Erica’s friends know her as an active, vivacious 44 year-old with a successful career in Manhattan’s frenetically paced finance industry. What they don’t know is that she has a family history of high cholesterol and also suffers from the condition. A casual observer would never take Erica for the stereotypical high cholesterol sufferer. By all appearances she fits the mold of an energetic and healthy go-getter. Likewise, pharma brand marketers planning their next TV campaign wouldn’t typically consider Erica to be their target consumer based on her demographic profile alone. As a result, she would miss out on the educational messaging regarding treatment.

Recent advances in data-driven audience and media planning suggest that pharma brands may not want to be so quick to overlook the “Ericas” of the world. New technologies and methodologies have paved a privacy-safe path for harnessing the power of predictive Rx and OTC data to identify and reach qualified health audiences with a much deeper level of granularity and precision. Admittedly, leveraging consumer sales data to inform TV buys is nothing new for other industries. But these innovations signal a fundamental paradigm shift in how pharma marketers leverage analytics to plan and optimize their campaigns.

History of DTC TV Advertising

Boots Pharmaceuticals aired the first DTC TV ad in 1983, promoting its prescription ibuprofen medication, Rufen. Due to strict FDA content regulations, DTC TV advertising grew slowly throughout the 1980’s and early 1990’s. It wasn’t until 1996, when a Claritin ad skirted around the FDA’s full disclosure requirement—by not explicitly mentioning what the product was indicated for—that the FDA needed to rethink their regulations. A year later, it issued new, more relaxed guidance redefining, in some cases easing the restrictions on DTC TV ad messaging.1 The guidance aimed to ensure that pharma ads fulfill the requirement for adequate provision, which stipulates that messaging cannot be false or misleading, must inform about risks and side effects and include all relevant information (such as limitations of use). As a result of the FDA’s mandate, the DTC TV floodgates opened and from that moment forward, TV became the dominant force in pharma consumer marketing.

Fast-forward nearly 20 years, and while U.S. advertisers’ spending on digital advertising is predicted to overtake TV in 2016 and represent 36% of all ad spending across all industries, TV will continue to command the lion’s share of pharma marketing budgets for the foreseeable future.2 According to Pharma Marketing News, TV accounted for 63% of overall DTC marketing spend in 2014.3

While other industries transition increasing portions of their media spend into mediums such as digital and mobile, pharma continues to bank on TV. The industry’s reliance on TV is largely due to the widespread perception that this medium is more readily associated with ROI. Also, the absence of clear FDA guidance on the use of digital prevents many pharma marketers from innovating within their DTC channel mix.

However, while marketers confidently spend the majority of their budgets on TV, they are not always able to confidently optimize their TV buys to efficiently reach relevant health audiences. For years, they have been trying to find innovative ways to concentrate on consumers most receptive to their brands, usually relying upon survey-based market research and demographic-based targeting. Each of these methods has provided some advantages—but not without challenges.

Survey-based media planning is a cost efficient method to reach audiences based on self-identifying treatment and TV viewing information. The key challenge of survey-based approaches is an inherent bias often leading to a gap between how a patient describes his or her treatment behavior and how the patient actually behaves. These approaches also tend to have small sample sizes, leading to decisions made based on tiny populations.

Audience reach strategies informed by demographic data is built upon a combination of assumptions about which types of people are likely to treat a condition with a specific brand. For instance, it’s understandable to assume that males 65 and older are more likely than others to suffer from high cholesterol. As shown in Figure 1, sometimes younger women are more relevant consumers than older men. Many brands cast a wide, demo-based audience net, but end up with a considerable amount of media waste as a result.

“What marketers are really looking for is the ‘juicy’ data, as programmers call it,” says Robert Williams, Senior Advisor of Television for Crossix. “They want to better understand how to extend the long tail of their buy by identifying opportunities to maximize their budget.”

New Hope for Precision Targeting

This juiciness can be found through the advances in data and technology that have recently enabled TV advertisers to reach qualified audiences in a precise and privacy-safe manner. By connecting consumer data (e.g., purchase behavior, demographic information, media consumption, etc.) with health data, marketers can understand which audiences are most likely to treat within the relevant condition category and/or on their Rx or OTC brand. With this predictive health data, they can get much more granular in understanding where their audience can be reached across the complex TV landscape, and then integrate those metrics within their buying process.

“The consumer packaged goods industry has found great success using actual purchase behavior to plan their TV buys,” says Sam Deutsch, Director, Client Consulting at Nielsen Catalina Solutions. “And now there is a way for the pharma industry to harness the power of that same kind of purchase-based data and reap similar benefits.”

The predictive data derives from models created by connecting hundreds of consumer variables with Rx purchasing behavior. This connection enables determination of the specific combination of consumer variables (e.g., new home buyer, veteran, PC owner, shops at Target) that have the highest correlation with treatment of a condition or with a specific brand. These predictive models can then be applied to TV viewership data to allow marketers to proactively identify the programs, networks and dayparts that index most favorably for reaching their brand’s intended audience and optimize their TV buys accordingly. The data and technology now exist to use the audience as a proxy to select the right programs.

Whereas traditional methods might miss consumers who fall outside of demo-based assumptions, predictive data helps to reach often missed audiences. Marketers can now reach their audiences more efficiently. Moreover, the ability to identify audiences according to their modeled likelihood to treat within a condition or on a brand, instead of targeting based on actual treatment behavior, provides a safe, HIPAA-compliant way forward since it does not target individuals based on their individual health behavior. No identifiable user-level patient data is ever used to apply the models to TV viewership data.

“This type of optimization is becoming the new standard for how pharma brands optimize their TV campaigns,” says Jeremy Mittler, VP, Analytics Services at Crossix Solutions. “Brands can understand and reach their audiences more effectively than previously imagined.”

Case Study: “Olinix” Maximizes Spend

Let’s take a real example of a brand—blinded for confidentiality purposes—that used predictive data to optimize their TV buy. Olinix, as we’ll call them, wanted to understand which parts of their TV campaign were over- or under-indexed in reaching their intended audience of high cholesterol treaters. They also wanted to discover what opportunities existed to adjust their strategy to drive improvements in audience reach and greater campaign efficiency.

The Problem: An analysis of their campaign found that while the majority of TV inventory out-indexed national average indices by media type (e.g., broadcast, cable, syndicated), 56% of their overall spend was allocated toward under-indexing media.

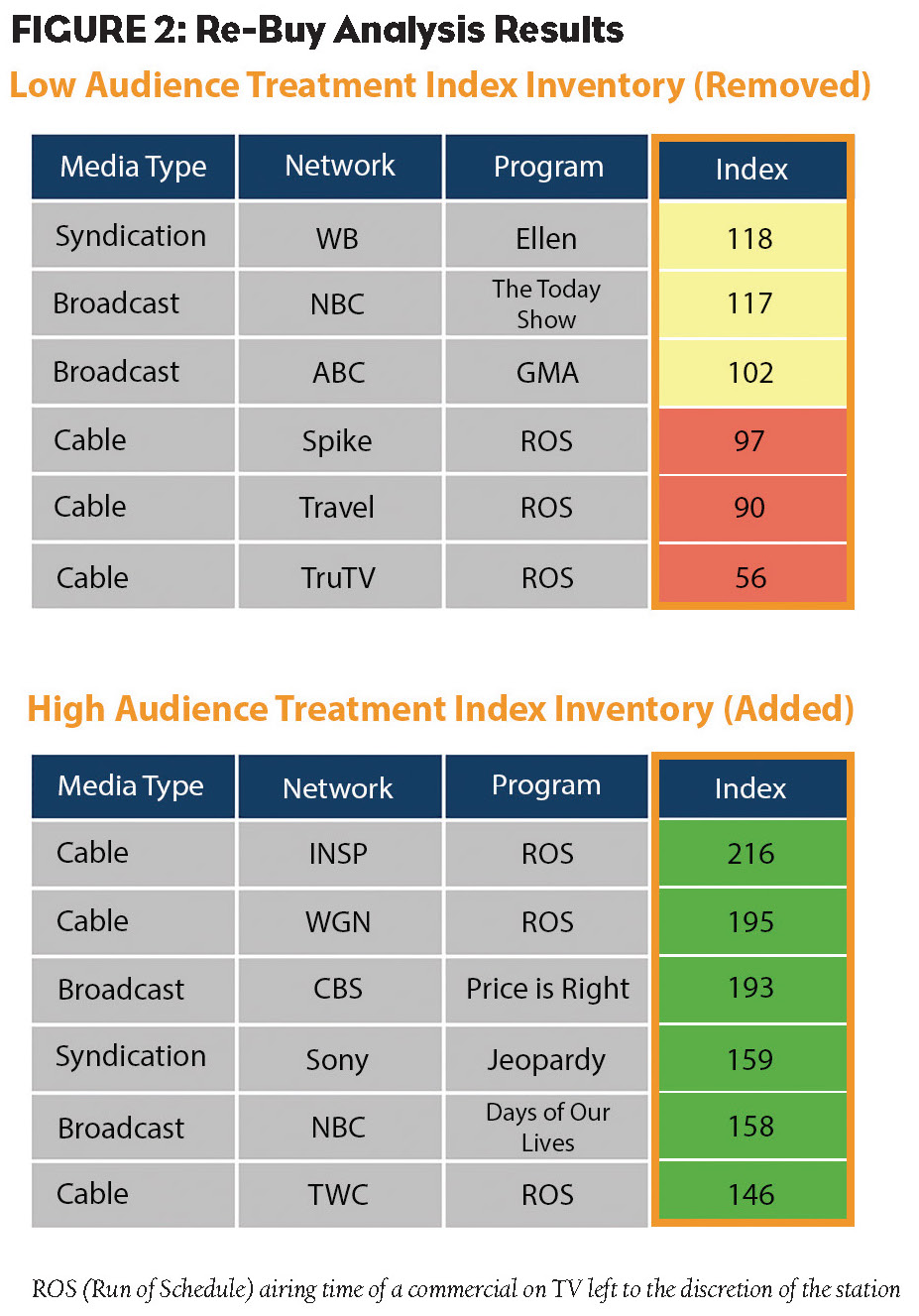

The Solution: In addition to measuring the actual audience reach of their campaign, Olinix conducted a “re-buy analysis” to determine how their campaign would perform if they were to proactively optimize it based on the results of the analysis. Overall, the results revealed considerable optimization potential for future Olinix campaigns, and they were excited about the opportunity to reach their desired audiences more efficiently. As shown in Figure 2, the brand removed inventory with a low audience treatment index and added higher-indexing inventory.

The Result: Upon implementing the adjustments suggested by the analysis, the campaign generated a lift not only in treatment index but also in ratings points and represented more than $600,000 in media cost savings for the brand.

This new approach fueled by predictive health data is not meant to completely supplant traditional planning and optimization strategies. Rather, it is designed to complement and expand upon what brands are already doing today to optimize campaigns to drive greater efficiency. And as TV viewers continue to engage with content in an increasingly multi-screen world, marketers will need to adapt and learn to market to audiences via the devices they use. With the enormous amount of data available about how, when and where people interact with all of their different screens, understanding the nuances of who these consumers are and how best to reach them will become even more imperative to sustained campaign success.

Resources

1. “Guidance for Industry Consumer-Directed Broadcast Advertisements.” http://www.fda.gov/downloads/Drugs/GuidanceComplianceRegulatoryInformation/Guidances/UCM070065.pdf. August 1999.

2. “Digital to Overtake TV Ad Spending in Two Years, Says Forrester.” http://adage.com/article/media/digital-overtake-tv-ad-spending-years-forrester/295694. November 4, 2014.

3. “Digital Ad Spending Rises From the Grave.” http://www.pharma-mkting.com/news/pmnews1403-article02.pdf. April 2015.