This fall’s 6th Annual Coupon and Copay conference in Philadelphia provided multifaceted insight as to how the affordability landscape is evolving. Our speakers delivered powerful content on how to navigate this highly regulated environment. And the audience questions and side exchanges provided a real sense of their grassroots concerns.

As the founding and continuing conference chair, I worked closely with a team dedicated to bringing relevant content on how the copay industry can respond to accumulators, access hurdles, and other trending challenges. What’s more, the increasing diversity of registrants enlivened the discourse. Manufacturer teams included marketers (of course), but also representatives from patient engagement/access services, managed markets, procurement, and legal. In addition, we heard from the Center for Medicine in the Public Interest, the National Business Group on Health, Vanderbilt University Medical Center, The AIDS Institute, U.S. Attorneys at the Department of Justice, and more. With this vivid mix of opinions, the dialog at this year’s event was the most engaged since we launched the series in 2013.

Five Key Conference Themes

Five key themes emerged, each of which brings both challenges and opportunities:

1. Accumulator adjustment programs. Accumulator adjustment programs are products sold by PBMs to employers/insurers that exclude moneys paid by manufacturer copay assistance programs from counting toward a patient’s deductible. This was, without question, the dominant theme of the entire event. Not only was it an important part of the official agenda, it was also the central topic of side discussions. As I survey attendees’ accumulator-related comments, three points of view became apparent. First, some were asking “what is this thing?” A second group was extremely concerned about accumulators. And the final group (which I predict will be quickly growing) was looking for ways to continue to help as many patients as possible notwithstanding the barriers created by accumulators.

2. Managed care. Manufacturers and payers are frequently on opposite sides of the copay-support conversation, but both are also searching for ways to understand all the arguments and, in many cases, work together to serve patients’ needs.

3. Cost (for both patients and brands). Increasing patient out-of-pocket (OOP) cost is a growth driver for copay programs overall. But the cost of providing OOP-cost relief can strain a brand’s budget, and controlling the cost of rebates, discounts, fees, and copay support is an increasing challenge for many brands.

4. Patient access and journey. In many therapeutic classes, patients are more access-challenged than ever. Our manufacturer guests were interested in how to create effective copay support within their budgets. Additionally, patient advocacy groups were looking for ways to make patient access easier and longer lasting so that patients can achieve the best possible health outcomes.

5. Specialty brand expansion. Copay challenges are magnified for specialty brands. In a breakout session offering two options—specialty copay in one group and retail copay in another—over 65% of attendees chose to attend the specialty group.

Let’s explore further the two top themes: Accumulators and Managed Care.

More About Accumulators

Accumulators became a dominant theme virtually overnight; they weren’t even on the agenda at the 2017 conference. Accumulators’ effect on any given brand depends on the therapeutic class, the competitive mix, and the degree to which the brand is targeted by payers. A recent ConnectiveRx analysis of patients using copay cards for specialty medications suggests that in 1Q 2018, approximately 4% to 8% of copay patients using manufacturer support programs were impacted by accumulators. However, these programs are an expansion priority for PBMs and health plans. One industry observer estimates that by the end of 2018, 50% of self-insured employer plans will be employing accumulator adjustment programs.1

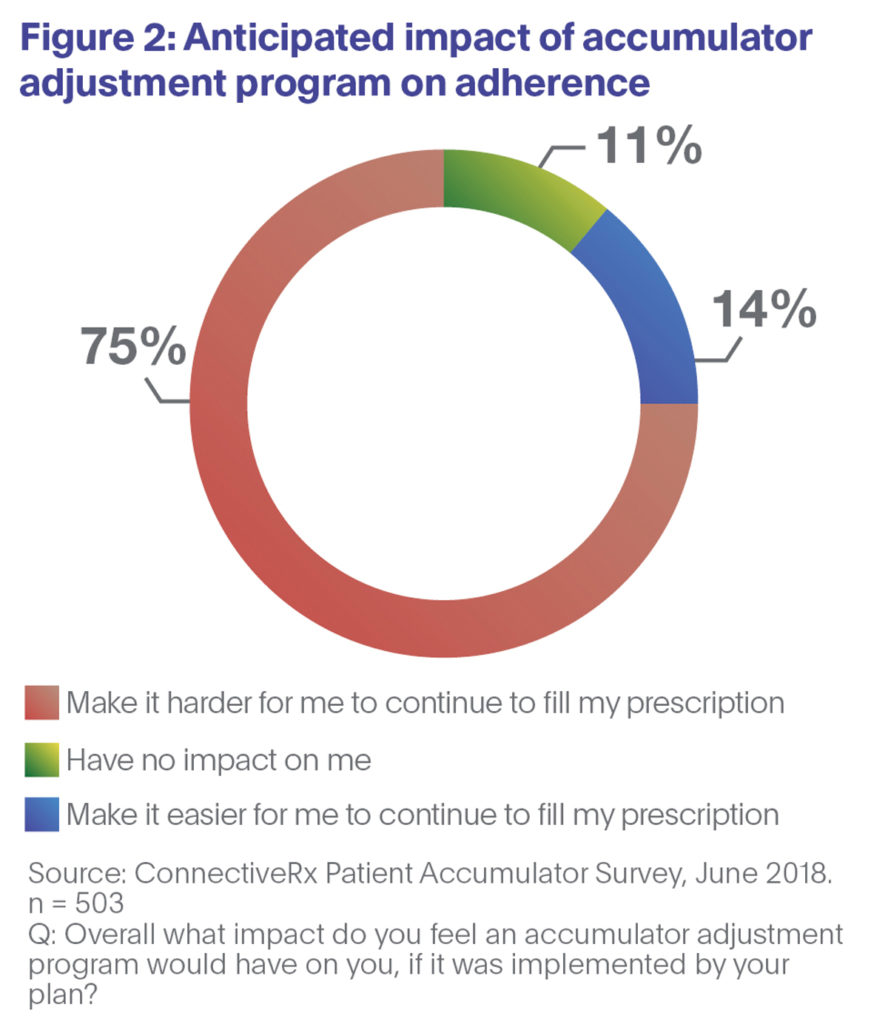

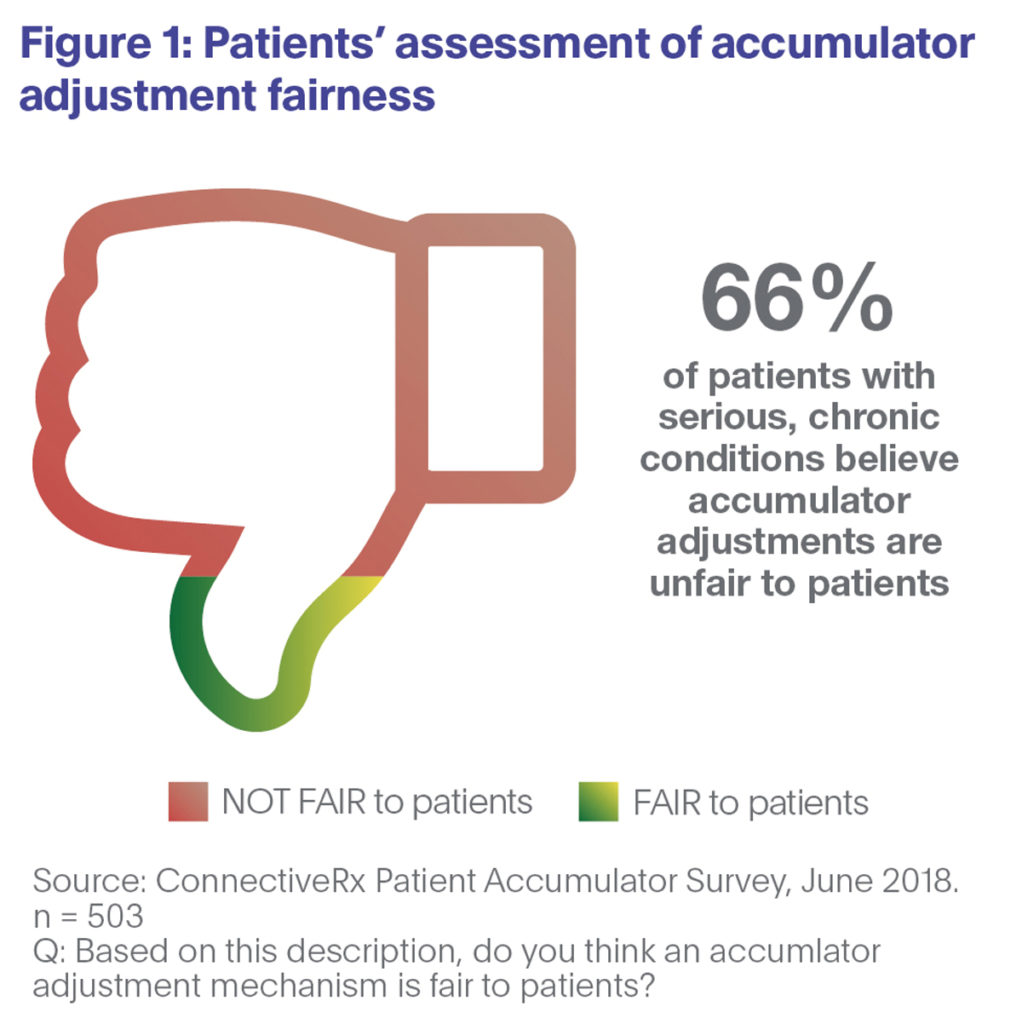

Our recent research shows that two-thirds of patient respondents consider such programs to be unfair to patients (Figure 1). And three-quarters of those surveyed say accumulators would make it harder for them to adhere to their medications (Figure 2).

Our recent research shows that two-thirds of patient respondents consider such programs to be unfair to patients (Figure 1). And three-quarters of those surveyed say accumulators would make it harder for them to adhere to their medications (Figure 2).

Responding to accumulators will be difficult. However, because pharmacy-adjudicated copay programs operate within the pharmacy claims process, they provide sponsors with rich data sets that yield actionable intelligence. That is certainly true in the case of accumulators: Claims data can inform successful strategies.

More About Managed Care

One of the forces that pull industry folks together at any conference is the desire to answer the question, “Do you see what I see?” That was common at the 2018 conference. Many brands are faced with the reality of “brand exclusion,” as up to 300 drugs are now fully blocked by PBM exclusion lists. And prescribers say the workload on prior authorizations is “high” or “very high,” and growing. Participants appreciated the conference’s focus on ways to navigate today’s managed care landscape of high deductible plans, accumulator programs, and copay blocks in ways that support patient affordability, adherence, and long-term health.

Conclusion

Copay support continues to be one of the most important means by which to improve access and adherence to vital medications. Nevertheless, significant hurdles from the health insurance industry complicate the patient journey. In the face of these hurdles, the annual Coupon and Copay conference has become the leading event dedicated to copay programs. Can’t wait to see you in fall 2019! In the meantime, consider registering for CBI’s spring copay event, the Formulary, Copay, and Access Summit, April 9-10, 2019, in San Francisco.

References:

1. Silverman E. “Which Drug Makers are Most Vulnerable to a New Cost-Shifting Maneuver?” STAT. April 18, 2018. Accessed October 24, 2018.