The heat is on payers to identify which brands offer the best value, and many key decision makers turn to health economics and outcomes research (HEOR) to help them pick the winners and the losers.

Marketers should understand how payers use HEOR studies if they want to maintain or grow their brand’s competitive advantage. Here are five key points about HEOR every marketer should know.

1. HEOR USE IS GROWING

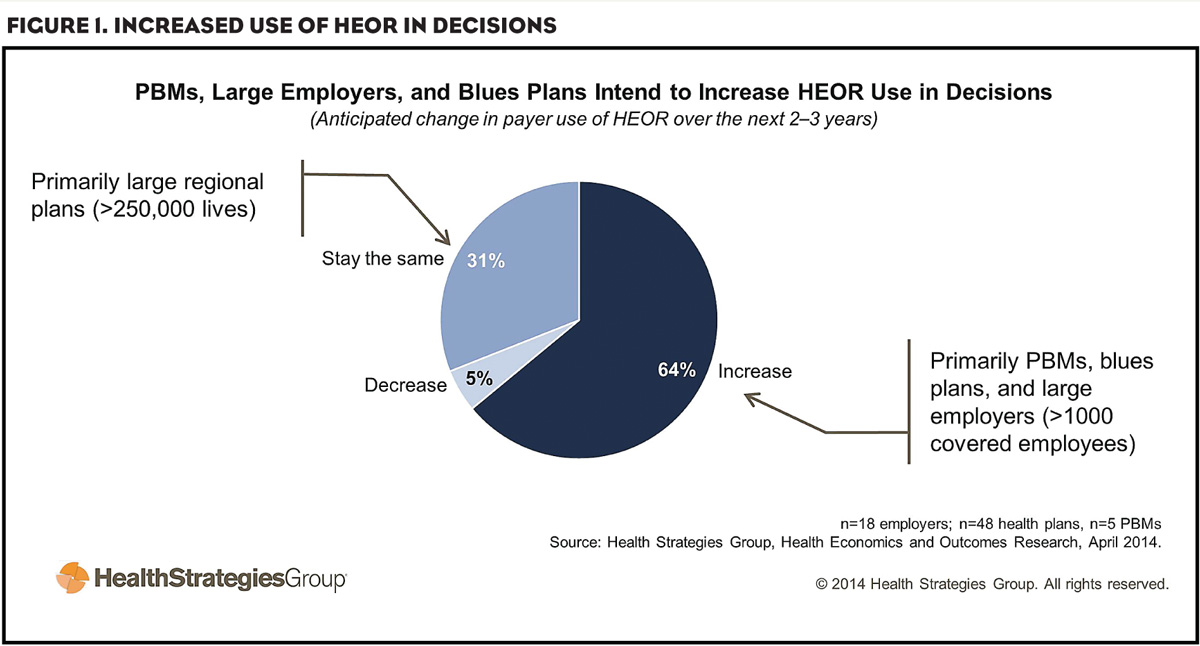

Nearly two-thirds of payers expect to expand their use of HEOR for access and reimbursement decisions, according to our research (Figure 1). A number of trends drive broader adoption of HEOR, including:

- Pressure from employers to cut costs and deliver more value.

- Coordinated efforts to manage patients with multiple chronic conditions.

- Expansion of health services for at-risk patient populations.

- Growth of IT and analytics tools that allow for more robust data analysis.

- Rising specialty drug costs, which prompt payers to identify better ways to evaluate brands.

2. HEOR IMPACTS FORMULARIES

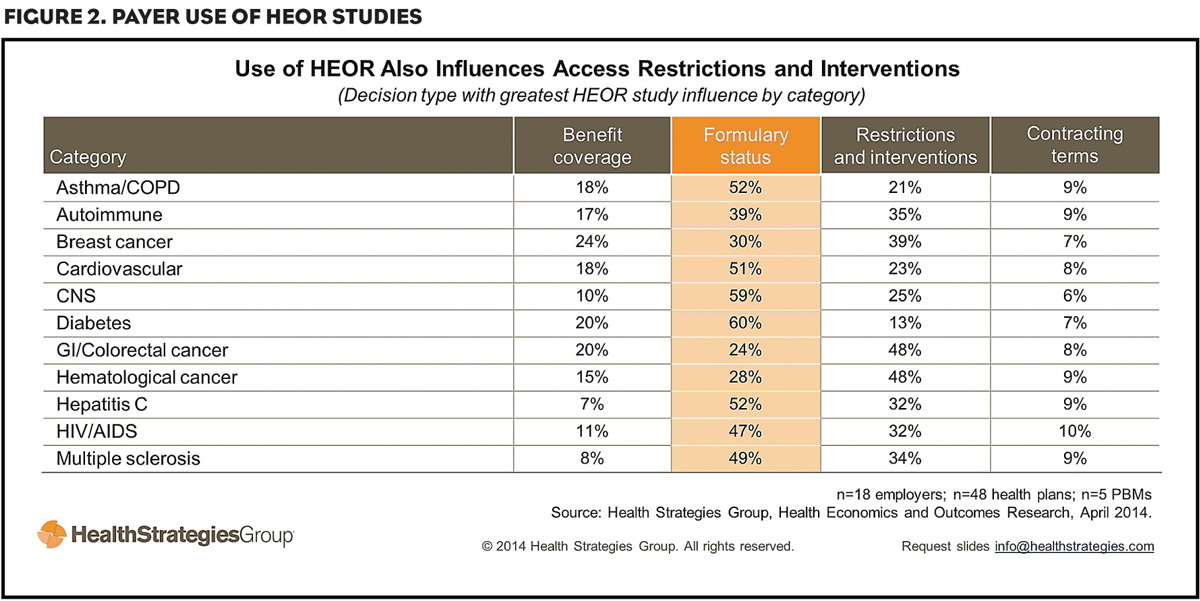

HEOR studies influence formulary status decisions in the top 11 therapeutic categories (Figure 2). Payers expect the influence of HEOR to grow in these categories, putting more pressure on brands to demonstrate best-in-class performance. As one health plan executive put it, “Outcomes are going to dictate product selection—period.”

3. HEOR USE GREATEST IN HIGH-COST CATEGORIES

Typically, payers are most likely to use HEOR studies when evaluating brands in high-cost categories. Most often, plans use these studies—particularly drug-to-drug comparisons—to make formulary decisions for hepatitis C, cardiovascular and asthma/COPD agents.

Payers also tend to advantage higher-cost therapies when HEOR studies demonstrate future cost savings and positive clinical outcomes.

4. PAYER SOPHISTICATION VARIES

Currently, some technologically sophisticated employers, health plans and pharmacy benefit managers (PBMs) conduct HEOR research in-house using their own data. But most are still working on integrating members’ pharmacy, medical, laboratory and hospital data, and developing an analytics platform that allows them to query their data sets.

Understanding the level of HEOR sophistication at individual organizations helps marketers provide payers with the right resources and support, which may or may not include HEOR data. That understanding also helps marketers anticipate brand access and utilization challenges with customers that interpret, incorporate and apply HEOR into their decision-making process.

5. CREDIBILITY IS KEY

In addition to using their own data, payers rely on academic institutions, third-party data providers and government agencies for HEOR studies.

Some payers are open to biopharmaceutical company-supplied research, particularly modeling, prospective, retrospective and quality of life studies. But many are still uncertain how to use HEOR from the industry to augment their decision making. Some payers believe these HEOR studies are biased and offer little value compared with research conducted by academic institutions and third-party data providers.

Moving forward, biopharma companies will need to explore ways to overcome this credibility gap and improve payer perceptions of their HEOR studies. To start, marketers should assess how payers perceive their studies so they can better meet their customers’ needs. They also may want to build relationships with organizations and other payers that are willing to partner on HEOR initiatives.

In addition, marketers should develop resources or tools to help payers interpret HEOR data. By following these strategies, marketers can help protect their brand’s value as the use of HEOR grows in the coming years.