Modern-day commercial success is no longer exclusively dependent on how many providers are actively targeted by manufacturers’ sales forces. The pharmaceutical stakeholders that hold the key to success in the marketplace are rapidly changing. In the not-so distant past, branded pharmaceutical market access was driven by a company’s ability to reach potential prescribers as often as possible, while simultaneously achieving favorable status on payer/plans through extensive rebates.

However, out-of-control healthcare costs are tilting the balance of power toward payers, patients and provider networks. While many of these stakeholder groups have existed for years, changing market factors have given rise to their increasing power and are helping to shift the commercial model from one based on share of voice (SOV) to one focused on total value offered to the customer.

While most in the industry acknowledge the importance of integrated delivery networks (IDNs) and accountable care organizations (ACOs), many don’t yet have an understanding of their degree of importance. IMS research indicates that IDNs and their ACOs cousins are quickly becoming significant forces in the prescribing process.

There are almost 1,000, mostly for-profit, IDNs in existence today. These IDNs own or are closely affiliated with 80% of U.S. hospitals. IDNs own more than 60% of group practices, accounting for more than 388,000 affiliated physicians. Given their remit to often manage costs on a “for-profit” basis, IDNs exert great influence on physician prescribing choices and patient treatment. However, their key decision makers are typically non-prescribers, including quality review boards, medical directors and pharmacy directors.

IDNs Significantly Affecting Treatment Choices

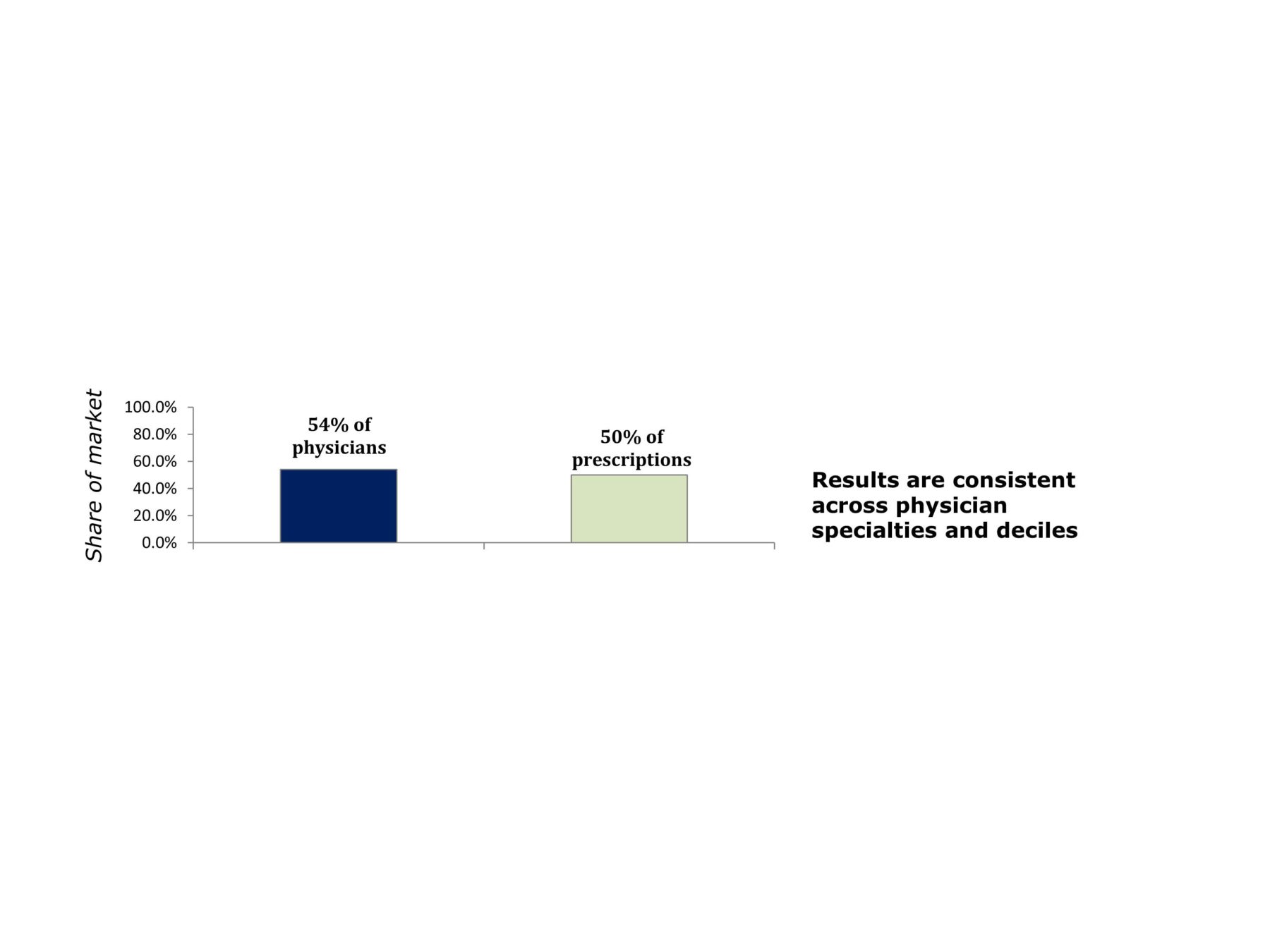

By sheer numbers alone, it’s not hard to believe that IDNs can have a significant impact on treatment choice. For example, an IMS study on diabetes launches revealed that more than 50% of physicians and prescription volume are affiliated with IDNs (see figure below).

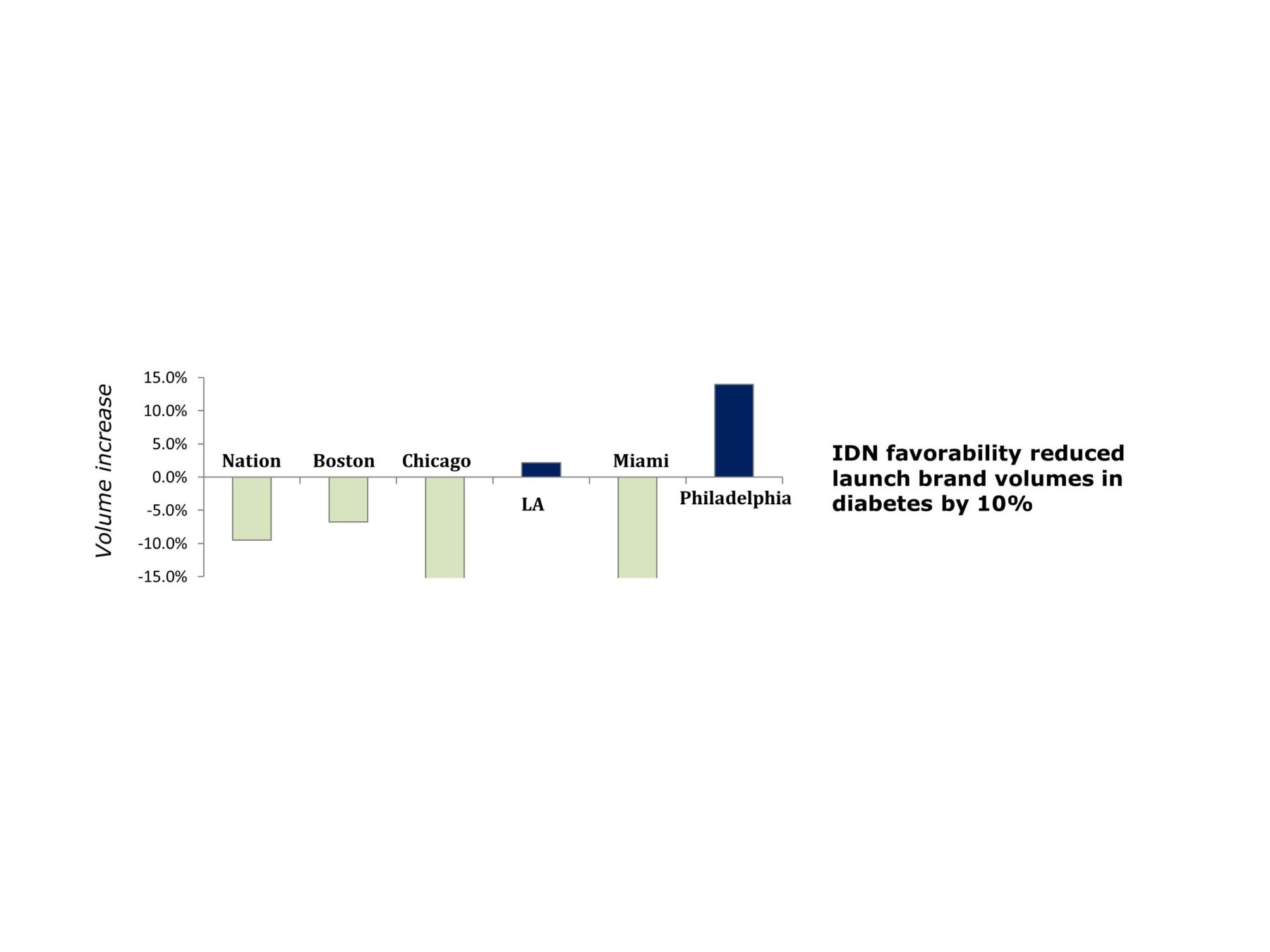

As IDNs routinely review prescribing guidelines with providers as a condition of network inclusion, it would follow that an IDN has ample opportunity to impact prescriber choices. In fact, our research proved that IDNs alone reduced the nationwide volume of diabetes launches by an average of 10% in the two years prior to 2011 (see figure below).

A more granular look reveals that the favorability—either positive or negative—of IDNs toward a particular launch brand varies widely between geographic locations. This calls into question the top-down design processes of commercial planning that pharmaceutical companies traditionally employ.

In our study, we defined favorability as the extent to which IDNs can drive the prescribing choices of their members, on average, toward a different direction (positive or negative) from their non-affiliated colleagues. Our results represent the pure favorability toward a brand as a result of IDN affiliation and are controlled for physician specialty, prescribing volume of physicians and affiliation to payer/plans.

Clearly, this indicates that local market dynamics are critical in driving success, and pharmaceutical companies should be deploying locally relevant commercial strategies to drive volume and share instead of relying mainly on physician share-of-voice models.

Interplay of Managed Care and IDNs—A Core Component of Local Variations

Relative influence on treatment choice between managed care and IDNs is a core underlying driver of the observed local variations in prescribing trends. In our study, we defined influence as the extent to which the local payer/plans or local IDNs more tightly control the variation in treatment choices of their respective members. This definition is similar to “control” that has been used to describe payer/plans over the years.

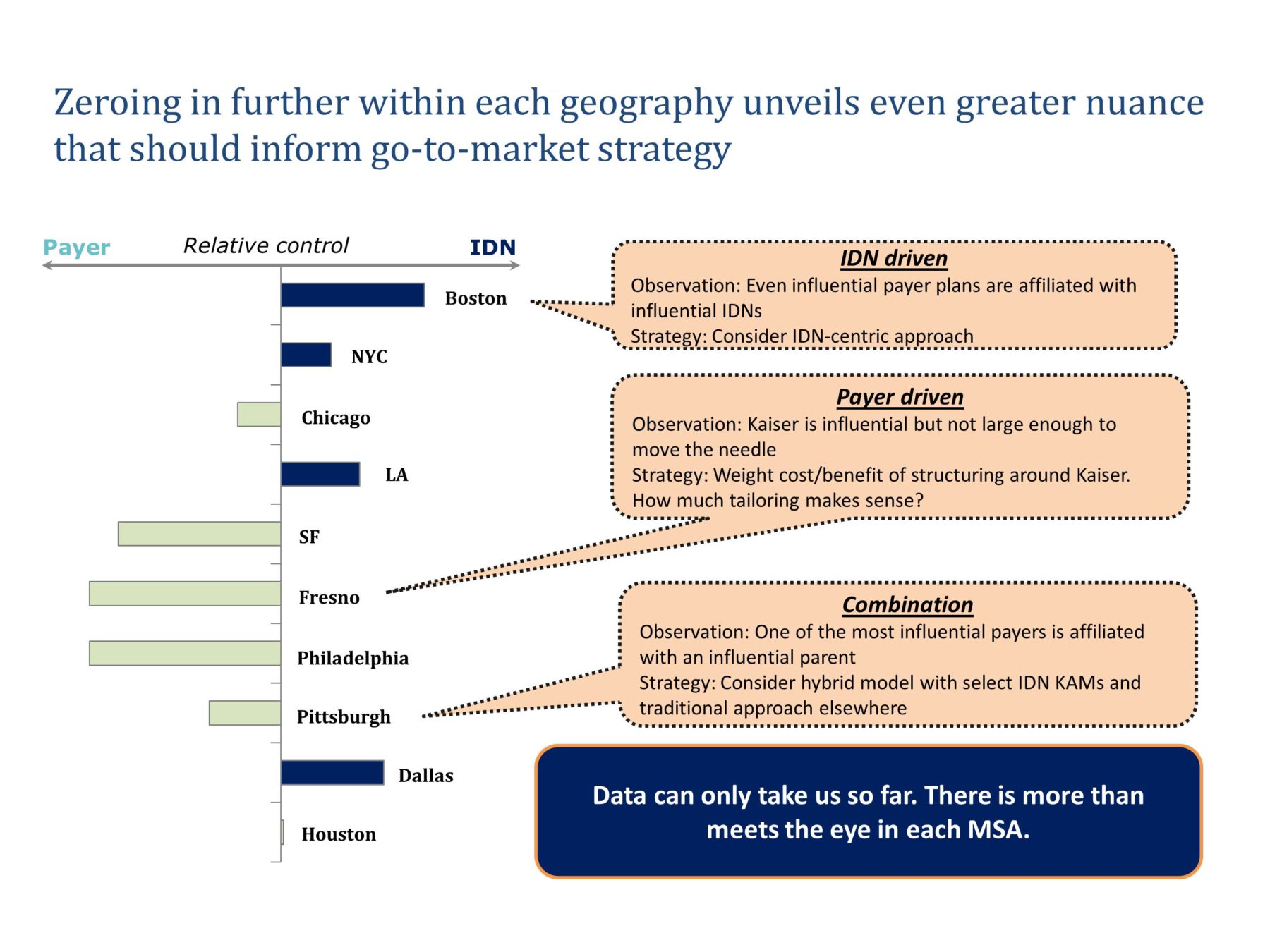

Contrary to conventional wisdom, IMS found that IDNs exert more influence on their physician members than managed care entities in certain geographies. Indeed, stakeholder influence is a local phenomenon and can vary from region to region.

Where IDNs drive: In Boston (see figure above), it’s generally believed that good tier status with Blue Cross Blue Shield Massachusetts is a requirement for local commercial success. In our analysis, however, we found that BCBS MA does not crack the top five in terms of influencing prescribing choices. In fact, Harvard- and Tufts-affiliated IDNs exert significantly higher influence on their affiliated physicians. As such, we conclude that Boston is a largely an IDN-driven local market.

Local tailoring to maximize ROI: While Fresno, California-based Kaiser is highly influential for the physicians in its network, other IDNs in the area are not. As a result, Fresno is surprisingly mostly payer-driven. From a commercial strategy standpoint, therefore, it would make sense to follow a hybrid method that is based on a more payer- and physician-centric approach, while recognizing the need to address Kaiser individually.

Where there is more than meets the eye: In Pittsburgh, UPMC is one of the most influential and prominent IDNs in an area that has attracted attention as a testing ground for different approaches on how to commercially engage with IDNs. However, our research shows that payer/plans in the Pittsburgh area present higher influence on prescribing choices than IDNs. A closer look at the data reveals that one of the most influential payer/plans is affiliated with UPMC. This is an excellent example of managed care and IDNs meshing together and becoming nearly indistinguishable. We expect such cases to increase in number going forward, with IDNs creating their own plans as well as payers entering the healthcare delivery market. As such, addressing managed care strategy and provider strategy can no longer be viewed in isolation from each other.

It’s clear that not all IDNs are created equal, and even large ones may have little to no influence on provider treatment choice. However, many IDNs do affect treatment choices and more will in the future. As the reduction of healthcare costs and improvement in patient outcomes become more entrenched as the overarching measurable goals in healthcare delivery, IDNs will ultimately exert more influence than payers. While many plans exist, influential IDNs that also command a high share of their local markets can significantly move the needle on the treatment choices of their members. Therefore, pharmaceutical companies should target IDNs that influence treatment choices and have a large enough market presence to make a difference.