Pharma marketers are always looking for new ways to improve their brand’s commercialization prospects at launch. The best way may be to examine analogs (past successes) and anitlogs (past failures) of similar products.

Blockbuster products are fast becoming a fad of the past, paving way for a more complex market characterized by increased government regulation, persistent generic competition, reduced periods of patent exclusivity and the heavy weight of third-party payers. This new emerging market is forcing pharmaceutical executives to explore new avenues for maximizing product potential throughout its lifecycle. By laying emphasis on developing strategic commercialization plans earlier in the drug development process, companies are hoping to gear their products for success.

A constant supply of new products and their successful commercialization is the life blood of a company. According to experts, “it is important to acquire market share and establish industry leadership. The company with the first product in a therapy area to the market can usually capture premium segments, build strong name recognition, and control a large market share.” However, studies by Booz Allen and Hamilton, among others, have found that between 50% and 67% of new products fail in the commercialization process.

The Holy Grail of pharmaceutical marketing campaigns is in trying to interpret how a strategy on paper will translate into real sales. With the cost of launching a new drug now over $1 billion, it is critical to set the right expectations for launch. The key to quantifying the opportunity is to identify and apply the right analogs—successful predecessors worth mimicking in some ways—as well as antilogs—unsuccessful predecessors not worth mimicking.

Defining a brand strategy involves solid positioning of the product and its values, with strong clinical trial programs to support its claims. Pre-launch, this will focus on the lead indication; beyond it will involve the entire lifecycle strategy, including line extensions as well as end-of-life strategies ahead of patent expiry.

Some keys to consider when forming your brand strategy:

• Use evidence-based forecasts to make better decisions.

• Plan your marketing activities accordingly to the right expectations.

• Determine the right promotional mix according to historical analogs and antilogs.

• Save time and money with a systematic classification of product and market characteristics to realistically forecast performance.

The challenge starts with the limited understanding of how analogs and antilogs—historical precedents—can be applied more inventively. Analogs and antilogs can be a very useful way of validating forecast models and modeling what is typical. However, their application could be broader still if we knew more of the details behind them—to value different strategies and Critical Success Factors (CSFs). Product analogs and antilogs are thus essential for business planning and assessing the market potential for an acquisition target.

It is easier to pick the right analog to understand what is quantitatively possible within any given market situation. But the real challenge lies in picking analogs and antilogs to understand which strategic option will be most effective. Analyzing analog and antilog products within a therapeutic area allows you to define the “true” conditions for a new product launch.

Choosing the Right Analogs and Antilogs

Analogs and antilogs offer an unparalleled depth of categorized benchmarks. Methodical steps to follow include:

1. Identify analogs and antilogs—preferably within the same therapeutic class. It is often difficult to find an adequate number of analogs and antilogs in the same therapeutic category, in which case it is useful to go beyond the therapeutic class of interest to understand the success and failures of predecessors. There are essentially three types of analogs and antilogs: Competitor Brands, Broader Therapy Area Brands and Broader Market Brands.

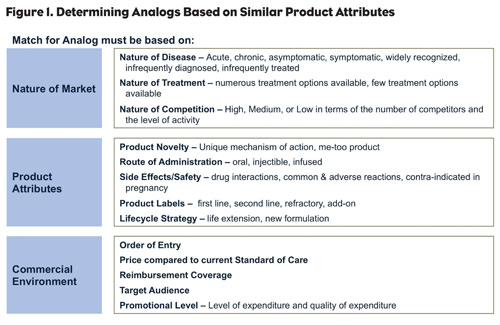

2. Match the characteristics of your drug. As your product approaches launch, compare it to products with similar profiles, based on attributes and market characteristics such as indication, disease state (chronic versus acute), therapeutic class, market type (satisfied versus unsatisfied), market fragmentation, competition, prescribing specialties, patient profile, use setting, sales, efficacy, safety, tolerability, use and administration, form, dosing, promotional support at launch (include information on co-marketing if any), and Managed Care (Figure 1).

Analog screening criteria are developed based on:

• Product—Order of entry between two and five in key competitive markets; Oral formulation; Launched in last five years.

• Market—Chronic treatment; Retail product; Product helped define new market segment.

• Promotional—DTC advertising for at least 12 months; started DTC relatively soon after launch.

Promotional analogs and antilogs are:

• Selected based on likelihood to have the right promotional sensitivities.

• Used to develop response models assessing the promotional sensitivities.

Forecasting analogs and antilogs are:

• Selected based on likelihood to have a similar performance for the baseline level of spend.

• Used to determine the baseline forecast for the promotional assumptions imbedded in the forecast.

3. Collect information on analogs and antilogs. Key information that can be obtained from analogs and antilogs includes spend levels, mix selection, market share/penetration, new starts/switches, geography focus, targeting, and messaging.

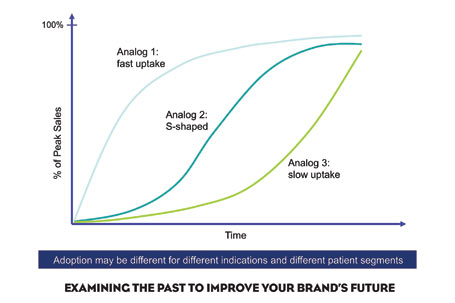

4. Extrapolate analog and antilog curve to your product’s “fitted” line. See Figure 2.

[Insert Figure 2 here]

5. Apply the “fitted” line for your product onto in-house forecasts. Then generate forecasts of potential revenue for your product (Figure 3).

[Insert Figure 3 here]

Applying Analogs and Antilogs

Pharma companies can learn from the experiences of others using both successful and failed endeavors to help with the decisions and then develop and test hypotheses to mold the business. The key to quantifying the opportunity is to identify and apply the right analogs in a unique strategic forecasting tool that selects historical lessons based on product attributes and market characteristics. Accelerating cost-efficiencies by harnessing large sets of data and associated analytics has allowed even smaller firms to participate in such offerings and potentially benefit from:

• Collating large numbers of potential analogs from both pharma and non-pharma entities.

• Analyzing analogs and antilogs and then selectively choosing those that appear to help build a robust business analysis.

• Making better decisions with evidence-based forecasts.

An example of a company that appeared to have successfully leveraged analogs was Astra Merck, Inc. (AMI) and its launch of Prilosec. Since a number of the product’s brand team members had experience and/or exposure to a multitude of prior Merck product launches, AMI was able to create a launch strategy that leveraged its unique mechanism of action (proton pump inhibitor). This worked despite tremendous competitive hurdles from existing market leaders (H-2 antagonist manufacturers) that strived to corner Prilosec into a niche section of the anti-secretory marketplace (e.g., recalcitrant cases). Additionally, a tremendous competitive focus on safety concerns (gastric carcinoids) was also raised during the launch of Prilosec. Still, given similar challenges to prior Merck product launches (Mevacor and the raised risk of liver enzymes during its launch), AMI’s team was able to craft a purposeful brand launch strategy for Prilosec that tenaciously competed with market leaders (GSK). It also proved to be sustainable for the long-term benefit of both patients as well as its parent entities (Merck, Astra Merck Inc. and AstraZeneca).

For some companies, it is challenging to recognize that for a number of reasons, their product might fare better by actually pursuing a niche-focused strategy. For example, imagine the potential value that Daiichi Sankyo and Lilly might have reaped if they had looked at potential analogs for personalized medicine before they launched their brand plan for Effient? A 2012 article on Effient stated “…Since launching three years ago, Effient’s sales have been slowly climbing. The drug helped power Lilly’s 5% growth in sales last year—along with growth from antidepressant Cymbalta, cancer drug Alimta and erectile dysfunction product Cialis—by contributing $302.5 million in sales. This is up from $115 million in 2010 and $27 million in 2009.”

Still, if the companies had selected a different initial launch plan that focused on personalized medicine opportunities, might there have been a stronger commercial success? For instance, in 2010, the FDA announced a black box for Plavix warning physicians of treatment failures in CYP2C19 poor metabolizers representing up to 14% of their patients. Rather than take the “traditional” pharma approach of going after the market leader and attacking their core group of clients, what could have happened if the firms pursued Plavix’s failures? After all, back in February 2009, EvaluatePharma’s NPV Analyzer commented that “Effient’s sales would reach $1.42B by 2014 and be the biggest growth driver at Eli Lilly over the next seven years.” With over $6.1 billion in sales for Plavix in 2010, this potential missed opportunity of $854,000 ($6.1 billion x 14%) represents a good case model for those managers looking to be more innovative with their brand plans.

While analogs and antilogs leverage historical insights for future planning, there is still the need for pharma companies to develop forward-thinking capabilities. Pharma companies now have access to analytical tools that can enable them to run simulations that experiment with a variety of different hypotheses and analyze potential outcomes. In the end, it is often the gaps in the analogs and antilogs, the leaps of faith—such as the testing of hypotheses—that make the difference between failure, mediocrity or success. Leaps of faith are crucial to the innovation process and they often emerge from a thorough understanding of what has come before, namely analogs and antilogs.Blockbuster products are fast becoming a fad of the past, paving way for a more complex market characterized by increased government regulation, persistent generic competition, reduced periods of patent exclusivity and the heavy weight of third-party payers. This new emerging market is forcing pharmaceutical executives to explore new avenues for maximizing product potential throughout its lifecycle. By laying emphasis on developing strategic commercialization plans earlier in the drug development process, companies are hoping to gear their products for success.