The pharmaceutical industry’s digital marketing investment trails way behind other verticals in terms of the compound annual growth rate (CAGR). While pharma’s digital investment is predicted to grow to $1.47 billion in 2017 from a projected $1.18 billion in 2013, it is currently projected to grow at a much slower pace (5.9%) when compared to other industries. The automotive and consumer packaged goods verticals’ digital spends, for example, are projected to increase annually by 13.1% and 12.6%, respectively.1

While some companies remain risk-averse due to the lack of clear FDA guidelines on digital marketing, some marketers feel safer with traditional channels such as TV, where heavy spend is perceived to be more readily associated with positive return on investment (ROI). According to Jason Russo, President of digital marketing agency, Results Digital, “The lack of historical ROI data may be the biggest problem the industry faces when considering digital spend. Pharma is hesitant to move away from strategies perceived to be effective, especially on a large scale.”

Concerns over the assumed lack of online interaction also generate skepticism. The common belief: Much of the industry’s audience is older and watching TV rather than surfing the web. Even if the target audience is online, common approaches for finding and marketing to them using behavioral targeting or offline data have not worked in healthcare due to privacy considerations.

“I can go to WebMD and easily buy diabetes-related content that will help educate our target audience—these people have identified themselves as either having diabetes or as the caregivers of a diagnosed person,” says Blair Sieber, Senior Media Manager of Multichannel Marketing at Sanofi US. “What’s much more difficult is going outside the condition-related site to a general news site like CNN.com to inform patients. It has always been challenging to engage the patient on a lifestyle site rather than endemic sites. As a result, digital is perceived as a limited channel with few relevant media properties.”

Due to this, and a lack of reliable data analytics, marketers find it difficult to make a compelling case for more spend in the digital space. Fortunately, recently published insights about online audiences’ active prescription (Rx) and over-the-counter (OTC) purchasing behavior—coupled with innovations in online ROI-based analytics and audience targeting technologies—suggest these challenges are disappearing.

Digital Folklore: New Studies Dispel Widely Held Beliefs

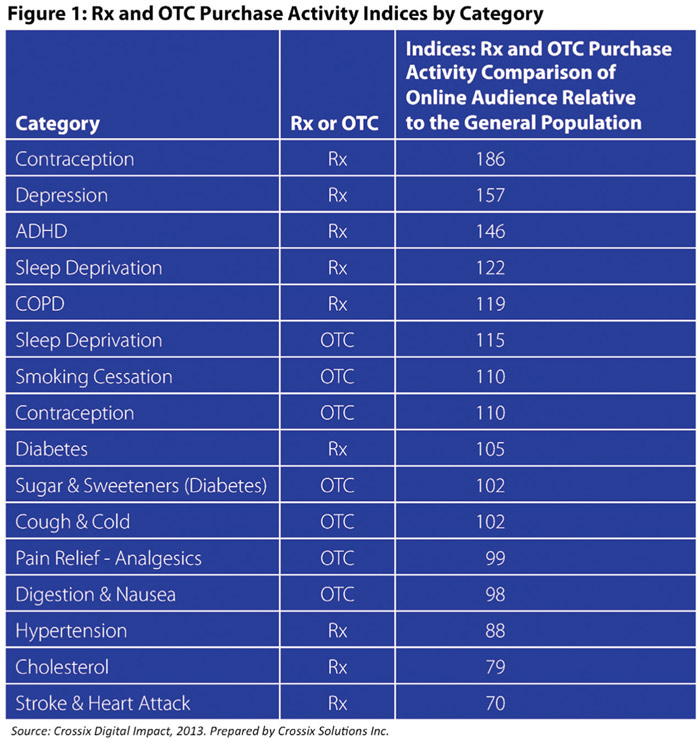

A recent Crossix study dispels longstanding myths that Rx and OTC purchasers are harder to reach online, and found, for many condition categories, the online audience actually over-indexes compared to the general population with respect to Rx and OTC purchase activity. Figure 1 summarizes the results of this study.

The study also analyzed the Rx purchase behavior of audiences exposed to brand campaigns run across various types of websites, including endemic, health-related publishers (e.g., WebMD, Everyday Health) and non-health related lifestyle publishers (e.g., AOL, Yahoo). Again, the study revealed that audiences exposed to online campaigns indexed considerably higher than the general population with respect to Rx purchase behavior.

The widely held notion—patients are not easy to reach online—is turned upside down. In fact, the industry’s target audiences spend a lot of time online. Furthermore, their resulting behavior is now measurable in a privacy-safe way because no personal healthcare information is used to target audiences, finally enabling the industry to leverage the efficiency, speed and impact of digital channels and measure campaign ROI.

Pharma marketers can now safely use vast consumer data pools of millions of records to target audiences based on correlations between consumer demographic and lifestyle variables and the likelihood to perform a specific treatment-related action. New business analytics methodologies “train” consumer data to be associated with behaviors identified for target audiences.

Marketers now have sophisticated data analytics tools and platforms to safely tap into mass consumer data pools. New behavioral models allow marketers to buy media based on reliable audience targeting, and are not restricted to buying based on contextual placements alone. In addition to helping marketers build a stronger case for greater digital media spend, these new tools enable marketers of smaller brands, or brands that treat conditions with lower incidence rates, to buy digital media more efficiently.

The Digital Life: How Analytics are Driving Success

Recently, one major healthcare marketing agency successfully integrated the digital channel into a new campaign designed to reach patients and caregivers of those with ADHD. Using the latest analytics-driven technology platforms to identify the right consumer segments, the agency ran a campaign on two different lifestyle sites against the top two deciles isolated from a pool of 100 million people. Results were measured on an individual and household level in near real time, affording the team an early look into the campaign’s impact. Rather than waiting until the end to evaluate performance, the agency could reallocate resources to improve campaign ROI early in and midway through its duration by re-prioritizing top-performing sites, altering messaging and making other adjustments.

“We have evolved to a more predictive model based on near real-time, continuous feedback, along with post-campaign reporting,” adds Russo. “Digital can now be used as an essential component of the pharma marketing mix.”

The Future for DTC Digital Marketing Begins Now

This ability to efficiently target, measure and deliver meaningful messaging digitally, with scale, opens up marketing opportunities never before possible, especially for smaller brands that might otherwise languish. According to Russo, “The beauty of digital is its ability to leverage the endemic sites to reach your targets.” And, with recent measurement and targeting innovations, marketers can now truly optimize their campaigns across all types of sites, endemic or otherwise.

“A consistent message hitting the right audience at the right time wherever the patient is interfacing is the ultimate goal,” concludes Sanofi’s Sieber. “It’s about understanding the customer and where they are so we can communicate with them throughout their journey whether they go to WebMD at night or Walgreens during the day or CNN.com at lunch. It’s time to take that next step.”

References

1. “Healthcare and Pharma Digital Spend Rises, but Outlays Stay Low.” http://www.emarketer.com/Article/Healthcare-Pharma-Digital-Spend-Rises-Outlays-Stay-Low/1010296, October 14, 2013.