Moving a product from the prescription marketplace to the over-the-counter marketplace can be a lucrative opportunity for a pharmaceutical manufacturer. The market potential is huge and the FDA, through its Non-prescription Safe Usage Regulatory Initiative (NSURE), is examining several disease states and drug classes that will make Rx-to-OTC a profitable venture for manufacturers. The EU as well as China and other countries have expanded the OTC use of products that were once available only via prescription, expanding the market potential even more. Rx-to-OTC product movement is consistent with a long-term lifecycle strategy that doesn’t run afoul of regulatory agencies or legal challenges and is endorsed by the Affordable Care Act. It’s a strategy that many brands have successfully employed for over two decades and more brands are likely to follow in the near future.

FDA NSURE Initiative

Even though the Rx-to-OTC market potential is large, estimated at $35.7 billion, the limiting factor has been the FDA, which has stringent requirements for approving an Rx-to-OTC switch. Safety and efficacy must be demonstrated in a self-diagnosis and self-treatment environment. The manufacturer must prove to the FDA’s satisfaction that consumers can interpret product labeling, adhere to dosing instructions and continue therapy over the intended treatment period.

These requirements have limited some product switches especially in asymptomatic or chronic disease states, such as hypertension and hypercholesterolemia. Mevacor was not approved for an Rx-to-OTC switch primarily due to the asymptomatic nature of the disease: Patients might stop taking the medication because they might feel fine while still having the need for the medication. These types of situations exist for all asymptomatic disease states. By contrast, easily identified acute disease states (e.g., GERD/heartburn) have seen and will continue to see Rx-to-OTC switching.

Due in part to the Affordable Care Act, the FDA is exploring ways to increase access to therapies and reduce healthcare costs. It has embarked on the NSURE initiative to identify therapies that can quickly and effectively be switched from Rx to OTC. While the FDA has not yet changed the switch approval process, it is actively exploring ways to make more therapies available to consumers. These may include videos and interactive smartphone applications that help consumers accurately improve self-diagnosis and compliance routines.

Lifecycle Management

Lifecycle management is started from the day the manufacturer applies for an NDA. Over the years pharmaceutical manufacturers have employed many strategies to extend a product’s patent protection, including introducing a new delivery option, modifying product strengths, adding new indications and delaying the introduction of generics by negotiating deals with generic manufacturers. Each of these tactics has been successful for various brands over the years. However, many of them have come under attack, either from physicians (e.g., new product strengths and delivery options that are viewed as veiled attempts for product exclusivity) or from regulatory or legal challenges such as “pay to delay” tactics to deflect the impact of impending generic competition.

Many pharmaceutical brand managers marvel at the longevity of consumer brands due to the loyalty of the customer base. Loyal consumers are willing to pay a slightly higher price for a respected brand versus a competitor. By contrast, in the prescription pharmaceutical marketplace third-party payers often dictate what the patient pays or even the product delivered. Because OTC products do not experience the pressure from payers and managed care, the appeal to many manufactures of OTC is that once the consumer is brand loyal, a small price premium is often absorbed by the consumer. This price inelasticity and brand loyalty are driving a renewed effort for Rx-to-OTC switches in the industry. We have seen this scenario play out in several disease states. The competition for the consumer’s acceptance has resulted in an active marketplace trying to gain a loyal customer base.

Rx-to-OTC Switch Success Factors

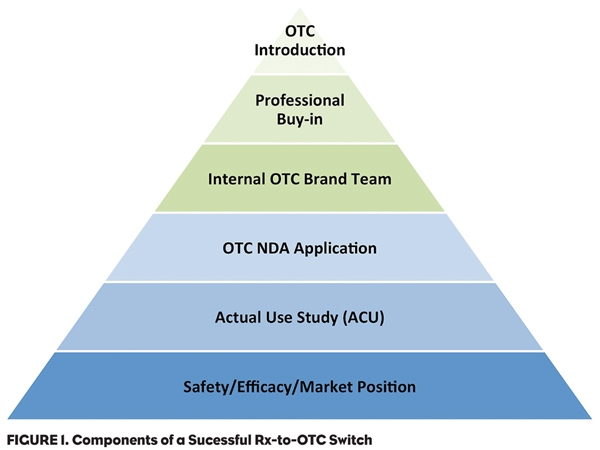

When embarking on an Rx-to-OTC switch strategy, there are a number of key questions to consider to ensure a successful roll out. These include: 1) What is the product’s drug class and likelihood of FDA OTC approval? 2) What is the product’s current market position? 3) Will the switch create a new OTC class or be moved into an existing class? and 4) What are the internal marketing challenges and how to address them?

Product’s Drug Class

Experience has shown that some product classes are more readily accepted for Rx-to-OTC switching by the FDA. While most drugs can show a product safety and efficacy profile that would meet the FDA’s approval standards, to provide proof that consumers can correctly diagnosis and treat their medical condition with minimal professional supervision can become problematic. Merck and Bristol-Myers Squibb failed to obtain approval for their statins (i.e., lovastatin and pravastatin), due primarily to the FDA’s conclusion that patients’ perceptions of their disease and the monitoring necessary for successful disease management were not adequately understood and demonstrated. Using well-designed and executed Actual Use Studies to simulate the use of a product to predict if the drug will be used properly, safely and effectively in the OTC environment help alleviate these concerns.

Market Position

A product that is the leader in an ethical market has an advantage when moving to the OTC marketplace. Being the market leader brings name recognition and a large customer base once the switch is completed. While not all ethical market leaders continue to enjoy the advantage following the switch, the cases when the prescription market leader was overtaken by a later-to-market product has typically occurred when that product has had a superior product profile.

New OTC Class

Creating a new OTC class for a disease state that has only had effective relief from a prescription product offers the best chance for continued success and extended product longevity. The introduction of Gyne-Lotrimin in the 1990s created a new OTC treatment for vaginal yeast infections previously available only via prescription. Gyne-Lotrimin held its leadership until the introduction of Monistat almost two years later. Monistat has been able to maintain its leadership position for almost two decades.

By contrast, H2 receptor antagonists entered the unsatisfied GERD/heartburn market as an alternative to antacids. These products were well received by consumers for offering longer term, although slightly slower acting relief, when compared to antacids. With the launch of PPIs, each product is vying for marketplace differentiation on product features such as quick relief, long-term relief, only one pill relief, etc.

Marketing Challenges

While manufacturers have only minimal control over the FDA approval process as well as the product’s safety, efficacy and market entry position, they do have almost total control over the marketing effort. Research has identified several areas that must be effectively managed to obtain a successful Rx-to-OTC switch scenario.

1) OTC marketing is different than ethical marketing. Physicians are motivated by different criteria than consumers. Initially, physicians must be convinced of the efficacy and safety of the product versus other competitors in the class. Consumers often assume safety and efficacy because the product is approved by the government. Consequently, marketing emphasis must shift to one of product image and its ability to gain a position in the mind of the consumer. This shift in focus requires that the company move away from a scientific promotion mindset to one of product image. Some manufacturers have difficulty making this shift. Consequently, the OTC brand team must sell internally to the corporation as well as externally to the consumer.

2) Analysis of successful Rx-to-OTC switch products reveals that developing internal OTC expertise is more successful than licensing the product to a “consumer products” company. Some companies can find that expertise within the corporate environment (Abbott with its Ross Products Division or Merck with the acquisition of Schering-Plough and its consumer products division); others must build it from the ground up. In either case, a successful OTC launch requires a dedicated team to manage the OTC marketplace and a consumer products sales force and distribution network.

3) Prior to the Rx-to-OTC switch, the product has been promoted to physicians, pharmacists and payers. With the OTC switch, these audiences should be informed of the impending OTC availability of the product. Physicians should be informed of any differences between the prescription product and the OTC version (i.e., strength, dosing, etc.). They should also be made aware that the prescription strength will still be available to them and whether the sales force will be able to supply them with additional information. Pharmacists also need to know these differences. The leadership of the professional sales force should be brought into the Rx-to-OTC discussion because it might impact the sales reps’ interactions with physicians and potential changes in product allocation and incentive.

4) Consumers have come to rely upon the perceptions of Facebook friends and Twitter feeds to help them choose products. Consequently, to maximize the chance for success, these media must be managed for the OTC switch. A dedicated product manager to monitor all social media is important. The role of this person is to answer questions and to correct misperceptions of the product. A few unwarranted unfavorable comments can affect market performance as can solid product endorsements.

Making the Rx-to-OTC switch can be an effective lifecycle management strategy—it has been successfully employed by many manufacturers. Given the current political and economic environment we will see more products employing this tactic.