“What would Apple do in this situation?” This may seem like a common question for marketing circles. Not in pharma. Or, not in pharma until very recently. The industry is starting to look outside for leading practices, at consumer goods, financial services, airlines, etc.

Patient adherence experts are hired with increasing frequency for their success with loyalty programs at companies like American Express and Delta Airlines. The key words recruiters are looking for are no longer diabetes or oncology, but end-to-end customer experience, social media, integrated campaign management, reward system and ROI measurement.

As the revenues lost for lack of adherence become better understood by senior management,1 and new growth drivers become more scarce, pharma companies are reconsidering their investment in patients’ ongoing care. Have they forgotten the limitations of disease management, the difficulties for pharma to interface directly with the patient and the stringency of HIPAA? Not really. But the technology is there, and that justifies a new look at the old patient adherence problem, and, its big sister, patient centricity.

Where Are We Now?

If you look at the industry as a whole, you can see clear trends as well as more timid steps forward. Commercial investments are certainly shifting. Whereas TV, radio and print represented 62% of marketing budgets in 2009 against only 10% for social and mobile media, two years later, the picture has significantly changed. We now see as much as 28% spent on social and mobile media, a multiplication by almost three.2

On the people side, the transformation is less dramatic. A few vanguards such as Merck and GSK invested in patient centers of excellence with cross product responsibilities. However, they are the exceptions, and most pharmaceutical structures remain unchanged, with adherence or even patient responsibilities buried deeply in the organization chart.

The most advanced companies are those that invested in patient services to survive. Biopharma operating in specialty areas such as hemophilia or oncology have long been investing in extensive patient adherence platforms, sophisticated access services and specialty distribution channels that provide them with greater patient intimacy. Even more interesting is the experience of the companies that had to enter into risk sharing agreements with payers, by which access and reimbursement levels were linked to observed health outcomes. In deals such as the Merck-Cigna Januvia contract, patient adherence and outcomes took center stage and started to transform the pharma business model.

The Financial Imperative

What is quickly changing: Many executives are recognizing the importance of patient adherence to financial success. The difference in profit growth between leaders and laggards in customer experience has become too large to ignore. According to Watermark Consulting, the cumulative stock performance over 2007–2011 of companies with the highest customer experience index was 22.5%, against -1.3% for the S&P 500, and -46.6% for companies with the lowest customer experience scores.3

But what makes most executives pause is the progressive evolution of the healthcare landscape away from fee-for-service towards true accountabilities for end-to-end patient care.

Accountable care organizations (ACOs), patient centered medical homes (PCMHs), value-based purchasing, Medicare Star Rating and the PPACA is replete with measures intended to shift stakeholders’ incentives to make them mindful of the impact of their actions on patient outcomes. Many sections of the new regulation are aimed at improving patient adherence. And many of the measures that do not directly address adherence focus on creating the technology infrastructure required to measure and manage it: electronic health records (EHR), meaningful use, Health IT, etc.

As a result, pharma’s customers’ needs are evolving fast:

• Payers increasingly want real world outcomes rather than just products or procedures. They are shifting whatever risk, cost and responsibilities away to other stakeholders. At the same time, they are willing to spend more on prevention and quality.

• Providers see their world changing dramatically. Although pay-for-performance and ACOs are only at the pilot stages, consolidation and affiliation to larger systems is growing fast. As much as 75% of chronic disease prescriptions are already funneled through integrated delivery networks (IDNs). E-prescribing adoption exceeded 69% of office-based physicians in 2012.4

Providers are trying to figure out how they can truly coordinate the care of their patient populations. For all but the most advanced IDNs, any help they get along the way is welcome, be it tools, education or services. IDNs often close their doors to reps, but they quickly reverse their policies if the right medical or support services are offered.

With such a change taking place before their eyes, many pharmaceutical executives realize that they need to act. They understand that the patient is key. The question is: where to start?

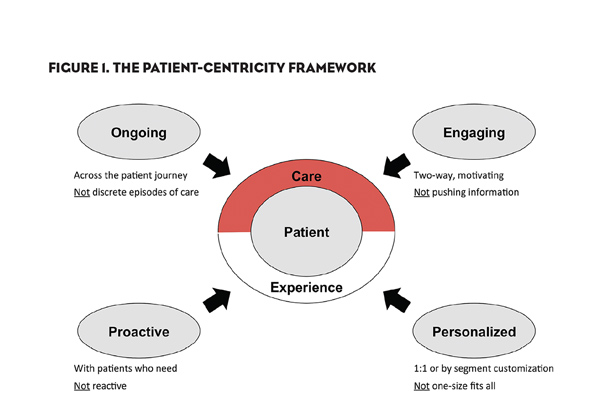

Ongoing, Engaging, Personalized and Proactive Patient Interactions

The phrase “patient centricity” has been so frequently misused that it feels awkward to see in it pharma’s path forward foundation. However, what is at stake: Effectively rethinking patient care and patient experience throughout the disease and treatment journey. The questions that most advanced companies are asking are:

1. How can we help enhance patient care from disease awareness to cure or ongoing management?

2. How can we ensure patients and their caregivers are more engaged with their own treatment?

3. How can we personalize patients’ treatment and health management?

4. How can we be more proactive in addressing patients’ health risks or issues?

1. Ongoing. While the patient flow has long been the heart of pharma’s planning process it generally follows the journey to and with the prescription drug, not the experience of the patient with the condition. Going from traditional marketing to patient-centric care requires a mindset shift, new analytical tools and a review of the full pharma-patient interaction.

Big changes for pharma include:

• Expanding the breadth and depth of their sole true direct interface with patients, opt-in programs to accompany more patients throughout their journey.

• Leveraging EHR, e-prescribing and clinical decision support to enhance knowledge of the patient, improve care and appropriate product usage.

• Creating true relationships with patients before and after the treatment decision, to help them better digest diagnoses, weigh in on the selection of a treatment adapted to their needs and lifestyle, and cope with the ups and downs associated with their disease.

• Embracing indirect interactions with patients through other healthcare stakeholders such as providers or pharmacies, by providing those intermediaries with the tools they need to understand the patient experience and positively impact it.

2. Engaging. Our understanding of what motivates people to act has progressed significantly over the past decade, following new discoveries in the fields of behavioral economics, psychology and neurosciences. Businesses are proficient in the use of social and mobile media where they interact on a peer-to-peer basis with customers rather than push messages their way. Despite regulations, healthcare websites, communities and apps have multiplied. Pharma now needs to start truly engaging with patients.

Big changes for pharma include:

• Leveraging loyalty programs, rewards, gamification and visualization techniques to better educate patients and help them take control of their disease, treatment and lifestyle.

• Getting into two-way conversations with patients through opt-in programs, social media and other channels.

• Engaging with patients’ families, friends and caregivers, recognizing that they are their most trusted and most accessible sources of information.

3. Personalized. Non-healthcare businesses have been segmenting their customers according to differences in behaviors and customized interactions for a long time. For pharma, customizing interactions with patients based on observed behaviors or even demographics is still a relatively new concept. The website MerckEngage was recognized as innovative for its segmentation of patients based on their stated belief in the safety, importance and economic burden of a medication.

Big changes for pharma include:

• Accessing and analyzing rich data on patients’ health and multiple interactions with healthcare stakeholders to understand their behaviors, in a compliant manner.

• Progressively refining patient segmentation and messages based on such data and direct cues from two-way interactions.

4. Proactive. The benefits of segmen-tation are that it enables pharma to do what it has had a hard time doing until now: targeting patient adherence and other interventions at the right time at patients who truly need them and who may be responsive. The theoretical impact on health outcomes is enormous. A patient at risk of dropping his schizophrenia drug may be contacted by a case manager if he failed to show up for his doctor appointment, or simply if he belongs to a high risk category, thus avoiding admission to the emergency room or crisis center, as a result of lack of appropriate ongoing treatment. Multiple payers, health systems, and even some pharma companies, have started on this route toward population health management, and are using analyses of claims or EHR data to stratify patient risk and customize their interventions.

The big changes for pharma include:

• Finding a way to leverage patient data in compliance with regulations limiting its access to patient health information (e.g., HIPAA).

• Partnering with other healthcare stakeholders to run population health management operations.

A New Business Model?

The desired results of this shift to patient centricity are better care and a better treatment experience for the patient. For pharma, they are better outcomes and improved relationships with other healthcare stakeholders including payers and providers. In many ways, patient centricity marks the beginning of a journey that will transform pharma from an industry that sells products to one that sells health outcomes.

References:

1. Estimated at $564 billion globally in: Estimated Annual Pharmaceutical Revenue Loss Due to Medication Non-Adherence, Capgemini Consulting-HealthPrize, 2012

2. Digital marketing captures a greater “share of mind” among pharma marketing, says Cutting Edge Information, Pharmaceutical Commerce, January 11, 2012

3. Watermark Consulting, 2012

4. The National Progress Report on e-prescribing and Safe-Rx Rankings, year 2012, Surescripts

What Would Apple Do?