Information collection for tracking specialty product distribution in the U.S. has become highly fragmented, with a growing universe of 670 specialty pharmacy provider (SPPs) locations ranging from large, national SPPs to boutique pharmacy networks and local SPPs. Other sources of market information include syndicated data providers, wholesalers, patient management hubs, group purchasing organizations, and large group practices/accountable care organizations. These touch points with patients, payers and physicians provide rich possibilities for insights for manufacturers, who have been attempting to collect this information. Unfortunately, no two sources report the same information in the same way, causing integration and analytical difficulties that result in suboptimal use of these assets for insight creation.

Challenges Abound

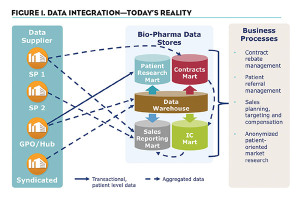

We’ve engaged many specialty companies who have shared their business and technical architectures with us. Do-it-yourself attempts to collect and manage these data frequently cause complicated systems (see Figure 1) to address the technical, operational and legal challenges:

- Heterogeneous sources often force analysts to triangulate information.

- Longitudinal tracking is limited to patients who use a single SPP, since anonymization techniques are not consistent across sources.

- Considerable duplication of customers exists in SPP data feeds.

- Without a standard methodology for determining fair market value for data, negotiating with suppliers can be time consuming and costly.

- Data contracts that include competitive data are not as accessible, and they are much more expensive than tracking your own product.

- Most sources will struggle to meet manufacturer data security policies due to the manual nature of transmission in Microsoft Excel.

- Maintaining compliance with federal, state, and therapeutic class-level variations in data restriction regulations (i.e., HIPAA) can be risky, difficult and labor intensive.

In specialty product markets, there’s a heightened need for analytical precision, and some of the problems above detract from achieving it. Smaller patient populations leave little room for error when using information to inform key business processes. For example, a difference of five vials of sales could make a significant difference to a rep’s compensation.

Setting the Data Strategy

Supportive of the distribution and patient servicing strategy, the underlying data strategy should be carefully formulated based on answers to these questions:

- What business processes will we need to inform? Knowing this will drive the amount of detail needed and the precision required around it. Typical processes informed by SPP data include contract rebate management, patient referral management, sales planning, targeting and compensation, and anonymized patient-oriented market research.

- From which SPPs do we need data? This should be determined by comparing the manufacturer’s chosen distribution network to the roster of SPPs already represented in syndicated sources.

- Will syndicated data sources suffice? The level of coverage from syndicated data sources varies by therapeutic class and may need to be supplemented through data contracts with a manufacturer’s distribution partners. Licensing syndicated data reduces the addition of staff to a non-core function to steward the data.

- What level of detail is needed to calculate our performance measures? Some sources may be able to provide data down to the de-identified patient level, but most provide more aggregated summaries. In general, manufacturers should strive to collect the elements below to create measurable business metrics:

- Your product and at least a class total

- Sales dollars and quantity dispensed, with unit of measure defined

- Drug use by indication/diagnosis

- Dosing

- HIPAA-compliant patient demographics

- Referring and treating physician demographics

- Details on primary and secondary payer, including co-pays

- Shipment details

- Referral status changes

- How can we ensure data quality and timeliness? Contracts with suppliers should contain well-chosen KPIs on data quality and timeliness. Establishing a consistent file layout that works across specialty products and SPPs can also improve reporting quality and timeliness.

- When should we begin the data contracting process? The process should begin at least six months in advance of a product launch, and ideally, should run concurrent with the distribution contracting process. This allows for testing time.

- Do we need a fair market value analysis? It is recommended that manufacturers develop a corporate point of view with their legal, compliance and accounting departments on this subject due to the potential implications in each of these areas. If this is a manufacturer’s first specialty product launch, talking with an advisory firm to glean precedents in this area would facilitate the development of an informed point of view.

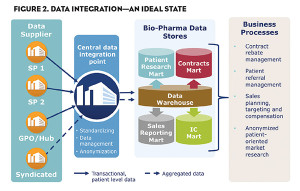

- How can we maintain HIPAA compliance? Incoming data must be de-identified before it reaches the manufacturer. This can be accomplished with a qualified business associate partner serving to consolidate data into a single source that remains detailed, compliant and ripe for market insights (see Figure 2).

Moving Forward

The age of product specialization is here. Coupled with manufacturers’ focus on understanding the patient experience, the appetite for data to arrive at deeper insights is increasing. Interestingly, unless the product distribution model is very tight, we don’t see a lot of specialty manufacturers making meaningful use of anonymized patient data yet. Looking forward:

- How do we begin to follow patients on their chronic journey that may last longer than the length of our partner contracts to distribute our product, or service our patients?

- How do we conduct an ongoing market basket analysis when the concomitant or supportive therapies used are simpler for the patient to pick up in their neighborhood retail store, or being supplied by their employer-sponsored retail mail service?

By partnering with specialty product data specialists, manufacturers can establish long lasting and distribution partner-spanning data strategies that will improve their long-term understanding of the patient. Simultaneously they also create operational efficiency, minimized risk, and deeper patient insights needed to make better decisions.