Philips, Siemens, DePuy, Boston Scientific. A simple Google search on the topic of ambulatory surgery centers (ASC) returns results from medical device manufacturers like these that are building and marketing solutions specifically for the ASC space. And it’s no wonder—the size of the global ASC market is expected to increase by more than 25% over the next five years, according to a recent report from Vantage Market Research.1

But it’s not just the significant market growth that makes the ASC sector attractive to medical device manufacturers. It’s also the dramatic impact that the COVID-19 pandemic has had on in-hospital surgical volumes and patient perceptions of alternative care settings, opening the door for even greater acceptance and utilization of ASCs. So, while the ASC market had already been growing at the expense of the traditional hospital setting, the COVID-19 pandemic accelerated that.

In the first seven weeks of the pandemic, elective procedures dropped by 48% following the Centers for Medicare and Medicaid Services (CMS) recommendation that elective surgeries be postponed or cancelled.2 Hospital systems recovered quickly, and overall surgical volumes had only decreased by 10% by the end of 2020.2 But the pandemic shone a bright light on some of the inefficiencies in our healthcare system and drove a seismic change in patient behavior—changes that we do not see reversing anytime soon, if ever.

Patients Are More Comfortable Using an Alternative Care Setting

Patients stayed away from hospitals during the early days of the pandemic unless necessary and emergency room admissions dropped by nearly 150% in some states, as reported by a retrospective study published in JAMA in August 2020.3 On the flip side, patient use of telehealth services increased substantially. This was driven in part by institutional adoption of better telemedicine services and by waivers issued by CMS that authorized telehealth visits for Medicare patients. Rebecca Haffajee, JD, PhD, MPH, Principal Deputy Assistant Secretary for Planning and Evaluation at HHS, said, “During the COVID-19 pandemic, various telehealth flexibilities enabled patient access to their providers and…pre-pandemic telehealth visits for Medicare beneficiaries went from hundreds of thousands to tens of millions, with many utilizing telehealth for the first time.”4

This acceptance of alternative care settings has helped pave the way for ASCs as patients are increasingly comfortable with the idea of surgery taking place in the ASC setting. ASCs can be a great solution to keep patients out of the hospital (and all its risks) and have care performed in a more intimate setting. Any concern with ASC care is being mitigated by high patient satisfaction scores—scores that are at least as good as if not better than standard hospital outpatient departments, according to the April 2022 publication of the Outpatient Surgical Care Report.5

ACS Can Address Some Inefficiencies Within the Current Hospital Setting

ASCs, with their smaller footprint and more specialized focus can improve both surgical efficiency and reduce costs. “From a financial perspective, the ASC delivers the clear benefit of avoiding the expenses associated with inpatient admission to the hospital, affording insurance companies and providers considerable savings,” says Kern Singh, MD, Co-director of the Minimally Invasive Spine Institute of Midwest Orthopaedics at Rush in Chicago.6

A study that compared procedures performed in a pediatric orthopedic sports day surgery department at an ASC versus those performed at a university-based children’s hospital demonstrated a direct cost savings of 17% to 43% for procedures performed at the ASC. Cost savings were derived by a 64-minute reduction in time (on average) and decreased supply utilization.7 The same study also found that resource utilization was significantly lower at the ASC. A total of six operating room support staff were involved with a patient’s surgical care at the surgery center compared with 41 operating room support staff at the corresponding university hospital.

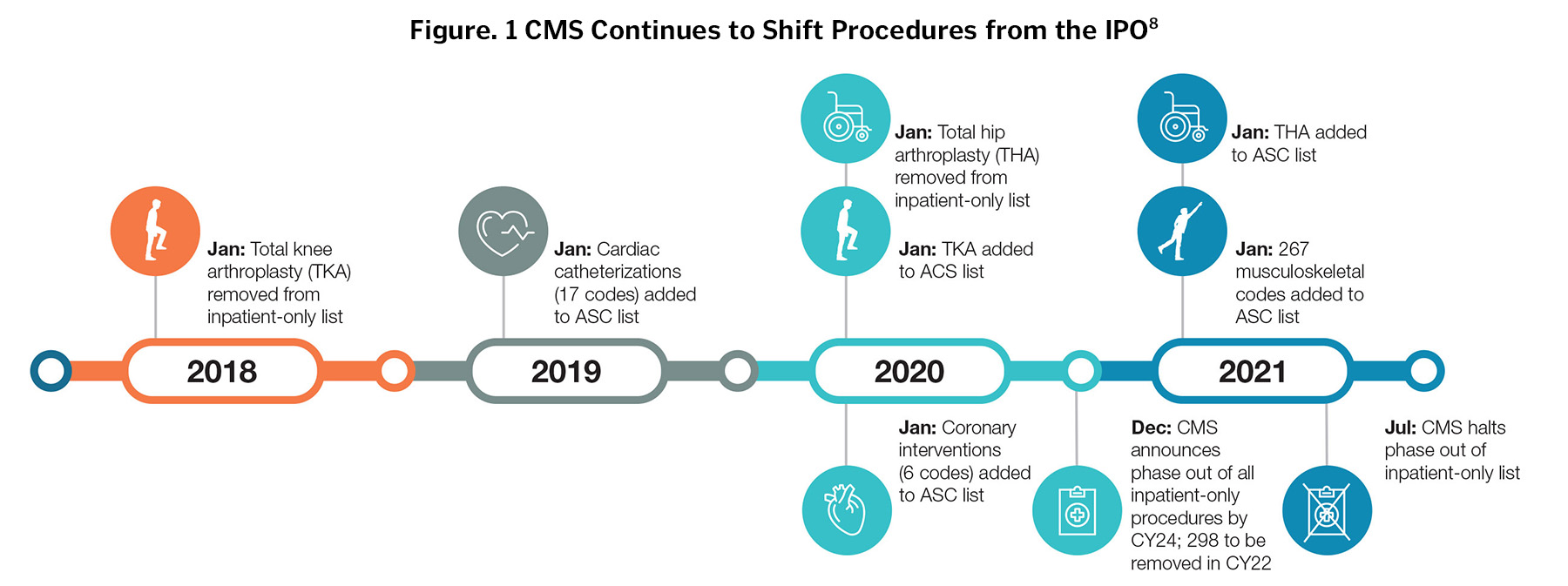

Payers are particularly interested in the positive effects that ASCs are having on healthcare costs and are encouraging procedure migration. Recent decisions from CMS regarding the removal of certain procedures from their Inpatient Only (IPO) list will only continue to further drive procedures to the outpatient and ASC setting (Figure 1).

ASCs are helping to address inefficiencies in the healthcare system, reducing costs while providing a more than satisfactory patient experience all while minimizing resource demand, which is especially important during times of staffing shortages.

ASCs are helping to address inefficiencies in the healthcare system, reducing costs while providing a more than satisfactory patient experience all while minimizing resource demand, which is especially important during times of staffing shortages.

Medical Device Manufacturers Are Building Solutions to Address ASC-specific Needs

For these reasons, ASCs are increasingly important to medical device manufacturers. However, the needs of the ASC are very different than those of the hospital and medical device manufacturers recognize this. Many of these companies have already put systems and solutions in place for, or built their businesses around, ASCs. As Rajit Kamal, an orthopedic executive at Johnson & Johnson, told Becker’s in January 2020, “Outpatient sites of care require cost-effective, efficiency-driven innovations, and our products and solutions support these key areas.”

Johnson & Johnson isn’t alone. Organizations large and small are ensuring their product and service offerings support ASCs in a more holistic way. For example:

- Cardinal Health is helping ASCs grow by providing customized solutions that can help identify potential ways centers can improve workflows, cut waste, and maximize efficiency through inventory and logistics management.

- com has built their business model around the needs of the outpatient care centers providing just-in-time suture ordering with same day shipping, no minimums, and no contracts. This added flexibility allows ASCs to order just what they need exactly when they need it.

- ASCs don’t have access to the same large sterile processing departments that hospitals use so companies such as Conventus-Flower Orthopedics have retooled their equipment. The Conventus-Flower “Ready for Surgery” kits are pre-packaged with sterile, single-use, anatomic, and procedure-specific implants and instruments that can help eliminate costly pre-op sterilization.

- Companies such as Johnson & Johnson have developed ASC-specific education platforms. Their DePuy Synthes Outpatient Preceptorship program delivers in-person education for surgeons and their teams focused on surgical technique, pain management, and the safe and effective use of their products.

- Digital innovations such as ASK ANGIE from Boston Scientific are designed to virtually connect clinicians with on-demand product, case, and clinical support.

The pendulum is not going to swing away from ambulatory surgery centers anytime soon. The ASC market growth is expected to outpace that of the hospital and the decisions made by CMS and other large payer systems will continue to accelerate the shift in procedures. Medical device manufacturers who recognize the growing importance of this segment of the market and who can streamline their product offerings and create customized solutions designed with the needs of the ASC in mind will benefit in the end.

References:

2. https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2786935.

3. https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2768770.

6. https://www.beckersasc.com/leadership/can-ascs-save-healthcare.html.

8. “Not-for-profit and For-profit Hospitals – U.S.: Pandemic Accelerates Shift from Hospital-based Care, Crimping Revenue, and Margins.” March 15, 2022. Moody’s Investors Services.