The global pandemic has transformed society and everyday life, directly impacting consumers’ media consumption patterns and preferences, as well as their decision-making process as it relates to healthcare. In-person interactions have sharply declined, for patient-HCP and also salesforce-HCP interactions, forcing pharma companies and their marketing partners to take another approach to communicating product benefits and facilitating prescriptions.

As a leading media strategy, planning, and management agency dedicated to the pharmaceutical and healthcare industry, Convergence Point Media wanted to quantify and better understand exactly how the pandemic is impacting our clients, colleagues, and the industry as a whole. We’ve thus created, distributed, then analyzed the results from our own pharma survey.

We received responses from a wide swath of healthcare industry marketing teams including Theravance, Ixcella, Collidion, DePuy, Isoray, Alk, Flexion Therapeutics, Acorda, BMS, Integra, Vertex, Horizon, EMD Serono, Genentech, AstraZeneca, AMAG, J&J, UCB, Pfizer. Their brands span product types, lifecycles, and therapeutic areas, including Pulmonology, Oncology, Mental Health, Respiratory, Neurology, Cardiology, Orthopedics, Immunology and Gastrointestinal, Cystic Fibrosis, Ophthalmology, Rheumatology, Women’s Health, Infectious Disease, and others.

Our survey included questions regarding personal and non-personal promotion, shifting investments, creative tactics, and more. We strove to gain a clear snapshot of our fellow marketer’s mindset and how they are addressing challenges, to learn from other’s expertise, and better understand how we can leverage our own expertise to help. While these are challenging times, we see great opportunity, particularly in the digital realm.

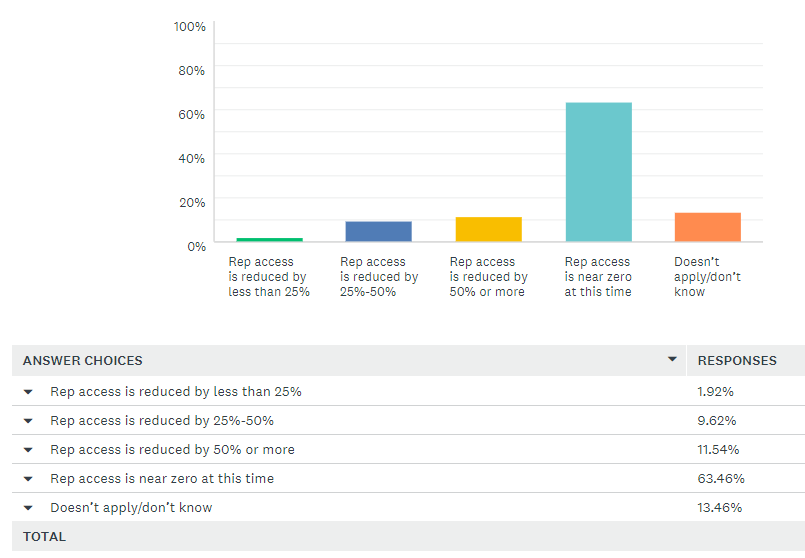

Sales Rep Access

Personal promotion is still the bedrock of pharma marketing, as brands seek to provide 1:1 communication and detailing to key treatment decision makers.

Although sales rep access to physicians has diminished over the last two decades, many HCPs nonetheless state that pharma sales representatives are one of their most-valued ways to learn about treatments and new launches. Many physicians are still eager to see reps: But are reps able to access physicians at the height of a pandemic and physical distancing lockdowns across the country?

We asked pharma brand managers, marketing and communications decisions makers, and other key influencers the question: “How has the pandemic impacted in-person sales rep access?”

- 63%: “Rep access is near zero at this time” while another

- 12%: “Rep access is reduced by 25% or more”

- 10%: “Rep access is reduced by 25%-50%

Write-in comments from survey respondents including statements such as:

Write-in comments from survey respondents including statements such as:

- “We pulled all reps from field 4 weeks ago”

- “We are doing webinars and video meetings only”

- “We’re focused on performing virtual calls instead”

- “Both clinical research and new product evaluations were stopped at seven hospitals across the country two weeks ago. We have zero clinical research or sales activity at this time.”

- “We only are doing virtual consultations now and they are very limited.”

Implications

What does this historic and unprecedented reduction in sales rep access mean for HCP marketing and sales impact? Does this new reality suggest pharma and healthcare marketing teams should increase their non-personal promotional activity to compensate for the reduction in face-to-face sales calls?

The answer depends on multiple factors, some known and some unknown. The duration and intensity of the state-mandated lockdowns and physical distancing protocols vary, so we cannot be sure when and where most rep visits will commence again. That said, how should teams react now?

Since every treatment and device is different, the optimal media strategy depends on the competitive landscape, lifecycle milestone, distinct target audiences, and other factors. Digital media and NPP does a great job of filling in sales rep white spaces; now these spaces dominate, so opportunities abound.

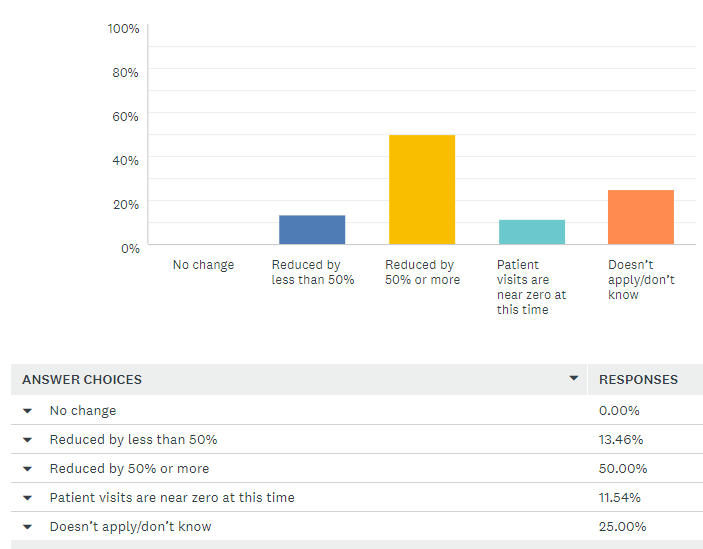

Point of Care Access

Given physical distancing we can assume that much like sales rep visits, patient visits to physician offices have also plummeted. Rather than assume, we wanted to get a better read, so we asked the question: “To what extent have patients reduced their visits to their physicians at the point of care?”

- 50%: “Down by 50% or more”

- 13%: “Down by less than 50%”

- 5%: “Patient visits are near zero at this time”

One comments stated: “Inpatient and residential are still near capacity but outpatient is 97% virtual.”

One comments stated: “Inpatient and residential are still near capacity but outpatient is 97% virtual.”

Implications

Not surprisingly, patients advised to stay at home aren’t going to physically see their doctors. This begs the question of alternate means for point of care experiences, which we’ll explore with another question shared below. It also begs the question of what marketers should do to fill the vacuum.

We’ll explore that below, also. Suffice to conclude based on these answers that the pharma and healthcare industries aren’t immune to the impact felt from retailers and other industries dependent on physical promixity and social gatherings. With dimished POC visits come diminished Rx, simple as that.

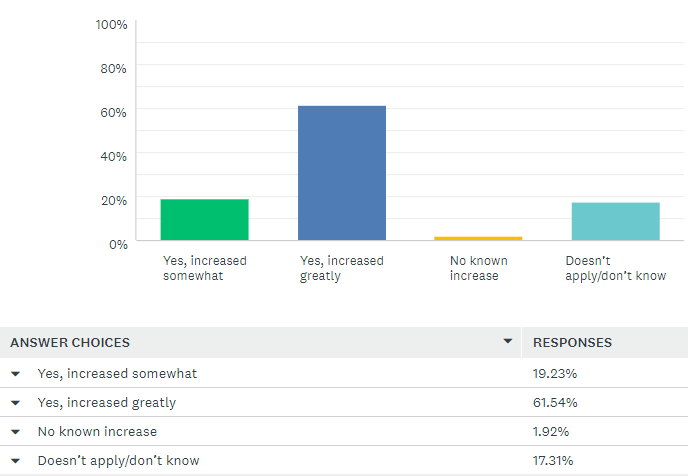

Telehealth Utilization

With in-person patient visits substantially down, does this imply increased use of telehealth through video consults and similar virtual means? Turns out the answer is yes. Consider the answers to our question: “Are you aware of an increase in the number of patients engaging with their HCPs via telehealth, video consults, and similar technologies?”

- 62%: Telehealth engagements have “increased greatly”

- 19%: Telehealth engagements have “increased somewhat”

Implications

Implications

Of all the lasting changes to our healthcare delivery system resulting from this pandemic, we predict this one as most significant. Telehealth technology has been available for many years but has never achieved wide-spread adoption. A recent Bloomberg opinion piece also predicts that the pandemic may be the impetus to transform telehealth into a viable and prevalent alternative to physical point of care visits.

“Medicare, which used to pay a much lower rate for telemedicine when it reimbursed it at all, is now covering a wide range of telemedicine services at the same reimbursement rates as in-person offerings. Private insurers are following, voluntarily or by demand from state regulators. That equal treatment likely won’t continue once the pandemic passes, but it sets a precedent for how to think about telemedicine: It doesn’t have to be a quick, cheap, and transient service offered by companies without bricks-and-mortar investments in local clinics. It could also serve as an addition to primary care, especially for patients with chronic conditions—if reimbursement rates reflect clinic overhead.”

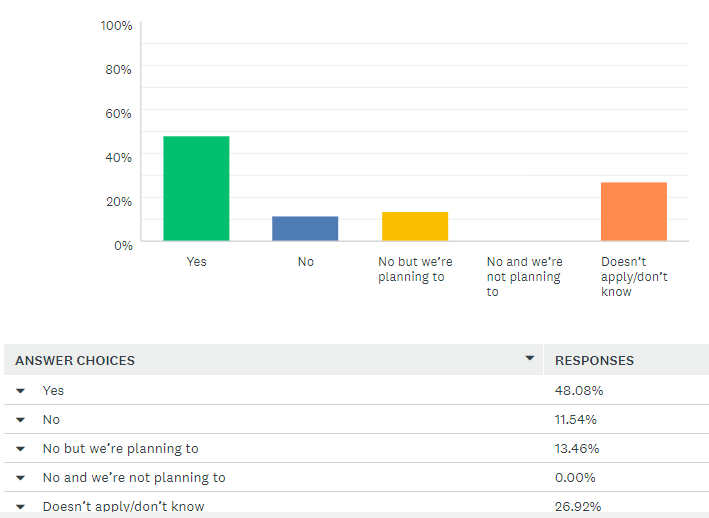

Pharma Marketer Impact: Telehealth Video Utilization

Given the reduction in both in-person sales rep and face-to-face patient visits, we were curious to see if pharma marketers were doing anything to encourage patients to use telehealth and video technologies to meet with their physicians and receive prescriptions based upon these remote consults.

Our results confirmed our hunch: That’s exactly what’s occurring now. When we asked the question “Has your company done anything to encourage more telehealth or video consults?”

- 48%: “Yes”

- 13%: “No, but we’re planning to”

- 11%: “No”

Implications

Implications

A possible pandemic silver lining is the exponential increase and long-term adoption of telehealth. The challenge for marketers, especially now, is how to encourage its utilization in lieu of POC visits through paid, earned, shared, and owned media opportunities. Our next question dives into digital media.

Digital Media Engagement

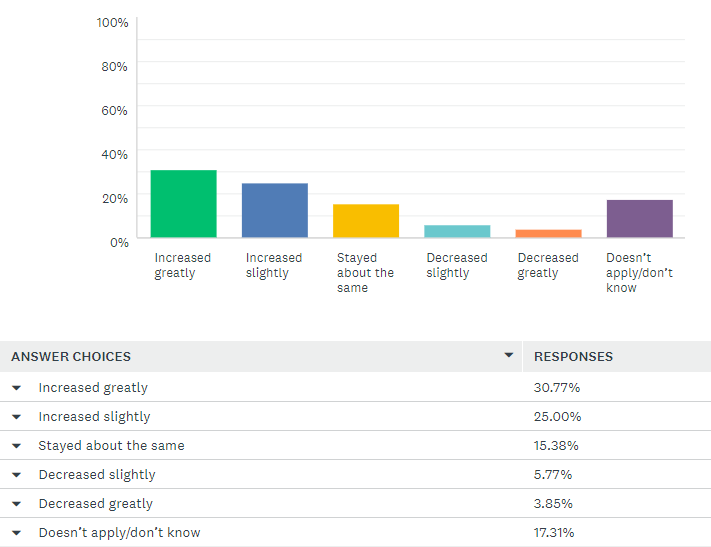

Our results were no surprise here given the national and unprecedented physical distancing mandates and the work from home new normal. Specifically, we asked: “Have you found engagement with your digital content and/or ads has increased or decreased since the pandemic started?”

- 31%: “Increased greatly”

- 25%: “Increased slightly”

- 15%: “Stayed about the same”

- 9%: “Decreased greatly” or “Decreased slightly”

Implications

Implications

Results suggest that most pharma marketers think that engagement with their digital content has increased since the pandemic lockdowns. Given data that we have seen from Version and other sources, this makes sense considering that overall screen time has also increased with millions of people homebound and often idle. The bad news: Reps and patients can’t physically go to the point of care. The good news: Digital marketers might be able to pick up some of the slack with a captive audience.

Such a silver lining amid the chaos presents a unique but challenging opportunity for pharma marketers. Even if our audiences are hungrier for digital content, what kind of content is most impactful, relevant, and actionable given their inability to physically go to the point of care? As we’ve seen telehealth could play a significant role; how are marketers able to incorporate messaging and calls-to-action for this new and disruptive channel? On the NPP side, how can digital not only supplement but temporarily replace sales rep visits and detailing? These are questions that need speedy answers—and action.

Pharma Marketing Investments

The relative level of investment is the surest indicator of pharma marketer commitment. Given all the current disruption, pharma marketing teams are not sitting idly by. When asked “On a scale of 1-10, to what extent has the pandemic altered your existing or near-term marketing and media investment plans? (1= not at all 10 = re-thinking all of our marketing and media plans)” the average response on a scale of 1-10 was an 8. Clearly pharma and healthcare marketing teams are paying attention and adjusting.

Implications

Paradoxically, an unprecedented pandemic that’s diminished time at the point of care for both patients and sales reps is nonetheless encouraging pharma marketing teams to invest more heavily in media than less. The contradiction likely makes sense if viewed through the lens of hidden opportunities in terms of increased screen time from captive audiences, and the unique power of digital technologies.

Increased Investment: HCP vs. DTC

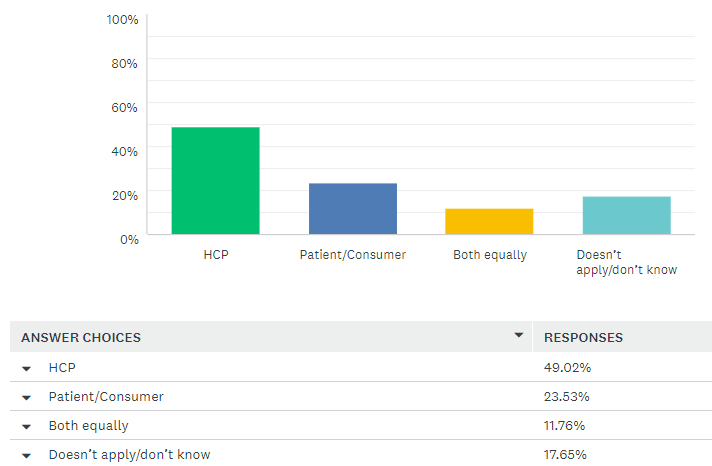

But where is most of that increased investment happening? We drilled down further “Which of your audience-focused marketing investments has it impacted more – HCP or Patient/Consumer (DTC)?”

- 49%: HCP

- 23%: DTC

- 12%: “Both equally”

Implications

Implications

Disproportionate emphasis on HCP makes sense considering prior spends and success with digital non-personal promotion (NPP) for physicians. As we’ve seen telehealth adoption for patients has increased, but likely not to the point of becoming a comprehensive substitute for actual point of care visits.

Marketing Budgets

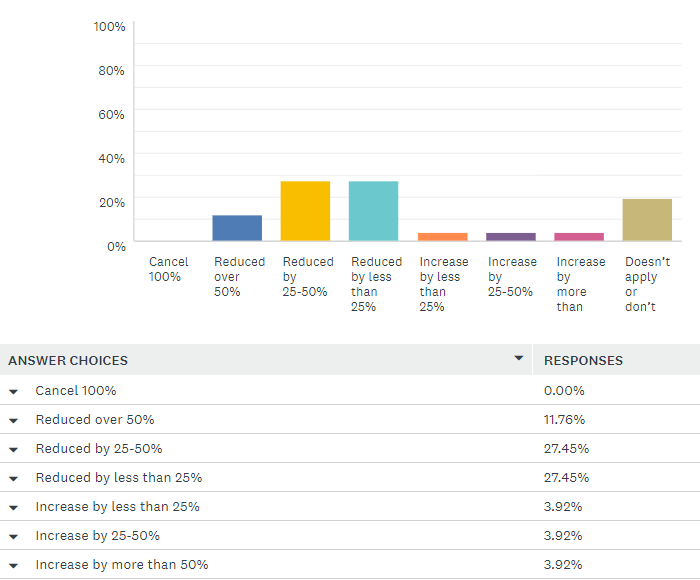

Spend is literally the bottom line of pharma marketing commitment to media, so the answer to “How has the pandemic impacted your 2020 marketing and media budget?” reveals the most about what’s on everyone’s mind and their feelings about the quarter ahead:

- 12%: “Reduced over 50%”

- 27%: “Reduced 25-50%

- 27%: “Reduced by less than 25%”

- 12%: “Increased by 25%” or more

Implications

Implications

Budgetary allocations are a business, strategic, and ultimately an intuitive decision. Do you decrease marketing and media outreach to reflect plummeting sales rep and patient visits and therefore reduced sales in the near term—possibly including supply-chain issues that preclude treatments even being available? Or do you increase media spend at least within certain channels knowing that your audiences are spending more time online and in front of their TVs? Is now the time to grow market share, or at the very least build awareness for sales that might not happen for weeks if not months?

Owned Media Considerations

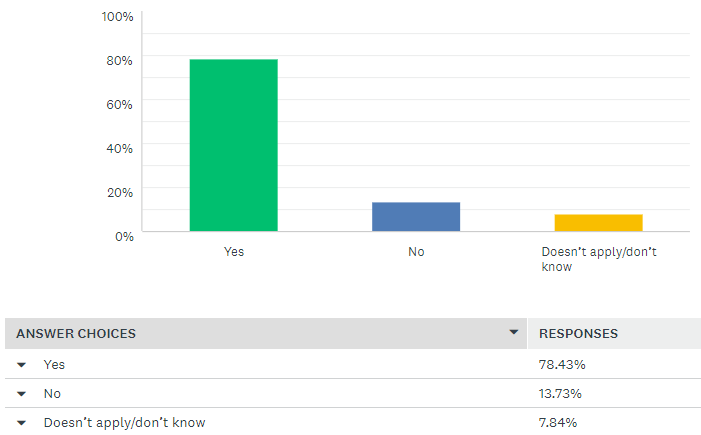

After we discovered pharma marketer response to investment, budget, and targets, we next turned to specifics around pandemic content and messaging. We asked: “Are you or do you intend to make changes to your website and/or creative to reflect COVID-19 issues?”

- Nearly 80%: Yes to core website or creative changes

- 14%: No changes

Implications

Implications

Regarding content strategy, an overwhelming majority of pharma marketers are either currently or will soon reach and engage their audiences with COVID-19 related content. Obviously relevant and top of mind, the topic creates immediate interest; how marketers pull that messaging through to retain engagement and trigger a call to action varies based on campaign goals. But clearly the opportunity is ripe to address concerns and tie response opportunities back to corporate and even brand benefits.

Campaign Types: Branded vs. Unbranded

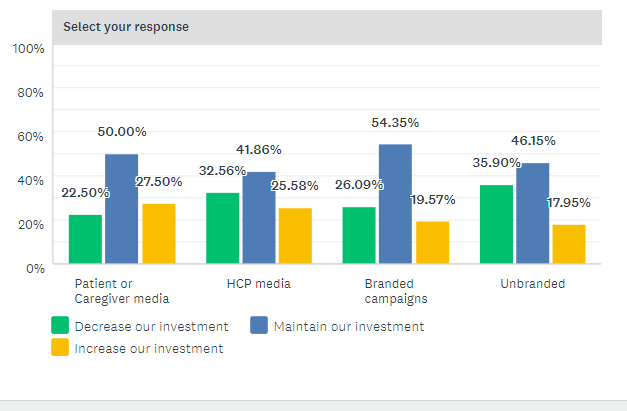

We drilled down further to learn if any patterns could be discerned for investment levels by audience and type of campaign: “For the following campaign types, please indicate your most likely disposition to decrease, increase, or maintain current spend levels”

Implications

Implications

One interesting comment we received in response to this question is: “We are focused on nurturing interest and creating awareness given long sales cycles and recognizing people at home have more time to research and plan.” Depending upon the product or service, this appears to be a very smart, long-term response to the pandemic for a brand-building perspective.

Content Strategy

Next, we wanted to discover pharma marketer attitudes and practices around any pandemic-related changes to content. “Have you changed your ad messaging – i.e. your creative, as a result of the pandemic?”

- 45%: Changing creative

- 20%: “Thinking about doing so”

- 29%: Not changing creative

Implications

Implications

The global pandemic has fundamentally transformed our lives and changed our mindsets in the short term and will likely persist for quite some time to come. A majority of pharma marketers revealed that these seismic shifts necessitate changes to content and creative, and have committed their resources to tweaking and in some instances evolving their entire campaigns.

Pandemic Impact: Open Responses

Finally, we provided the opportunity for all respondents to respond to this open-ended question: “Please share any other ways in which the pandemic is impacting your business or your customers and what you are doing in response”

- “We launched a new service delivery vehicle and need to overcome objections to online therapy.”

- The pandemic has “impacted our ability to collect data for clinical trials due to risk of infecting patients during study visits.”

- (Our goal is to) “Support HCP’s and patients as best we can during this pandemic.”

- “We need to have a long-term strategy that re-thinks our go-to market model.”

- “Elective surgeries are all but postponed.”

- “The level of interaction with HCPs is greatly decreased. As a result, we need to be present via digital media.”

- “We let go of our commercial team.”

- “Patients and visitors to our laboratory have been stopped. Our reps cannot physically visit HCP offices. They are doing a lot of email, phone calls, and video conferencing.”

- “We are helping customers work from home with special licenses. We are also giving free licenses to people working on COVID.”

- “Fear of returning to the dental office due to infection concerns.”

- We need to “focus, resources and funding moving to ICU care area. Protocols/guidance are being rewritten to address COVID-19 patients. Very new focus. Getting questions we’ve never faced even about a product that has been in the market for 10+ years.”

- We are “Creating a new virtual promotion platform for reps.”

Implications

We are all living in real time through an unprecedented healthcare crisis that impacts every aspects of our lives, the pharma marketing response is varied, complex, and continuously evolving. In general, the survey reveals that sales rep and patient visits to the point of care have plummeted, while media engagement is high and has often increased.

Pharma marketers have responded to this strange set of circumstances with increased investment and often budgets, have created COVID-19 specific creative and messaging, and are doing their best to maintain and even heighten awareness to a captive audience.

How strategy, planning, and commitment will evolve depends to a large extent on the trajectory of the pandemic, but one rule won’t change: The best prepared and most strategic media teams will survive and even flourish throughout this time of crisis and opportunity.

This survey represents a current, snapshot in time. No doubt if we run this survey again in three months, we may receive quite different responses. We appreciate everyone’s participation and again, hope you find some value here. Thank you.