According to data collected continuously since January 2010, patients are changing the ways they access manufacturer copay support. But before we discuss those changes in detail, a disclaimer: The data described in this article have been collected from programs managed by ConnectiveRx only, and do not necessarily reflect data across the entire industry. That said, ConnectiveRx has processed more than 108 million copay claims for nearly 600 brands, so its data set does represent a meaningful evidence base. So, let’s get started.

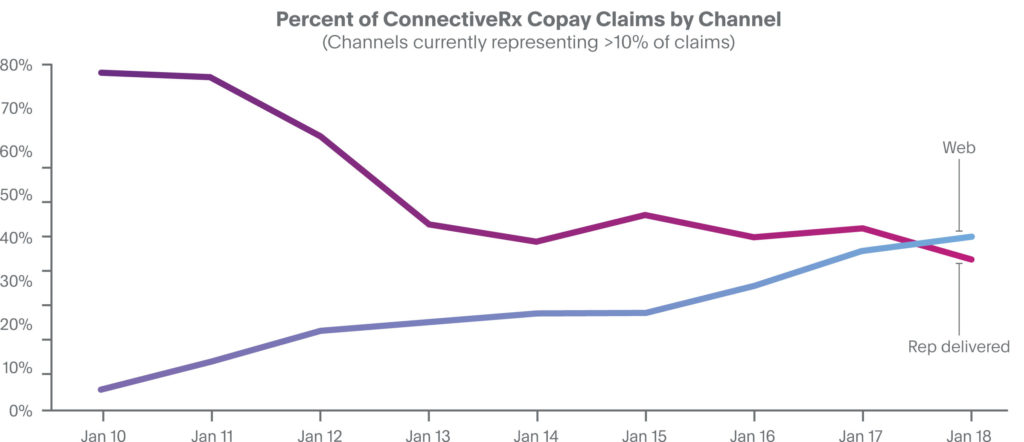

In the early stages of the copay industry, rep-delivered cards were the prevailing distribution channel, representing 75% to 80% of all ConnectiveRx claims in 2010 (see Figure 1). At that time, web-sourced offers accounted for only about 5% of all claims, even trailing mail-delivered offers. Beginning in 2011, a steady and seemingly inexorable shift has occurred in the channel mix. Over the ensuing years, the percentage of claims stemming from rep-delivered cards has fallen to a current all-time low of 34%. At the same time, the percentage of claims originating from web-sourced offers—primarily website downloads—has grown to now account for 40% of all claims.

This trend makes sense, as physicians increasingly restrict access to reps, as digital channels expand, and as new channels within EHR workflow provide critical support in doctors’ offices. Expansion of channels to increase visibility of copay offers is evolving to ensure awareness of brands’ copay support.

This trend makes sense, as physicians increasingly restrict access to reps, as digital channels expand, and as new channels within EHR workflow provide critical support in doctors’ offices. Expansion of channels to increase visibility of copay offers is evolving to ensure awareness of brands’ copay support.

In many respects, this profound shift represents a sea change in the delivery of copay offers. What’s more, it may raise key questions in the minds of brand teams: What’s behind the shift? What are the likely dominant channels going forward? What should brand managers be doing—if anything—to capitalize on these trends?

What’s behind the shift?

While there is limited hard evidence regarding the causes of this shift, several factors are likely at play:

- Increasing patient copays. Average retail copays for patients using ConnectiveRx copay programs spiked to $212 in January 2018, and the challenge is even more pronounced in the specialty market, where the average copay was nearly $800. For many families, this level of financial burden is simply too much to bear. Many patients fail to ask about copay support as they meet with their prescriber, perhaps because they are unaware of the high copay they will face at the pharmacy or are too embarrassed to raise the issue.

- Digitally engaged patients. Today’s patients are no longer passive recipients of medical care. Instead, they’re technologically savvy consumers increasingly engaged in their own health. They actively seek solutions that suit their personal situations, and they are particularly eager to search online for financial support. And, of course, ubiquitous mobile access makes online searching even easier, further increasing the opportunities for digital downloads.

- Reduced representative access. Recent reports suggest that more than half of physician practices strictly regulate or prohibit pharmaceutical rep access. For example, SK&A1 has tracked representative access in physician offices and reports a steady increase in those reporting “no access” to commercial visits (from 23% in 2010 to 40% in 2017). As a result, there may simply be fewer offices that are adequately supplied with copay coupons.

- LOE brand strategy. Loss of exclusivity drives many changes. Frequent among them are reductions in sales force strength and a decrease in the number of copay cards in market.

What are the likely dominant channels going forward?

First, in keeping with the factors described above, web-sourced offers are likely to continue to grow in number, although their share of total claims may begin to plateau as other channels expand. Data since January 2017 indicate a decline in the rate of web-sourced share growth (see Figure 1). Second, because rep-delivered offers are so entrenched in the prescriber-to-representative dynamic, it’s likely that they will continue to be an important distribution channel long into the future. Finally, recent years have seen the introduction of several new copay delivery channels. Of these, one of the most promising is the ability to present copay offers within prescribers’ EHR workflow and deliver them directly to pharmacies. In-workflow, EHR-delivered copay offers can be particularly valuable since they engage prescribers in real time as they make brand choices in the EHR application. Although EHR-delivered copay offers currently represent less than 10% of total claims, it is likely that this share will increase significantly as the EHR continues to grow as the de facto home base for the practice of medicine.

What should brand managers be doing—if anything—to capitalize on these trends?

1. Diversify! Resist the urge to rely on any single channel. On the contrary, each channel brings unique potential to enhance adherence and persistence:

- Web-sourced coupons are directly sought out, downloaded and delivered to the pharmacy by patients. As demonstrated by their actions, these patients are highly motivated to participate in their own care, and many of them are explicitly seeking savings opportunities.

- Rep-delivered coupons have their advantages, too: 1) the process of delivering tangible coupons often gives reps access to prescribers that they would not otherwise have, and 2) tangible coupons have a physical presence in the sample closet that may provide key reminders to prescribers.

- EHR-sourced coupons appear automatically within the prescriber’s ePrescribing screen and are electronically delivered to the pharmacist; the patient bears no responsibility to carry or present the offer.

- Don’t forget pharmacy-sourced coupons, which are accessed by the pharmacist in real-time at the point of sale. In many cases, pharmacists take action in direct response to a patient’s expressed need for financial support. These patients are motivated enough to go to the pharmacy—but may be facing a real affordability barrier.

For many brands, there really is no need to try to find a single perfect channel. Instead, consider an “all of the above” or “most of the above” channel strategy. Usually, the incremental cost of adding a channel to the mix is relatively low. And each added channel has the potential to connect with additional patients who need the support you are offering.

2. Expand communication! Recognize that, in addition to supporting the delivery of copay offers, each of the channel clusters (web, rep, electronic/digital/EHR, pharmacy, etc.) has unique characteristics that can be used to engage stakeholders at various points along the medication journey. For example, the EHR can be leveraged to deliver real-time prescriber messaging and patient-directed education and adherence messaging. Take care to match these characteristics to your specific brand situation.

3. Seek out partners who can help you innovate! Watch the market closely for the introduction of new channels that may have particular value for your brand. Copay program providers are always working to develop and roll out new solutions designed to help patients surmount managed care hurdles in order to access and afford the medications they need.

Resources:

- SK&A Commercial Access to Physicians. “Medical Industry Sales Reps Accessibility to U.S. Physicians.” Market Insights Report. September 2017.