Many of you have or will face the advent of generic intrusion on your brand. Can implementing product line extensions to your brand before a generic alternative becomes available help minimize the fallout? Some brands are using this strategy with a good deal of success.

Symphony Health Solutions has conducted several analyses that examine how various managed care organizations (MCOs) treat line extensions. We looked at several markets to determine how various brand extensions fared both pre- and post-launch of a generic, and to determine if there were differences by therapeutic class. Each of the extensions studied offered modified concentration of the original brand. Our research first looked at how brand share changed over time and how well extensions were able to hold on to share in the period shortly before and after a generic launch.

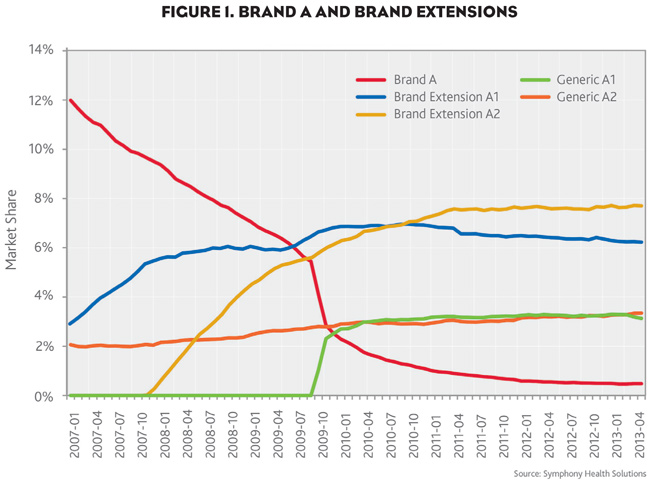

If we look at Brand A, a blinded product we tracked in a chronic disease state that primarily affects patients aged 65 or older (Figure 1), we see how two of its brand extensions performed. Upon launch, the brand extensions, let’s call them Extension A1 and Extension A2, steadily take market share from Brand A. Once the generic equivalent (Generic A) is introduced, it immediately and exclusively takes share from Brand A—driving the brand claims down to nearly zero. Interestingly, the extensions manage to hold pretty steady after the generic is launched with Extension A1 gradually losing some share to other competitors.

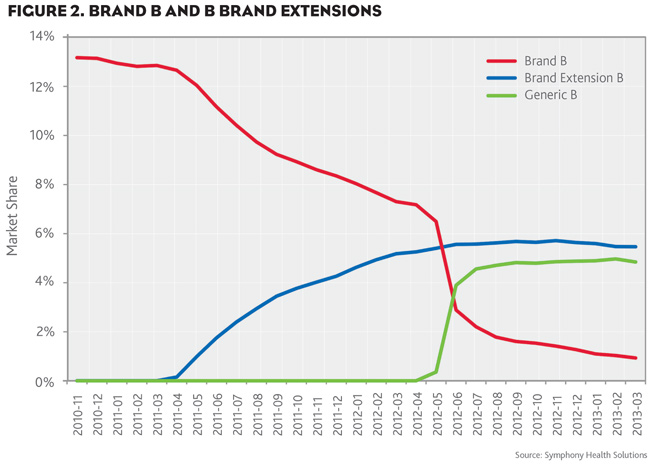

In another example, we examined a different chronic market—this one affecting patients across the age spectrum—and saw a similar phenomenon. Here, as depicted in Figure 2, Brand B quickly loses most of its share to a brand extension (Extension B) in the period pre-launch of a generic product. After Generic B is launched, it takes most of the remaining market share from Brand B. Extension B gradually loses some share to a competitor’s product, but it still holds on to a significant amount.

After looking at a number of markets—both chronic and acute, treating age-related disease as well as those diseases that affect a more varied population—we begin to see some consistent trends emerge:

- Branded line extensions primarily and steadily take share from their base brand while the base brand is able to enjoy exclusivity.

- Once the base brand loses exclusivity, it immediately loses nearly all of its remaining share to the generic.

- The line extensions, however, are able to maintain their share during the base brand loss of exclusivity.

Our research also looked at commercial payers to gauge their response. We looked specifically at the top MCOs to determine which ones were more predisposed to block or embrace line extensions within the first year of a generic launch. We found that several line extensions experienced post-generic increases in rejection rates, but all increases were in line with those of other branded products in these markets.

In Figure 3, we created a composite index of relative payer controls on a brand by aggregating all of the products in the markets studied. This index rolls up price controls and plan blocking to collectively gauge how much influence each payer is exhibiting by looking at the differential between pre-generic claims and post-generic claims. This basically allows us to see the “control” freaks, the MCOs most likely to administer controls.

After reviewing this data, we discovered a significant disparity in the way each payer reacts to line extensions and generics. This revelation underscores the need for pharma marketers to address each MCO individually. With this knowledge in hand, you can better focus valuable sales and marketing resources on the most encumbered MCOs and spend far less time on the rest.