Healthcare costs affect all of us, both personally and professionally. With the steady drumbeat of public outrage over high drug prices, it’s easy to see why healthcare costs have become a huge focus in the news—especially during this election season. Healthcasts recently tackled the issue by surveying those on the front lines of patient care. The survey, administered in October to Healthcasts physician members, was designed to gauge HCPs’ views on a range of topics from prescription drug costs to reimbursement, Medicare reform, and biosimilars.

The survey results suggest that whoever wins the upcoming election, physicians will want the next president to focus on rising healthcare costs. They will be closely examining the impact of outcomes-based care models on their bottom lines, while also looking to pharma to provide additional solutions to help their patients as well as their own practices.

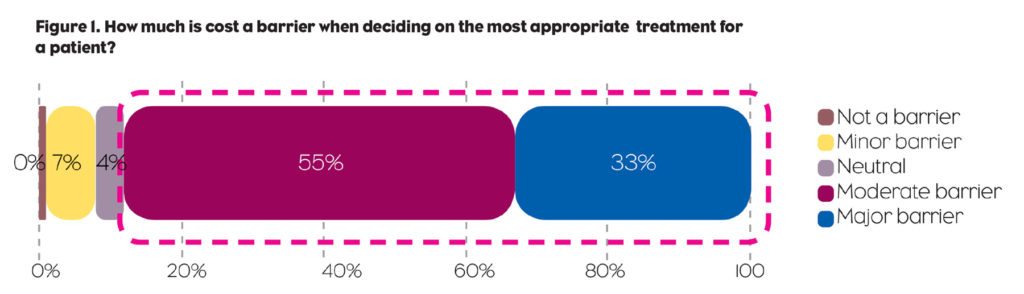

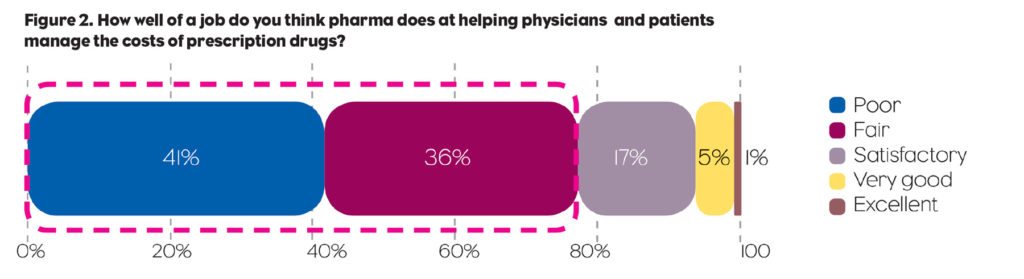

The survey touched on a wellspring of economic concerns. It should come as no surprise that the costs of care—specifically, high prices for prescription drugs—figured prominently in those concerns. Whereas physicians generally base their treatment decisions on efficacy, safety, and cost, a vast majority (88%) say cost is a barrier when deciding on the most appropriate therapy for a patient (Figure 1). A similarly large majority (77%) said the pharma industry does a poor job, or at best a fair job, at helping physicians and patients manage the costs of prescription drugs (Figure 2). More than two-thirds (69%) called for greater transparency from pharma companies—particularly regarding R&D expenditures and manufacturing costs—to justify the high prices of their drugs.

The survey touched on a wellspring of economic concerns. It should come as no surprise that the costs of care—specifically, high prices for prescription drugs—figured prominently in those concerns. Whereas physicians generally base their treatment decisions on efficacy, safety, and cost, a vast majority (88%) say cost is a barrier when deciding on the most appropriate therapy for a patient (Figure 1). A similarly large majority (77%) said the pharma industry does a poor job, or at best a fair job, at helping physicians and patients manage the costs of prescription drugs (Figure 2). More than two-thirds (69%) called for greater transparency from pharma companies—particularly regarding R&D expenditures and manufacturing costs—to justify the high prices of their drugs.

Suffice it to say that many pharma companies’ reputations are taking a beating amid the uproar over pricing. Yet some of the more astute companies, along with the governmental organizations involved in our nation’s health, are taking steps not only to improve their perception among physicians and consumers, but also to tangibly affect the costs of healthcare. Such initiatives include the Center for Medicare & Medicaid Innovation’s Oncology Care Model, and companies such as Merck (for Januvia and Janumet) and Novartis (for Entresto), who are negotiating value-based coverage plans that guarantee outcomes in exchange for favorable formulary placement. If such value-based initiatives pay off for these innovative companies and their payer partners, it’s safe to assume that the concept of “value for volume” will gain greater traction in the year ahead.

Suffice it to say that many pharma companies’ reputations are taking a beating amid the uproar over pricing. Yet some of the more astute companies, along with the governmental organizations involved in our nation’s health, are taking steps not only to improve their perception among physicians and consumers, but also to tangibly affect the costs of healthcare. Such initiatives include the Center for Medicare & Medicaid Innovation’s Oncology Care Model, and companies such as Merck (for Januvia and Janumet) and Novartis (for Entresto), who are negotiating value-based coverage plans that guarantee outcomes in exchange for favorable formulary placement. If such value-based initiatives pay off for these innovative companies and their payer partners, it’s safe to assume that the concept of “value for volume” will gain greater traction in the year ahead.

Value for Volume is Gaining Ground Quickly

This “value for volume” concept also extends to physicians, who generally are clearly concerned about their patients’ ability to afford care. However, many HCPs are also anxious about their own bottom lines, a concern exacerbated by the looming specter of Medicare reform. Specifically, the 2017 implementation of the Medicare Access and Chip Reauthorization Act (MACRA) will herald the start of a true pay-for-performance model for physicians. Indeed, many policy experts consider MACRA, which was signed into law in 2015, one of the most important—and potentially impactful—initiatives to reform the U.S. healthcare system since the passage of the Social Security Act of 1935.

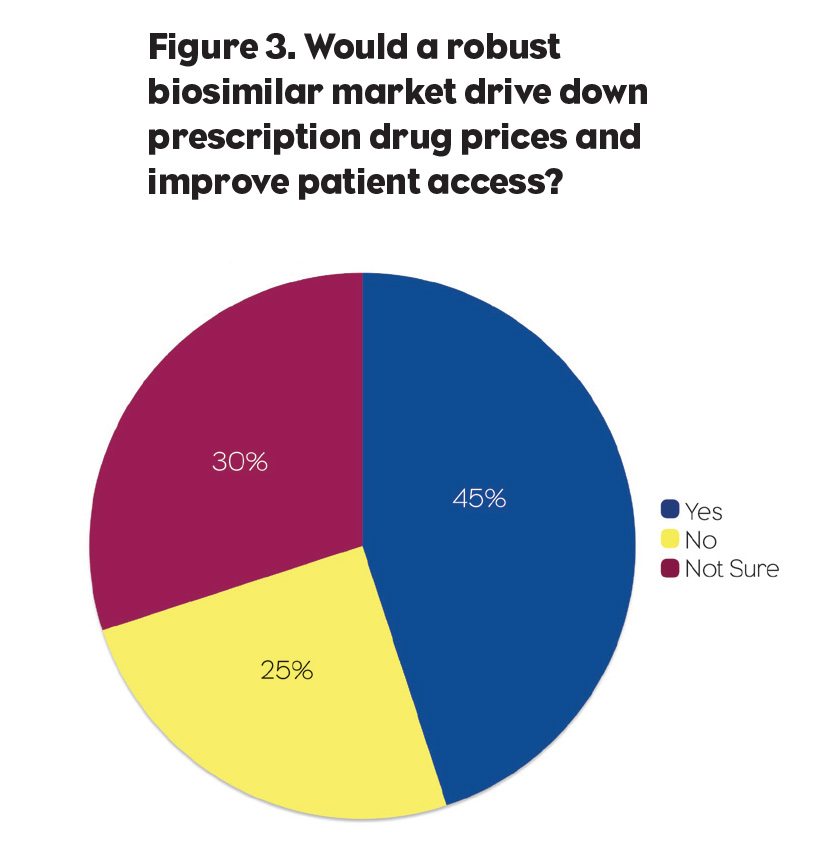

As talk of Medicare reform and “value for volume” rumbles through the marketplace, it’s important to note that the marketplace itself is shifting as numerous categories brace for the impending influx of biosimilar therapies. Our survey uncovered a divergence of opinion—as well as a need for education—regarding biosimilars. When asked if a robust biosimilar market would drive down prescription drug prices and improve patient access, nearly half (45%) of the participants answered “Yes,” 30% said “No,” and 25% indicated they weren’t sure (Figure 3). But most respondents agreed that pharma (66%), medical organizations (60%), and the FDA (73%) were doing a poor or fair job at educating physicians about biosimilars.

Biosimilars Education Gap

Biosimilars Education Gap

Additionally, 40% said their level of knowledge about biosimilars was “somewhat better” compared to one year ago; 34% indicated their knowledge level “has stayed the same” over the past year; only 23% described their biosimilars knowledge base as “much better” than a year ago. Even among those who feel educated about biosimilars, there are significant concerns about extrapolation and interchangeability with “innovator” products: These concerns will need to be addressed if biosimilars are to have a reasonable adoption curve.

Given these trends and the economic concerns they engender, how can we as an industry help physicians better understand the value of the drugs at their disposal? How do we ease cost barriers to uptake, and then bolster physicians’ confidence in prescribing the most effective—and most cost-effective—treatments to their patients? The answer lies in open and transparent communication. When a broad range of physicians have access to outcomes data, and when pharma companies and payers are up-front about formulary coverage and pricing models, HCPs are routinely reminded of the value of the medications they prescribe, and increasingly regard us as partners in their quest to advance and improve patient care.

Granted, the approaching election has brought many of these issues to the forefront (indeed, several of our physician members said the election itself would impact their practices more than any other issue in 2017). But regardless of the election, drug marketers should heed physicians’ concerns about rising drug prices, outcomes-based reimbursement models, and the apparent educational gap regarding biosimilars. We all (doctors, pharma, insurance, hospitals) need to work together to truly control costs. And, in addition to promoting their brand benefits as a major component of their products’ value, pharma companies must regain their customers’ trust through greater transparency, more robust educational efforts, and demonstrated dedication to patient care (as well as to patients’ pockets!). And to the extent that industry can forge productive and positive relationships with the incoming administration, so much the better.