Amazon’s Joint Healthcare Venture Focuses on Healthcare for its 1.2 Million Employees

The shared healthcare project announced a year ago between Amazon, JPMorgan Chase, and Berkshire Hathaway was recently christened as Haven, and some more details about its goals were released. Newly launched Havenhealthcare.com describes Haven as not-for-profit and independent of the three companies, though it will draw “on resources and expertise from Amazon, Berkshire Hathaway, and JPMorgan Chase,” as it focuses on helping their 1.2 million employees and family members get better access to primary care, simpler insurance benefits, and lower prescription drug prices.

The site also makes it clear that this visionary venture aims to devise ways to use data to improve the nation’s overall healthcare system and that “in time, we intend to share our innovations and solutions to help others,” according to the website. Haven CEO and renowned surgeon, Atul Gawande, MD, MPH, wrote in an open letter some of the initiative’s ideals: “We will be an advocate for the patient and an ally to anyone—clinicians, industry leaders, innovators, policymakers, and others—who makes patient care and costs better. We will create new solutions and work to change systems, technologies, contracts, policy, and whatever else is in the way of better healthcare. We will be relentless. We will insure our work has high impact and is sustainable. And we are committed to doing this work for the long term.”

Platform for Live Patient Summits Launches

The Inception Company, a leader in tech-driven production, and WEGO Health, a network of patient opinion leaders and health influencers, collaborated to produce “Patient Co-Lab,” a platform solution for hosting live, interactive patient summits with advocates and thought leaders across hundreds of health conditions. The solution, designed to support real-time collaboration between life sciences companies and patient leaders representing hundreds of chronic, complex and rare diseases, launched in time to be featured at ePharma Impact, a three-day digital marketing conference in New York City for digital innovators in the biopharma industry.

WEGO’s Patient Co-Lab is powered by Pando, The Inception Company’s innovative video-technology meeting platform. Hosted at the Pando studio in New Jersey, Patient Co-Lab boasts an expansive, digital video wall that can present up to 60 wall participants remotely and as many as 5,000 off-wall participants and observers from anywhere in the world.

“Virtual patient summits are a big leap forward for life sciences companies that understand the value of patient-centered innovation, and yet have been stymied by logistical and budget constraints,” said WEGO Health’s Vice President of Sponsor Programs, Kristen Hartman, in a statement. “It’s also a long-awaited breakthrough for patient leaders.”

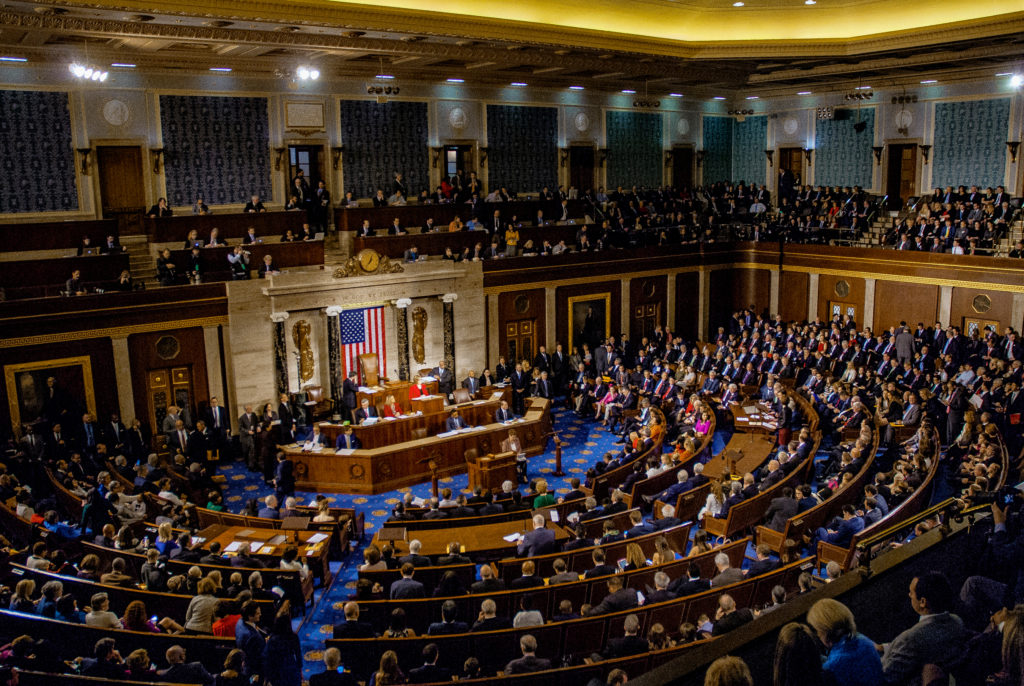

Pushback in Congress Over Biologic Drug Exclusivity in New Trade Deal

President Trump signed a North American trade agreement called the United States-Mexico-Canada Agreement (USMCA) that gives biologic drug brands a 10-year monopoly in Mexico and Canada. The Republican Senate is likely to approve the deal, but Democrats say setting biologic exclusivity could impede future efforts to rein in drug costs, while other parts of the trade agreement may potentially hurt the generics and biosimilar markets. The new agreement wouldn’t affect the 12 years of protection biologic exclusivity is currently guaranteed in the U.S., but it would change Canada’s biologics exclusivity policy which is set at eight years, and set a pharma-friendly policy in Mexico, where there are not yet any specific rules.

The long duration leads Rep. Jan Schakowsky to “believe that the balance between pharmaceutical monopoly profits and public health needs in current trade policies is already tipped toward industry. Inclusion of additional provisions in NAFTA to block access to generic drugs or provide new tools for pharmaceutical corporations to extort high prices would result in an even greater imbalance.” She added that the administration will “give pharmaceutical corporations and their monopolies a handout.”

On the other side of the debate, PhRMA CEO Stephen Ubl released a statement saying “countries protect and value innovation, America’s biopharmaceutical companies can continue bringing new medicines to patients around the world,” and that the negotiated IP protections “will help to usher in the next generation of medical treatments and cures.” Though President Trump has already signed the deal, it still needs to pass legislatures in all three countries as well as the U.S. Senate and Democrat-led House.

Dudnyk Joins Fishawack Group

The award-winning advertising agency expands its reach globally as it joins the Fishawack Group of Companies, a leading independent healthcare communication specialist with offices in the U.K. (London, Oxford, Knutsford, Brighton), U.S. (San Diego, Philadelphia), and India.

“The principals of Fishawack believe in a ‘client-centric’ approach to business, which is very much aligned with what has made Dudnyk unique, successful, and highly sought after in our industry,” says Dudnyk Chief Operations Officer, Rick Sutliff. “We will continue to maintain our dedication to long-lasting client relationships and to producing some of the highest-quality work in our industry.”

The Dudnyk senior leadership team will continue to guide the agency in their current roles. Dudnyk offers the group a specialized focus on rare disease, oncology, and the emergence of breakthrough therapies in molecular medicine. The partnership with Fishawack allows Dudnynk the opportunity to bring to market life-changing brands for patient populations desperately in need of approved treatments for their clients who operate on a scale outside of the U.S.

Thermo Fisher Buys Out Gene Therapy Manufacturer

Thermo Fisher Scientific has made a $1.7 billion cash deal to acquire viral vector producer Brammer Bio. The Cambridge-based biotech focused on gene therapy is expected to produce $250 million in revenue this year. With the market exploding, many gene therapy biotechs are committing money to building their own specialized manufacturing facilities. Thermo Fisher gains Brammer’s manufacturing locations in Massachusetts and Florida, along with 600 employees. Michel Lagarde, President of Thermo Fisher’s pharma services, said in a statement that the combination of the two companies can only strengthen both their positions in the burgeoning field.

Purdue Settles While Teva and J&J Face Opioid Trials

The Oklahoma head court denied the postponement of a trial set in May in which Purdue Pharma, Johnson & Johnson, and Teva Pharmaceuticals are accused of helping to fuel an opioid abuse and overdose epidemic in the state. The state is seeking $20 billion dollars in damages from the OxyContin manufacturer. There are a combined 2,000 lawsuits nationally that aim to hold opioid makers responsible for contributing to the abuse crisis.

Following the denial for postponement, the Sackler family, owners of Purdue Pharma, agreed to a settlement of $270 million to avoid going to trial on accusations of engaging in deceptive marketing that downplayed the risks of addiction associated with opioid pain drugs while overstating their benefits. This follows Purdue’s threat to file bankruptcy to cover the legal charges that they’ve faced over illegal marketing of the painkiller that devastated local communities.

There are a combined 2,000 lawsuits filed nationally against Purdue, Teva, and Johnson & Johnson. Oklahoma is the first state to try claims holding the opioid makers responsible for contributing to the abuse crisis. “This agreement is only the first step in our ultimate goal of ending this nightmarish epidemic,” Oklahoma Attorney General Mike Hunter said in a statement. The state is pressing ahead to “hold other defendants in this case accountable for their role in creating the worst public health crisis our state and nation has ever seen.”

Bayer and Janssen Settle at $775 Million Over Xarelto Risks

The two pharmaceutical giants have racked up over 25,000 lawsuits since 2014, alleging patients were not adequately warned about the risks of life-threatening complications. The cases piled up in New Orleans courts against Xarelto, the brand name drug for treating and preventing blood clots in the leg or lung and preventing strokes in people with irregular heartbeats, involved claims that users of the medication marketed by Bayer Healthcare and Janssen Pharmaceuticals were not adequately informed of potentially fatal risks including internal bleeding, strokes, and deaths.

After winning six cases that made it to trial, the pharma manufacturers agreed on a settlement of $775 million dollars that Bayer says, “allows the company to avoid the distraction and significant cost of continued litigation.” There was no admission of liability and the drugmakers stand fast behind the scientific data supporting Xarelto’s safety and efficacy.

Xarelto has been heavily marketed since 2015, especially through television commercials featuring celebrities including comedian Kevin Nealon, golfer Arnold Palmer, and NASCAR driver Brian Vickers. Individuals who have filed claims, some of whom have suffered injuries they attribute to the drug, are waiting to hear how much compensation they will receive.