The vasculitis treatment market is expected to change drastically by 2024 in the seven major pharmaceutical markets (7MM: U.S., France, Germany, Spain, Italy, UK, and Japan) with the anticipated launch of five biologics that are priced at a premium to the existing therapies. Besides Nucala, all biologics have the potential for label expansion to other forms of vasculitis. Four of these biologics will introduce novel mechanisms of action (MOAs) to the market, meeting clinicians’ need for new treatment options and driving growth in the vasculitis market.

Vasculitis is a family of rare autoimmune diseases that can occur in people of all ages, causing inflammation of the arteries, veins or capillaries. With the exception of Behçet’s disease (BD), which affects blood vessels of all sizes, the different forms of vasculitis—including large vessel vasculitis (LVV), antineutrophil cytoplasmic antibody (ANCA) associated vasculitis (AAV), and Kawasaki disease (KD)—are classified by the size and location of the affected blood vessels. Untreated, the organs and tissues affected by the damaged blood vessels do not get enough blood, and can lead to organ or tissue damage, or even death.

Branded Biologics are Big Game Changers

During the past decade, the vasculitis market transformed from a relatively non-competitive, generics-only space to a vying market, as a result of the launch of branded biologics.

Johnson & Johnson’s (J&J’s) Remicade (infliximab), a tumor necrosis factor (TNF) inhibitor, was approved for the treatment of BD with refractory uveoretinitis in January 2007 in Japan, marking the launch of the first biologic for any form of vasculitis. In August 2015, Remicade was approved for additional indications for entero-BD, neuro-BD, and vasculo-BD in Japan, generating sales of $16.5M in 2014 across the 7MM. Remicade is also in Phase III of development for KD in Japan.

In addition, in May 2013, AbbVie’s Humira (adalimumab) was approved for the treatment of intestinal BD in Japan. There have been no new drug launches in the 7MM for BD since the approval of TNF inhibitors, leaving a vast opportunity for pharmaceutical companies to launch new therapies.

In April 2011, Biogen/Roche’s Rituxan (rituximab), a CD20 inhibitor, was granted FDA approval for the treatment of granulomatosis with polyangiitis (GPA) and microscopic polyangiitis (MPA), two forms of AAV. It is also approved in the 5EU (France, Germany, Spain, Italy, and UK) and Japan. This marked a significant shift in the AAV landscape, as prior to Rituxan’s approval, the standard of care in AAV was generic immunosuppressants prescribed in combination with glucocorticoids.

Rituxan sales for AAV in 2014 were estimated at $91.2M, roughly 55.0% of the total AAV drug sales across the 7MM. The treatment landscape is expected to witness substantial growth, reaching approximately $256.6M by 2024, at a Compound Annual Growth Rate (CAGR) of 4.5%, as a result of the launch of the three biologics for AAV, as discussed below.

Novel MOAs Will Reshape the Competitive Landscape

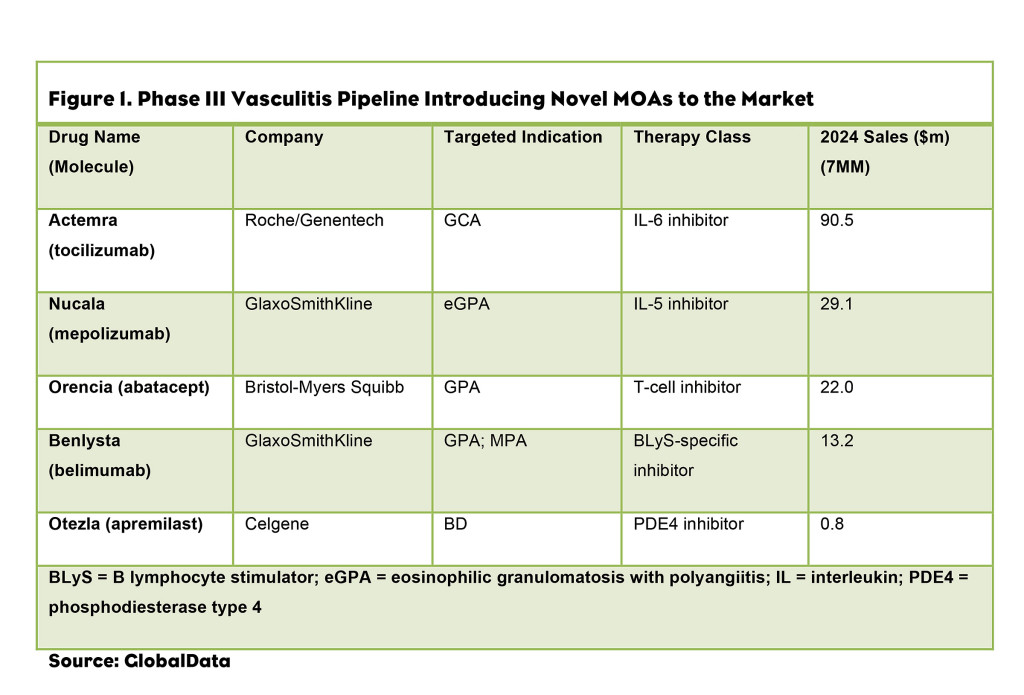

The coming decade will be marked by continued innovation in vasculitis; the late-stage development pipeline comprises five biologics with novel MOAs (Figure 1).

1. Actemra (tocilizumab) is a promising addition to the vasculitis market, as it will bring a novel target to the treatment armamentarium and has a strong safety and efficacy profile. Currently, no approved biologics for the treatment of giant cell arteritis (GCA) and Takayasu arteritis (TA), two forms of LVV, exist. GlobalData anticipates that Actemra will be used as a first-line biologic for GCA, and will be used off-label for the treatment of TA. Upon approval, Actemra is forecast to be the top-selling drug in the vasculitis market, generating sales of $90.5M in 2024, and since it is first-in-class, it is not expected to face significant competition.

2. Nucala (mepolizumab) marks a substantial advance in the treatment of eosinophilic granulomatosis with polyangiitis (eGPA), which is currently treated by immunosuppressants in combination with glucocorticoids. The biologic’s anticipated annual cost of therapy (ACOT) of approximately $71,600 in the U.S. is much higher than that of Rituxan, Orencia (abatacept), Benlysta (belimumab) and Actemra.

This drug’s commercial potential is noteworthy, as it is in development for a small segment of the vasculitis market—patients with eGPA—who represent approximately 13% of the diagnosed prevalent vasculitis cases in the 7MM. As the only drug, marketed or pipeline, for the treatment of eGPA, Nucala shows promise for strong performance in the current market, with anticipated sales of $29.1M in 2024 in the 7MM.

3. Orencia, a highly anticipated addition to the vasculitis market, is expected to be used as a first-line biologic for GPA; Orencia will likely be used off-label for patients with MPA. With a premium price of approximately $40,000 per year, Orencia is expected to generate $22.0M in sales from the 7MM in 2024, filling physicians’ need for a novel target MPA and GPA treatment.

4. Benlysta is in Phase III development for the treatment of GPA and MPA in the U.S. and 5EU. Unlike Orencia, it will experience slow uptake, as it has an overlapping MOA with Rituxan, with both drugs targeting B cells. Benlysta is expected to be used as a second-line therapy, with 2024 sales forecast at $13.2M.

5. Otezla, in regards to BD, (apremilast) performed well in clinical trials for vasculitis and has a strong safety profile. Otezla, with an ACOT of approximately $6,000, is more affordable than the existing biologics, and is expected to be used as a first-line therapy. However, Otezla is expected to generate sales of less than $1M in 2024, which is substantially lower than Remicade and Humira, which will generate sales of $12.5M and $14.1M, respectively.

Maintenance Therapy: Growth Opportunity Abounds

Vasculitis is associated with a substantial risk of relapse, which prolongs the duration of maintenance therapy and results in long-term exposure to therapies with significant side effects. Patients are at risk for developing serious comorbidities, which may result in death. All of the pipeline drugs are in development for induction rather than maintenance therapy, although significant opportunity exists for maintenance treatments.

Pharmaceutical companies can access the vasculitis market through the design of clinical trials specific to maintenance therapy that address unanswered questions, including the necessity, duration and frequency of therapy. The first biologic to gain regulatory approval as a maintenance therapy for vasculitis will have great success in the vasculitis market.