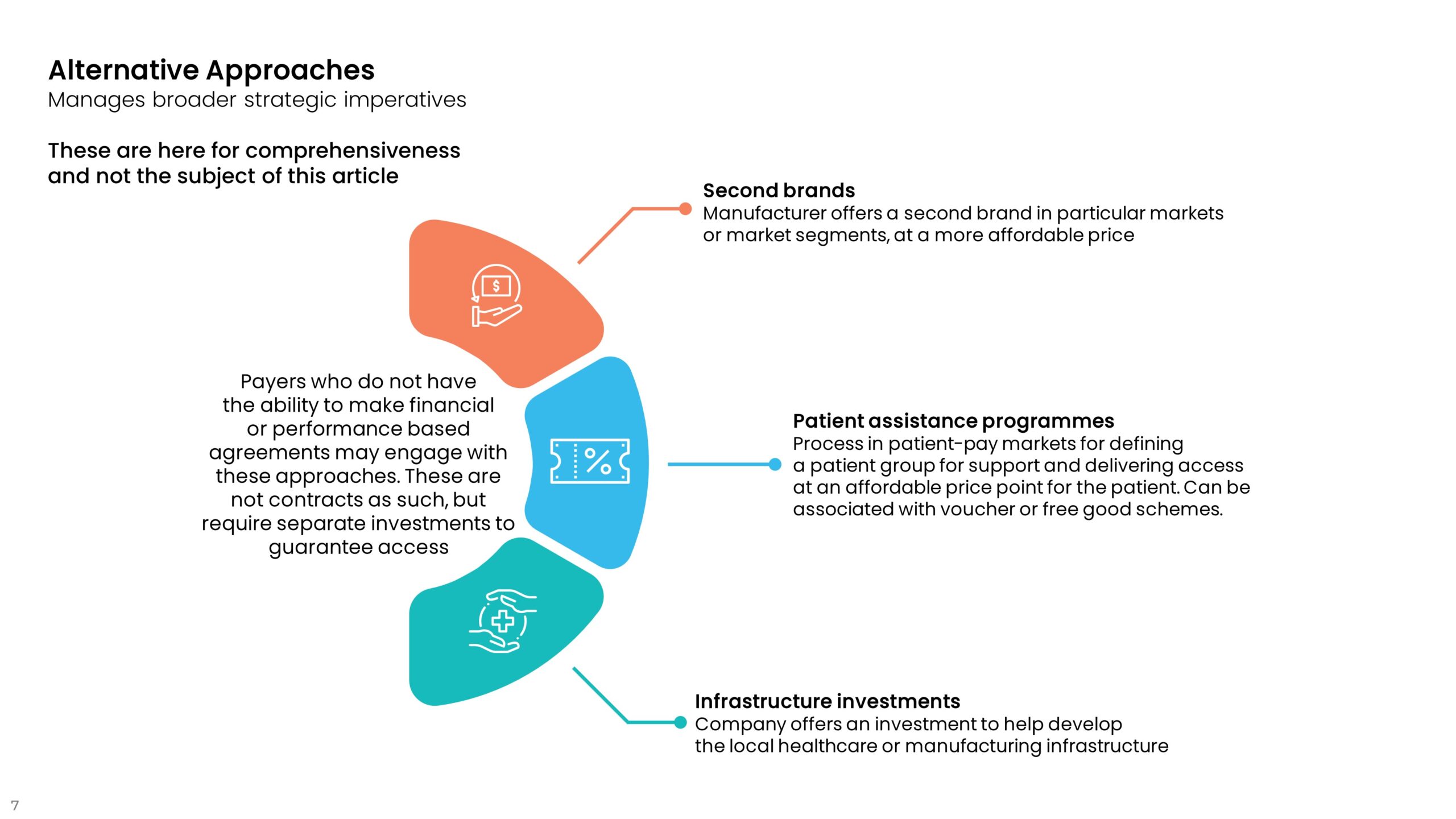

3. Alternative Approaches

3. Alternative Approaches

These are listed here to be comprehensive in describing the range of innovative contracting options. They are not the subject of this article.

These are listed here to be comprehensive in describing the range of innovative contracting options. They are not the subject of this article.

A Solution for Payers Becomes a Problem for Payers?

These contracts are tailored at market level to solve access problems. However, in their implementation several issues have arisen.

Innovative contracts are administratively cumbersome for payers. They are complex to negotiate, and once in place, may require the collection and monitoring of data that are not necessarily routinely collected. This puts a cost to the implementation of any individual contract, which becomes more problematic for multiple contracts for different drugs. To many payers, this has become a costly exercise that saps existing resources.

What happens when an agreement comes to an end? The contract may have supported initial access and the clinical performance of the drug, but systemic affordability issues remain, and new budget constraints may exist for payers at several years down the line from the initial agreement. Whether access agreements are a sustainable solution is still an open question.

How Do We Know When Innovative Contracts Are Most Effective?

Innovative contracts have become too ubiquitous as access solutions, but after many years of their implementation in markets that already have pricing and access challenges, it has become clearer when and under what conditions they are most effective.

- In rare disease there are always challenges at launch. Clinical evidence is often unclear due to small patient numbers and other trial design limitations. But this also means that for a relatively discrete group of patients and treatment centers, the implementation and monitoring of agreements may be less burdensome. This is most certainly not true where there are larger groups of patients, and likely other treatment options.

- Thinking through contracting options is often done too late when price or access negotiations fail. Thinking through options well before launch and testing this out in specific markets will support more efficient negotiation and implementation. Modeling true revenue gains will always be an important part of this preparatory phase.

- Using innovative contracting options as a competitive tactic gives, at best, short-term unsustainable gains, that may not give the returns that were expected. You may find that offering simple discounts may have a superior effect.

- Data that is collected from implementation of agreements is useful to help refine agreements and “spread” best practice. Conversely, they can also inform when contracts just don’t work.

Innovative agreements have been around for a long while and are not disappearing. However, in the context of rigorous pricing and access processes at all levels within healthcare systems, careful consideration needs to be given to whether agreements really do improve access in a profitable and sustainable way that does not devalue the drug or further pipeline innovations and indications.