Businesses are still surveying consumers directly about their buying habits, but this is only telling half of the story. A consumer also chooses a product based on a non-conscious response and companies need to learn how to measure this in order to improve their marketing decision-making.

It has become popular to say that people are irrational when it comes to buying decisions. Behavioral research continues to yield new discoveries about just how bad people are at making decisions and ethnography consistently illuminates the differences between what people say they do and what they actually do. Customers, it turns out, are impressionable, emotional and irrational.

“You would be amazed to find how often we mislead ourselves, regardless of how smart we think we are, when we attempt to explain why we are behaving the way we do,” Ernest Dichter observed in in his book The Strategy of Desire.

Yet despite what cognitive science has helped us to understand, many businesses continue to conduct traditional research by surveying customers directly about their preferences, desires and motivations. This approach elicits only rational, conscious responses; the net effect is a gap in understanding of the deeper preferences, desires and motivations operating at a non-conscious level. But aggressive companies are reaching beyond the traditional information to quantify the non-conscious response to new products, marketing communications and tracking to understand the deeper influences on preference and choice.

Conscious vs. Non-Conscious Buying

Conscious decision-making involves a deliberate rational process one is fully aware of when weighing the costs and benefits of buying. Non-conscious decision-making is a complex web of impulses, emotions, reflex actions, habits, memories and intuition that occur quickly and automatically, with little awareness or feeling of effort. It is “the silent author of many choices and judgments that you make,” according to Daniel Kanhneman, winner of the Nobel Prize in Economics. While this information is not new to the scientific community, the way choice operates in our thinking is generally not well understood in the business community.

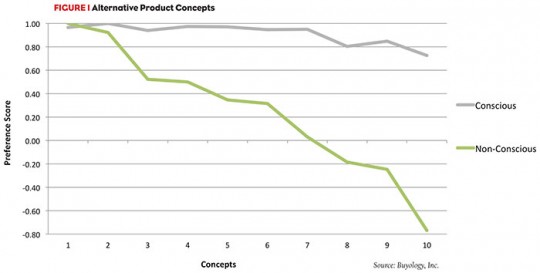

To gather a robust understanding of customer behavior and choice, you need to measure both conscious and non-conscious responses. An exciting revelation about the non-conscious response is that it is more discriminate, and reveals more variability, than conscious responses. This finding has been a consistent discovery in a wide range of studies across industries as different as healthcare, cosmetics, gaming, television and consumer products. Figure 1 illustrates this point. These results are from a research study conducted among 1,000 respondents in the U.S. and U.K. in 2012 to evaluate marketing materials.

Compared to the conscious data (grey line) there is much less data “clumping” in the non-conscious data (green line), and more pronounced differences are visible. If the business had only conscious data available, it would be blinded to the significant differences between materials 1 and 4, for example.

Why Non-Conscious Testing?

In order to grow your business you need to disrupt the status quo. Understanding what activity is truly differentiating and disruptive in the marketplace is critical. Disruption requires you to either enhance the affinity for your business or increase the competitors’ vulnerability, unless you are lucky enough to be alone in a new category. Most businesses don’t need to refresh more of the same customer data or conduct another segmentation study. What they need is information that will offer an advantage over the competition. More and more companies seem to be struggling with core issues such as traditional tracking data that show no real differences among the competitive set or marketing communication that beats their research norms but does not drive in-market results.

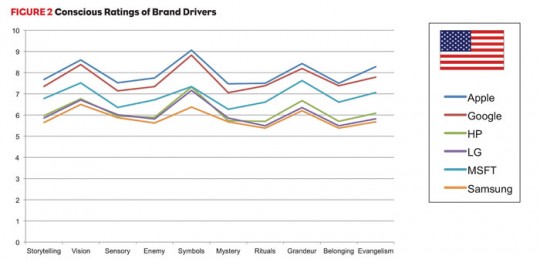

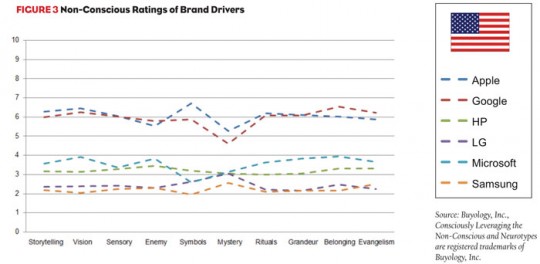

The non-conscious approach is also being applied to quantify the relationship brands have with their customers. As part of a global study of leading technology brands, 10 dimensions of a brand relationship were measured among 400 respondents in the U.S. A proprietary timed-response methodology was used to conduct the test. The conscious results displayed in Figure 2 indicate less discrimination among the brands than the non-conscious data set in Figure 3. This result is consistent with the marketing materials example from Figure 1. However, the non-conscious data shows Apple and Google separating significantly from the other competitors and there is more interaction between Apple and Google. On some of the measures Google exceeds Apple, which is different than the conscious results.

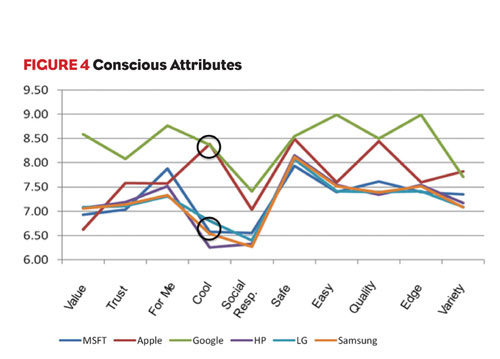

Brand tracking attributes were also measured in this same study, and the attributes with the highest correlation to brand favorability were “safe” and “high quality” (Figure 4). “Cool” was rated as one of the lowest factors, indicating a weak association. For all of the brands scoring low on “cool,” the implication is that they do not have to be concerned about improving their “cool” rating. Only Google and Apple had a strong “cool” score.

Brand Tracking Attributes

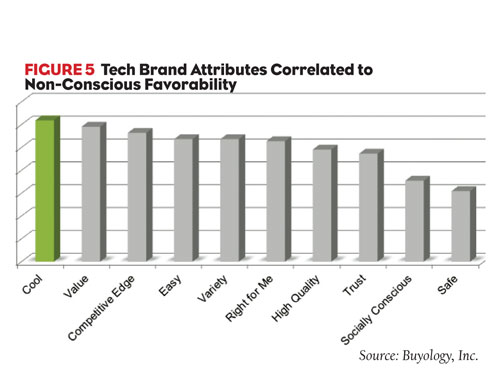

But here is the surprise: When these same attributes were correlated to non-conscious brand favorability, the two highest scoring attributes were “cool” and “value” as shown in Figure 5. “Cool” flipped from being one of the lowest ranked attributes to one of the highest ranked attributes driving brand favorability among the technology brands.

The dramatic increase in the rating of “cool” is because “cool” is more reliably measured in non-conscious testing where perception and intuition are formed. The conscious data did not accurately indicate the influence of “cool” on consumer choice. Instead, it produced a false negative for “cool.” It is easy to imagine why consumers may not report their primary purchase behavior to be influenced by “cool,” versus other more rational sounding attributes like “quality” and “trust.” What businesses are collecting in traditional conscious data is often only a partial picture of the customer response.

Products and services are bought not merely for the purpose they serve but for the values they seem to embody. There is an emotional response to the value proposition and that response should be quantified along with the conscious, rational response. Much of the brain is constructed to support automatic processes, and buying behavior emerges between the interplay of the conscious and non-conscious systems. There are times when the non-conscious results may actually contradict a subject’s conscious responses, but will reveal superior insights and greater discrimination for better business decision-making.