In September 2019, we discussed the definition and impact of the “Amazon Effect” in personalized health, a phenomenon we suggested would shape a “future of hyper-personalization in healthcare marketing.” One year on, in a health environment where change has been accelerated by COVID-19, the products and services offered by Amazon in this vertical have rapidly evolved. Amazon continues to make significant inroads into health-related industries with a mix of insurance, clinical facilities, pharmacies, and virtual and in-person diagnoses through to a dizzying array of digital tools that aid everything from medical transcription to prescription drug management.

Amazon’s push into all aspects of healthcare is guaranteed to continue the disruption of the industry, not just in the U.S., but globally. When we think about the key industries that stand to be impacted, there don’t appear to be any areas where Amazon is not in hot pursuit. Simply considering the breadth of its reach and the depth of its innovative capacity should send tremors through the existing healthcare establishment. Provider and service networks, health insurers, immediate care clinics, remote and distant diagnostic services (telehealth), retail and mail-order pharmacy, electronic medical records, audience segmentation and profiling, and third-party vendor profiling and engagement capabilities, to name but a few.

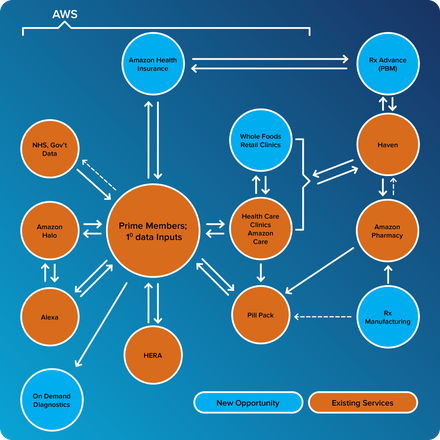

The schematic below provides an interesting line of sight into the channels that Amazon has currently aligned in health-related activities but also provides a perspective on the broader range of opportunities to where Amazon Health is in a position to evolve. The three potentially attractive new areas for Amazon include commercial pharmacy benefits manager (PBM) services, pharmaceutical generic manufacturing, individual health diagnostics, and therapeutic on-demand profiling.

Commercial PBM Services

Commercial PBM Services

Many employers are looking for alternatives to the existing PBM model. In many instances, the employers don’t understand their rebate model and would welcome an alternative to a rebate-driven business model. Amazon is positioned to offer the same functions traditionally serviced by PBMs through RxAdvance, but more importantly, it can offer those services at near 0% margin since Amazon doesn’t need to make money exclusively on that business offering.

Pharmaceutical Manufacturing

Kaiser Permanente (KP) is often considered the classic closed-loop model for healthcare. Amazon is in a position to build on that model and incorporate a manufacturing/supply side to the business—not just for generics, but for all related medical equipment supply and services. This would provide Amazon with a complete service model, leveraging global patient access services.

Therapeutics and Profiling On-demand

Amazon’s somewhat confidential “Hera” project is intended to review electronic health records (EHRs) to spot errors in coding or diagnosis. Through this technology, Amazon could leverage its own version of blinded data mining of EHRs. Starting with the National Health Service (NHS) in the UK, which is testing and refining its algorithms in an effort to make better therapeutic predictions for patients, leveraging known and predicted insights. Combining this data with data from Halo Health’s role-based collaboration platform and the now HIPAA-compliant Alexa could offer opted-in patients a predictable and accurate line of sight into current and future health considerations.

What’s Next

These three areas are but a sampling of the opportunities available for Amazon, as the future really is theirs to prescribe. Existing prototypes and pilots support testing and fine-tuning of all key people-, HCP-, and consumer-based marketing disciplines, including identity management, audience segmentation, personalization, omni-channel activation, measurement, channel propensity, and optimization.

The health industry has been anticipating someone to offer a full-service health solution, with diagnosis, prescription, support, follow-up, and renewal, potentially eliminating the need to go outside the offering for anything except a specialist and/or surgery. Amazon’s efforts take this model to a whole new level, with added dimensions of insurance, profile analytics and diagnoses, pharmaceutical benefit management, and potentially Rx manufacturing.

The end game for Amazon is what it has always been, to become the dominant player in all aspects of the $12 trillion global healthcare business. Amazon will continue to expand its “Amazon Care” pilots across multiple employee sites, preparing the foundation it needs to provide a patient experience that spans diagnosis, telehealth related services, Rx delivery, follow-up, Rx renewal, health insurance, and pharmaceutical manufacturing, all of which receives support from Amazon Web Services (AWS). This will, in turn, drive consolidation among family physicians, pharmacists, nurse practitioners, reimbursement specialists, and physician’s assistants, as their services convert to the broader virtual offerings, or potentially disappear. Suppliers to this industry, ranging from pharmaceutical sales reps to medical device manufacturers, should also reposition their value propositions, given the dramatic changes that are well within view.

Amazon is changing the rules for health engagement and personal exchanges. For those of us focused on cross-industry strategy and analytics, consumer segmentation and communication, personalized messaging, and media, it is time to rethink and re-rationalize our HCP and consumer go-to-market engagement strategy.