The Duchenne Muscular Dystrophy (DMD) treatment market is expected to change radically by 2019 in the six major pharmaceutical markets (6MM: The U.S., France, Germany, Italy, Spain and the UK), with the potential launch of mutation-specific therapies with orphan drug status, high-price points and market exclusivities. The current lack of efficacious therapies and a strong demand for drugs that are specific for DMD will allow several late-stage pipeline products to emerge uncontested.

DMD is a rare genetic disorder affecting approximately 1 in 3,500 newborn boys and is characterized by progressive muscle degeneration, loss of ambulation and death by the late 20s. Research and consulting firm GlobalData estimates that there were nearly 18,000 diagnosed cases of DMD in the 6MM in 2014. The disease stems from numerous possible mutations in the DMD gene, which encodes for the muscle protein, dystrophin. Some mutations, such as nonsense mutations and mutations clustered around exon 51 in the dystrophin gene, have come into the spotlight due to their therapeutic potential, as discussed below.

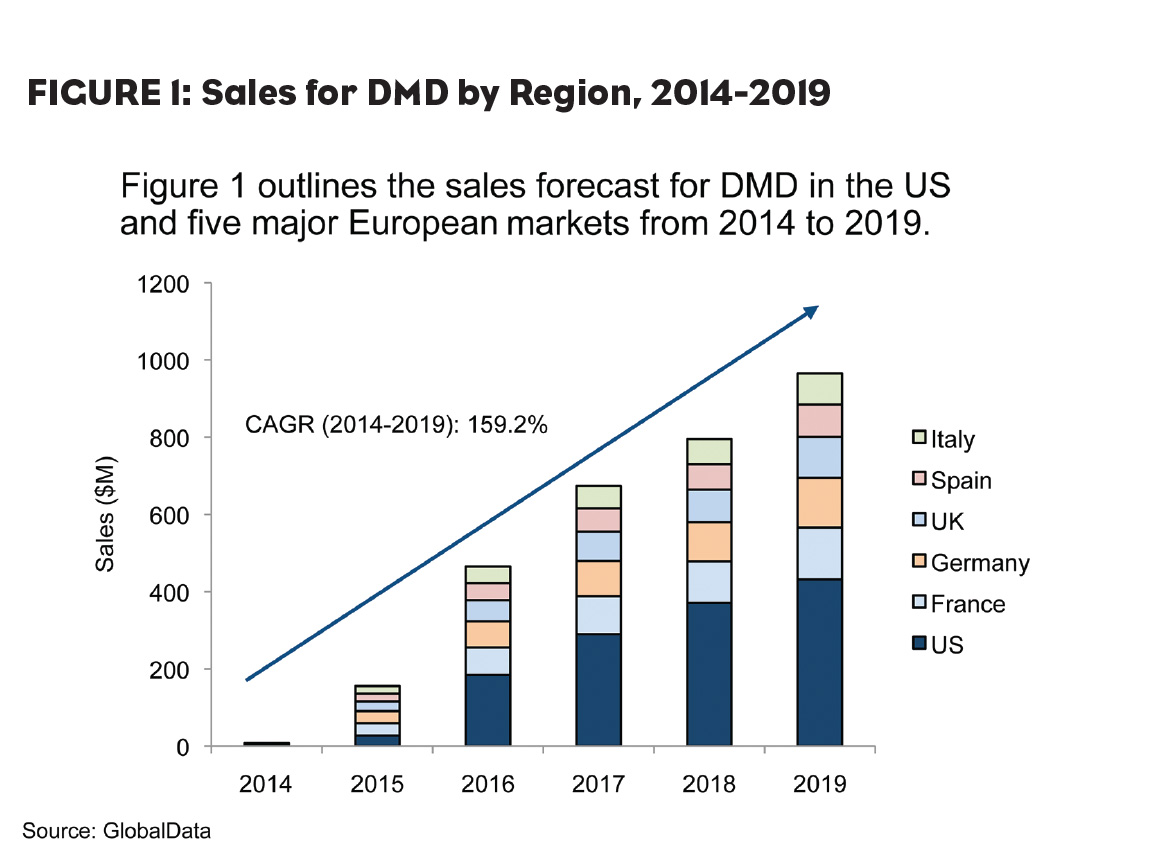

Generic corticosteroids, namely prednisone and deflazacort, remain the current standards of care and contribute to the nascent DMD market, which was estimated at $8.2 million across the 6MM in 2014. However, both the treatment landscape and the DMD market are set to witness tremendous growth—reaching nearly $1 billion by 2019—as a result of the launch of novel mutation-specific drugs in the coming years (Figure 1). However, a large segment of DMD patients are expected to be ineligible for these promising new drugs, leaving vast opportunity for developers to deliver new therapies and for continued growth in the DMD market beyond 2019.

Spotlight on PTC Therapeutics’ Translarna (ataluren)

In August 2014, PTC Therapeutics’ Translarna (ataluren) was granted conditional approval by the European Medicines Agency (EMA) for DMD with nonsense mutations (nmDMD) based on Phase IIb results. This marked a significant shift in the DMD landscape, as Translarna became the first approved disease-modifying therapy. Still, the caveat of this conditional approval is that it was based on Phase IIb results, meaning PTC Therapeutics will need to further demonstrate clinical efficacy in a larger Phase III trial in order to continue marketing Translarna as a DMD therapy in Europe. PTC Therapeutics is simultaneously pursuing the medication’s regulatory filing with the U.S. Food and Drug Administration (FDA).

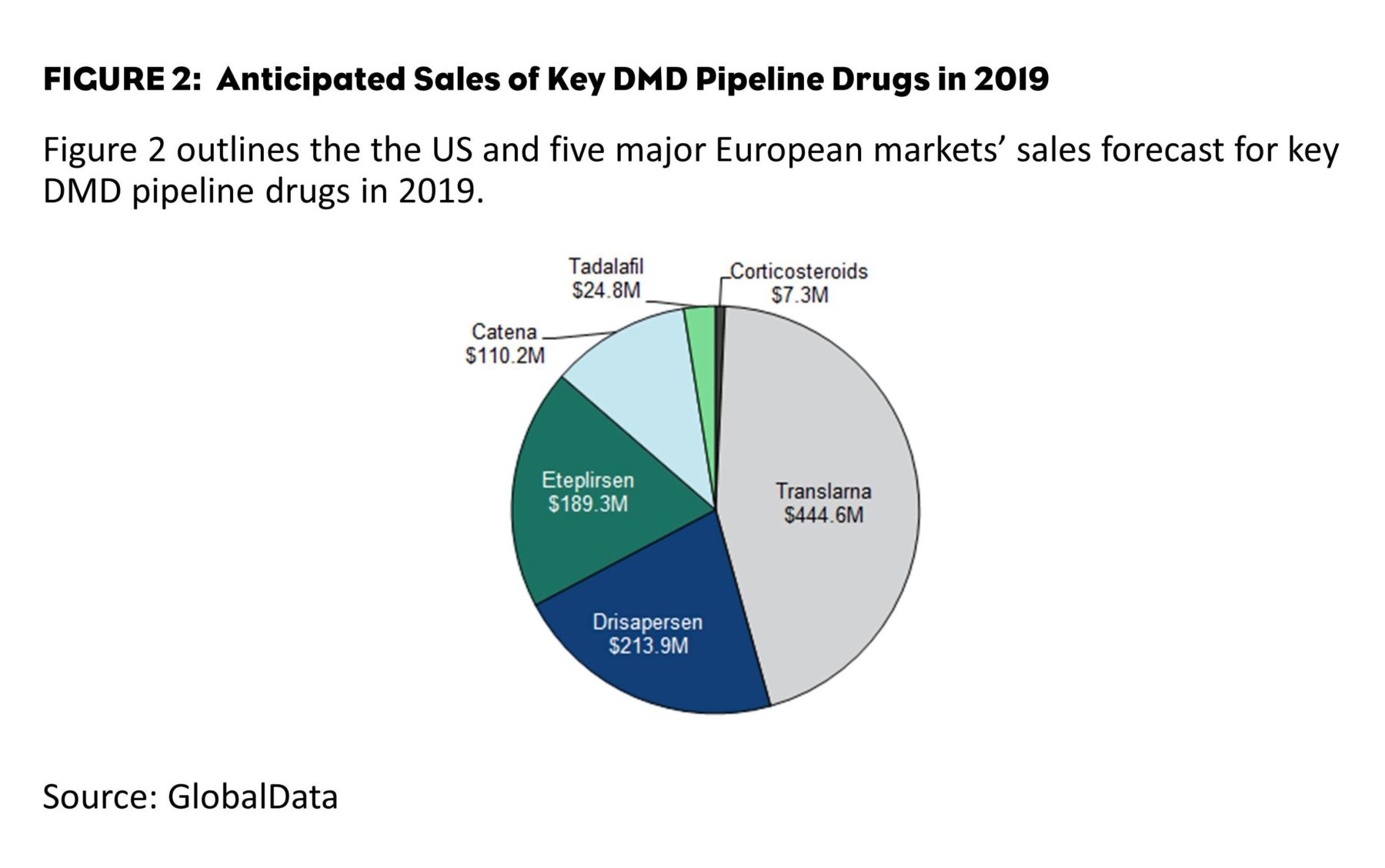

PTC Therapeutics launched Translarna in Germany in late December 2014, with an estimated annual cost of therapy of $438,000. Owing to strong lobbying from eligible DMD patients as well as clinicians, it is well-poised to become the top-selling DMD drug during the next five years (Figure 2). By 2019, GlobalData predicts that Translarna will generate nearly $445 million in sales from the 6MM, and approximately $196 million of 2019 sales will come from the U.S. market.

Focusing on market access issues, it is likely that this medication will receive payer reimbursement from local healthcare providers because of its proven efficacy along with the high awareness and strong demand for the drug by patients and physicians. In February 2015, PTC Therapeutics initiated a New Drug Application (NDA) for Translarna with the FDA. Meanwhile, the remaining major European markets are evaluating reimbursement of the drug, but are expected to follow in Germany’s footsteps during early 2015.

This treatment’s commercial potential is noteworthy because it commands a relatively small segment of the DMD market, namely ambulant DMD patients with nmDMD, who represent less than 5% of total diagnosed DMD patients. Within this niche target patient population—once it is reimbursed—Translarna is not expected to face significant competition over the next five years since it is first-in-class and first-to-market for nmDMD.

Game Changers: Exon-Skipping Therapies

Sarepta Therapeutics’ eteplirsen and BioMarin/Prosensa Therapeutics’ drisapersen are antisense oligonucleotides (AONs) that bypass a cluster of DMD mutations (specifically, exon 51), and are commonly referred to as exon-skipping therapies. With an expected premium price of nearly $275,000/year per patient for each exon-skipping drug, drisapersen and eteplirsen are expected to generate approximately $214 million and $189 million in sales, respectively, from the 6MM in 2019.

The DMD exon-skipping therapy space will witness strong competition between BioMarin/Prosensa Therapeutics and Sarepta Therapeutics. The companies are head to head in almost all clinical and developmental milestones and are competing for the same target patient population. Prosensa’s blocking patent for the commercialization of exon 51 skipping molecules in Europe may challenge the launch of eteplirsen in this region.

Conversely, Sarepta’s U.S. Phase II clinical trial in non-ambulant DMD patients provides early opportunity to expand into a wider patient population. A rolling NDA submission for drisapersen was started in October 2014, and the drug is expected to launch in late 2015 in the U.S., whereas eteplirsen’s NDA is currently in preparation, with a U.S. launch likely in early 2016.

Future Outlook: Ample Opportunities for Growth

Among the diagnosed DMD patient population, nearly 75% are ineligible for Translarna, drisapersen or eteplirsen. This unaddressed patient population is expected to benefit somewhat from repurposed pipeline drugs such as Santhera Pharmaceutical’s Catena (idebenone) and Eli Lilly’s tadalafil—currently marketed as Cialis. Both drugs, currently in Phase III development, are expected to treat specific stages of DMD progression.

Theoretically, 83% of all DMD mutations may be treated using the exon-skipping strategy. Indeed, BioMarin/Prosensa and Sarepta are planning to target additional mutations with follow-on exon-skipping molecules developed from their platforms. BioMarin/Prosensa’s three follow-on AONs—PRO044, PRO045 and PRO053—can potentially treat an additional 22% of DMD mutations whereas Sarepta’s SRP-4045 and SRP-4053 can expand treatment to an additional 16% of DMD patients. Given the promising clinical potential of flagship molecules drisapersen and eteplirsen, GlobalData believes that the entire portfolio of follow-on exon-skipping therapies from BioMarin/Prosensa and Sarepta have high clinical and commercial potential.

With ongoing research, large pharma companies, small biotechs and research institutions have teamed up to discover a multitude of therapeutic strategies to treat DMD. The development of novel disease-modifying drugs for treating the wider patient population is therefore set to dramatically change the DMD treatment and competitive landscape in the coming decade.