Cell and gene therapies (CGTs) have the potential to transform healthcare for patients suffering from a wide range of diseases, from cancers to inherited conditions, such as sickle cell anemia. The pace of research and development into the field is accelerating quickly. A 2018 PhRMA report on the CGT pipeline found 289 therapies in clinical development by pharmaceutical companies in the U.S. alone. That number has now risen to 362.1

In spite of the potential of CGTs, there are considerable barriers to the adoption of new treatments when they achieve regulatory approval. Overcoming concern and apprehension has been described as a significant challenge among not only patients, but healthcare providers (HCPs) and payers. In delving deeper into this topic, it is clear that there is misunderstanding and a need for rapid implementation of novel solutions to accelerate the acceptance of these ground-breaking therapies.

Cell and gene therapies are overlapping fields of treatment. Both have the potential to alleviate the underlying cause of congenital or acquired diseases, but there are nuanced differences between them. Cell therapies restore or alter certain sets of cells or use cells to carry a therapy through the body. Cells are cultivated or modified outside the body before being injected and can originate from the patient (autologous cells) or a donor (allogeneic cells). Gene therapy aims to treat diseases by replacing, inactivating, or introducing genes into cells either in vivo or ex vivo. Some therapies can be considered both cell and gene as they work by altering genes in specific types of cells and injecting them into the patient. The complexity, cost, and relative lack of awareness or understanding of how these therapies actually work can often be the underlying cause of concerns for patients.

A 2017 study, into patient perspectives on CGT treatments for sickle cell anemia found that cultural beliefs and public misconceptions of the therapy fueled patient fears about treatment.2 This can pose significant challenges when encouraging patients to begin therapy, delaying treatment start dates and often reducing optimal chances of therapy success. Apprehension due to the novelty and lack of infrastructure support for CGTs as well as cost and efficacy concerns among HCPs and insurance providers also present obstacles to therapy referral.

With all of this in mind, drug companies need to take steps as early as possible to implement CGT infrastructure and strategies to tackle these misconceptions. These measures will ensure that treatment is adopted and prescribed to the patients who stand to benefit from it. The key to achieving this is developing a comprehensive go-to-market strategy right at the beginning of CGT development.

Barriers to Adoption for Cell and Gene Therapies

CGTs have been viewed as a potential revolution for medicine since their development and yet their extensive potential is only starting to emerge. New treatments often generate an air of apprehension that must be understood and ameliorated before a treatment can be successfully incorporated as part of the healthcare ecosystem.

Since this novel therapy is in its infancy, distribution challenges, training and administration complexities, pricing and reimbursement challenges, as well as administration site accreditation hurdles all exist. These challenges contribute to HCP referral apprehension, which is further cemented with the shortage of CGT information for HCPs and their patients. HCP apprehension and delay in treatment referral has led to CGT treatment being overlooked or often viewed as a last resort treatment.

The COVID-19 pandemic highlighted the need for access to clear, concise, understandable information, for patients to feel in control of their healthcare decisions. As for most emerging medicine and treatments, the complexity of CGT lexicon adds to the barrier excluding patient self-learning and delaying treatment uptake. As patients may be critical to the supply chain of their own CGT treatment, this requires a new era of patient support and understanding of the CGT process.

To bring novel solutions forward, the industry and health authorities have to strategize early and innovatively. To ensure the optimal CGT treatment referral and uptake, pharma is now prioritizing support services and communication strategies to bridge the knowledge gap and implement the correct infrastructure, enabling early, potentially life-saving intervention for patients.

A New Era of CGT Understanding

Besides patient understanding, it’s also important to examine the perspective of providers and payers.

For providers: HCPs are incredibly excited about these new therapies, but they need help from the industry to place themselves and their patients effectively into the CGT journey. As for any new therapy, the core question is whether the benefit outweighs the risks and costs.

For CGTs:

- The repertoire of benefits may not be clearly defined as of yet.

- The costs involve not only historically high one-time payments but also complex logistics.

- Risk Evaluation and Mitigation Strategies (REMS), as well as accreditation, introduce additional administrative barriers to HCPs and pharma.

Before clinical experience enables predictors of response to complement patient profiles, HCPs must receive strategies and support from pharma and health authorities.

For payers and insurers: Payers and insurers also see the promise of these revolutionary CGTs; however, they are limited in their ability to act due to a lack of infrastructure and systems to incorporate and fund these on a large scale.

But with 1,085 CGT-based therapeutic developers and 1,220 ongoing regenerative medicine and advanced therapy trials worldwide, it is clear pharma companies recognize the market demand and potential of CGTs.3 There is tremendous investment and an explosion of clinical development and mergers and acquisitions in this very young space. Now is the time for companies to collaborate with health authorities and the healthcare system to strategize commercial success and implementation to overcome payer apprehension once and for all.

Strategize Early for True CGT Success

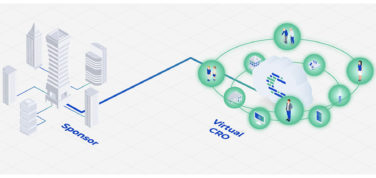

The pharmaceutical industry needs to apply a different mindset for CGT than for previous treatments. Greater collaboration is needed. Companies must ensure that the overall site onboarding and treatment process is more seamless, efficient, and less costly for providers and patients than ever before. Process standardization and simplification across manufacturers and sites is key to success. An opportunity exists for a coordinated, cooperative approach through the involvement of integrated healthcare services partners that specialize in CGT solutions.

Taking Advantage of Expertise

For CGT, it is now understood that market entry strategies should be commenced as early as technology transfer from the lab to Phase 1 trials. Many CGT companies are navigating this space for the first time and are taking advantage of partners that have extensive experience in the CGT space. Global integrated healthcare services partners can aid in strategizing in all areas impacting CGT development, manufacture, and commercialization. The latter, which plays an enormous role in the therapy’s commercial success, can encompass anything from pharma sales and HCP engagement to patient support programs and medical communications.

Regulatory and Communications Strategies for Success

Advisory support for go-to-market planning is now in high demand for CGTs to overcome development and commercialization pitfalls that could lead to apprehension. Patient mapping and payer insight generation are both needed to create solutions for both the financial and social burden of CGTs. Parallel to the early-stage development of the CGT, HCP treatment choice studies and patient service program benchmarking assessments must take place. Critical analysis of these, with the implementation of ongoing surveillance mechanisms by the industry will shape an effective strategy early in development.

There needs to be a high-level of global HCP engagement facilitated through a detailed HCP segmentation and profiling strategy. Detailed patient segmentation and profiling are also critical resources to be provided to HCPs prior to the therapies’ entry to market. As the patient’s caregiver is a crucial member of a CGT journey, strategies should include emphasis on a caregiver engagement plan, as well as the creation of patient and caregiver education materials. Healthcare service providers acknowledge that a major barrier to overcome will be in CGT pricing, reimbursement, and Health Economics & Outcomes Research (HEOR).

As well as congress planning and accreditation planning, organizational preparedness is a necessity to preempt pitfalls and challenges. For regulatory strategy and submissions, a global regulatory approach is required and regulatory interactions must be prioritized early in development. Education and disease awareness is also central to breaking through CGT misconceptions before commercialization.

Only in developing an in-depth go-to-market strategy to commercialize a new CGT right at the beginning of Phase I trials can all hurdles and apprehension be foreseen and overcome. This will propel CGT towards its full potential as a game-changer in disease treatment.

References:

1. https://www.phrma.org/en/Report/Medicines-in-Development-for-Cell-and-Gene-Therapy-2020.

2. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6201755.

3. https://alliancerm.org/wp-content/uploads/2021/01/SOTI-2021-pdf.pdf.