Since the Asia-Pacific healthcare industry comprises more than 60% of the world’s total population, it’s not surprising that—based on recent reports—the overall market shows a healthy outlook, driven by incremental healthcare spending and liberalized investment policies. But the region is also experiencing dramatic lifestyle changes—life expectancies, disposable incomes, amount of sedentary time and earlier disease diagnoses. Some reports say that by 2015, Asia’s global market share for the healthcare industry is expected to grow to more than 33%—up from 27.5% in 2011. Likewise, healthcare revenues in the region are poised to surge from US$337.94 billion in 2011 to US$521.42 billion in 2015, at a compound annual growth rate (CAGR) of 11.5% against the rest of the world’s CAGR of 4.3%.

The population aged 65 years and older is anticipated to rise by 36% from 293 million in 2011 to 398 million in 2020, which will be 9% of the total Asia-Pacific population. This trend will place significant pressure on governmental health budgets to treat the elderly population. In Japan alone, an estimated 29% of the population will be 65 years and older by 2020, while in South Korea and Taiwan, the proportion will be 16%. This aging trend has forced governments and health organizations to set up public programs to prevent and treat ailments and diseases related to aging, which will influence future sales of consumer health.

Asia Pacific is too geographically vast to talk about as a single community. Instead, it’s necessary to drill down to the two largest countries that offer some of the largest opportunities and challenges—India and China. Both are very different countries, with very different economic and developmental ecosystems. We need to understand what are their key development parameters for marketers.

China’s Revolutionary Healthcare Shift Begins

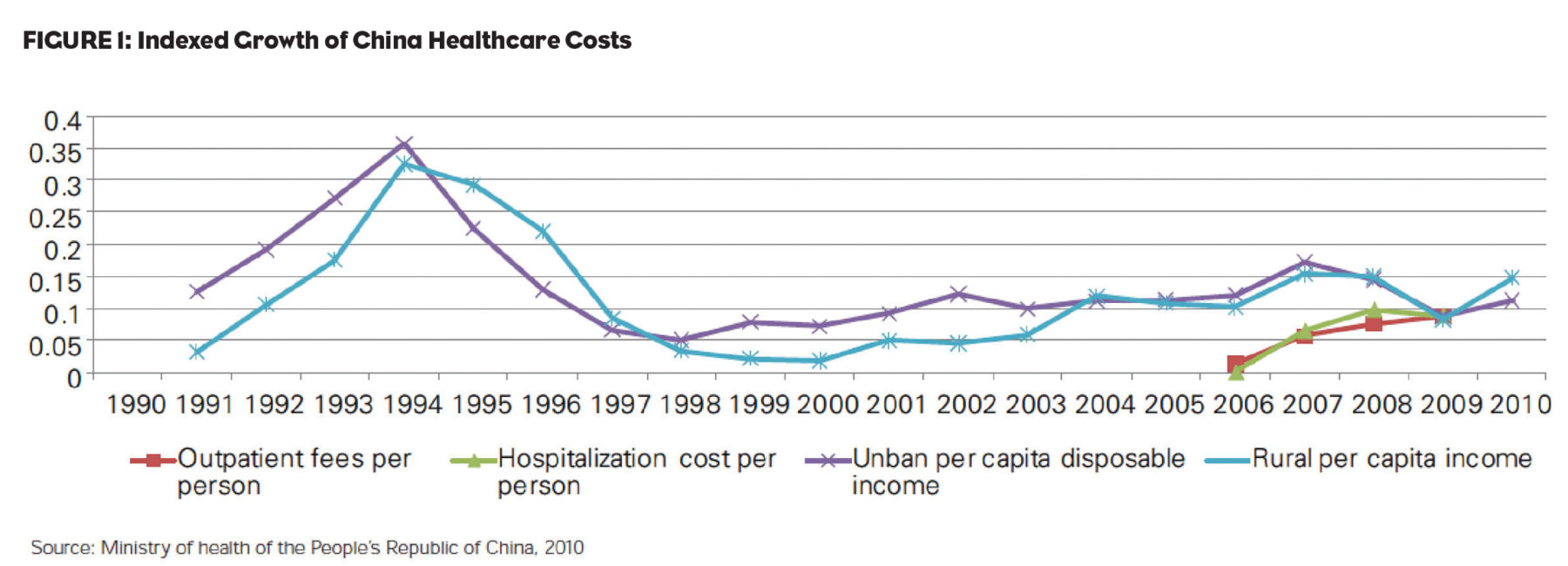

As a leading economic superpower, China has a long way to go in terms of improving its global health rankings. Saddled with rising health issues, the country ranked 89th in the 2010 human development index of the United Nations Development Program (UNDP), and its population’s healthy life expectancy (HALE) at birth is about 10 years shorter than in some of the leading G20 countries. However, the revolutionary shift of China’s human and socio-economic development model has only just begun, with the modernization of its health structure driven by the 12th Five-Year Plan (2011-2015). This plan emphasizes sustainable growth with equitable wealth distribution and human development (Figure 1).

That said, life expectancy at birth in China has shown a significant improvement, from 65.2 years in 1977 to 73.5 years in 2011. The advent of significant urbanization and the meeting of basic nutritional deficiencies among the population have enabled Chinese people to live longer. However, a high prevalence of rates of tobacco smoking (25.7% of the adult population in the 2006-2011 period), combined with fatty and salty diets, explain why cardiovascular diseases became China’s leading cause of death

in 2011.

To help counter this, the Chinese government increased total health expenditure per capita by a substantial 121% between 2006 and 2011, partly motivated by the healthcare reforms that began in 2009. Total investment in the new healthcare reform by the government had reached almost US$74 billion. Ninety percent of citizens are now covered by medical insurance, according to data released by the Ministry of Health in late 2010.

This may appear a Catch-22 situation—more prosperity, more illnesses and more diversion of funding to health solutions. Where would a focus need to be applied? Some say China needs to take strategic steps to stem the rising tide of its biggest health threat: Non-communicable diseases (NCDs). NCDs account for more than 80% of its 10.3 million annual deaths. Potentially, China could be burdened with a loss of US$550 billion between 2005 and 2015 due to cardiovascular diseases (CVDs), stroke, and diabetes.

NCDs put China’s social and economic development at risk. In fact, World Bank estimates for China indicate that the economic benefit of reducing CVD mortality by 1% per year over a 30-year period (2010-2040) could produce an economic value equivalent to 68% of GDP for the year 2010—in value terms that’s more than US$10.7 trillion. In China, the prevalence of hypertension, obesity, cholesterol and diabetes has increased dramatically over the years.

It is estimated that about 200 million people in China are overweight or obese. According to the World Health Organization (WHO), China has the world’s second-largest incidence of cancer. The country’s shifting socio-economic model has resulted in growing urbanization, changes in dietary patterns and health-impacting habits such as smoking. These have in turn brought about new NCD risk factors, particularly among low-income groups. The World Bank projects that a rapidly growing population of aging people may increase China’s NCD burden by at least 40% by 2030.

Desire for Innovation-Driven Pharmaceuticals

The Chinese government is keen to develop China into an innovation-driven pharmaceutical powerhouse, a process that will involve radical reform of the sector. This will allow companies both domestic and international to focus on delivering quality, innovation and affordability to the population—including the large sections that currently have no access to health services. Massive strides were needed to develop lower-tier infrastructure at a pace that necessitated that manufacturers and healthcare service providers consider how can they work to support and partner with China in this massive undertaking.

India Increases Healthcare Spending

A vast potential opportunity exists to be captured in India’s pharmaceutical market, as well. The expansion of the affluent middle class, the government’s healthcare policies and improvement in intellectual property rights will propel the demand for quality drugs and medical services and increase direct foreign investments in the sector. Both the government and India’s urban population are increasing healthcare spending—thanks in part to fast GDP growth, disposable income and rising living standards.

More important, however, are the gaps to be filled. The shift in disease profiles of the Indian population has been marked by fast growth of the chronic diseases segment due to changes in lifestyle, habits and diet. India’s pool of diabetic patients is the largest in the world—more than 41 million people suffer from the disease. That number is projected to reach 73.5 million in 2025, according to some industry estimates.

Pharmaceutical, medical device and healthcare service providers attempting to capture the full potential of these opportunities will require forward thinking and sustainable strategies to cope with the new class of patients. Priorities such as making medicines more affordable, working with the government to improve hygiene and infrastructure conditions, and improving accessibility to medicines and health insurance will all be part-and-parcel of the process.

A Vast Need For Patient Education

What will be equally important is the development of effective communication channels with patients and doctors in order to increase awareness and education about the ailments, prevention and treatment options. A long-term, public-private partnership strategy is critical for there to be greater success in controlling the spread of chronic conditions such as diabetes, obesity and hypertension.

Let’s take one critical industry as an example: Vaccination and preventable diseases. India is one of the largest producers of measles, DPT and BCG vaccines in the world. Globally, a shift in focus of patients and doctors from treatment toward disease prevention has taken place—which has boosted demand for vaccines. This has created opportunities for pharma companies to enter the health management and wellness space, and launch initiatives to complement governmental efforts. Education and awareness about disease prevention is a major driver of the vaccine market, which means marketers must look at engagement of communities and governments with an eye on how to improve access.

While India’s rural areas present massive opportunities for pharmaceutical companies, they are also fraught with challenges. Among these are poor infrastructure, lack of affordability of the rural population, lower literacy levels, and poor hygiene and living conditions. Understandably, healthcare is a low priority for the rural population, a large section of which make less than US$1.78 per day.

The rural population tends to rely on alternative forms of treatment (such as Ayurvedic and Unani medicines and acupuncture), a large part of which is provided by rural medical practitioners with no formal qualifications. These factors give rise to an even more fundamental need for pharmaceutical companies to raise awareness of diseases and treatment options through a comprehensive education and communication program involving medical practitioners, patients and the underprivileged population.