This historical analysis of a celebrated patent expiration case provides some lessons in how to handle Loss of Exclusivity strategies.

In many ways, the blood cholesterol lowering atorvastatin Lipitor has been a wonder drug for Pfizer in the 12 years since the company acquired Warner-Lambert, which developed the drug. Lipitor’s peak sales were $12.9 billion in 2006 and $10.7 billion in 2010, accounting for one-sixth of Pfizer’s revenues. Over its product life, Lipitor has contributed revenues in excess of $120 million to Pfizer.

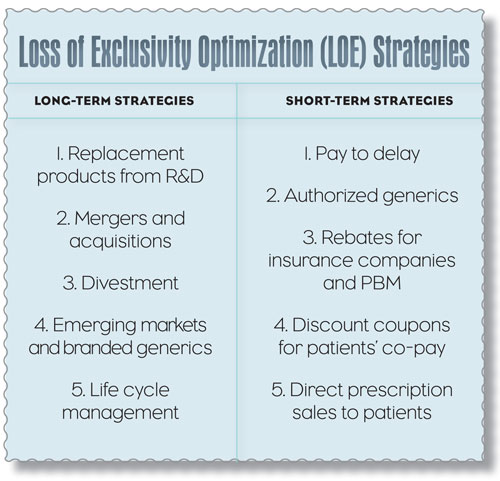

But Pfizer has been preparing for the loss of its patent for Lipitor since its Warner-Lambert acquisition. The patent expiration occurred on November 30, 2011 in the U.S. and it is difficult for any company, even one the size of Pfizer, to compensate for such a loss. Here, we’ll review Pfizer’s unique short- and long-term Loss of Exclusivity Optimization (LOE) strategies (see chart, page 45), as they intensely focused on retain- ing market share during the 180 days immediately after Lipitor’s patent expiration.

First, a bit of background: Atorvastatin is a high potency HMG CoA reductase inhibitor, commonly referred to as a statin. Atorvastatin is the largest product in this class with more than 3 million patients taking Lipitor in the U.S. in 2011. Sales volumes for statins began to decrease when Zocor (simvastatin)’s patent expired in 2006. A shift back to branded products in this class of lipid regulators occurred in mid-2011 when FDA issued safety warnings about high dose simvastatin and increased risk of muscle damage. Now with the availability of generic atorvastatin, one can expect further therapeutic substitutions from Crestor to atorvastatin since there is no clear therapeutic advantage to this more expensive branded product.

Pfizer’s innovative strategy

Pfizer’s initial strategy was focused on innovation. Its goal was to cushion the blow of patent expiration of this blockbuster product by having a portfolio of new replacement cardiovascular and metabolic (CVMED) products that would also be blockbusters. This would enable continued relationships with key opinion leaders and maintain therapeutic expertise for its primary care sales force. But these efforts have not been successful, as development compounds faced high attrition, including some notable late stage failures. Torcetrapib, for example, was expected to raise HDL and would have been an ideal companion product to promote with Lipitor, but was terminated due to safety concerns observed in Phase III studies.

In November 2006, Pfizer publicly presented information about its CVM R&D clinical development projects. They optimistically indicated expected market opportunities of $100 billion for these assets. How- ever, nearly all the drugs disclosed at that time have not progressed to successfully launched products.

M & A, Divestment And Emerging Markets

Pfizer’s other corporate growth strategies included mergers, acquisitions and divestments. Most notably, the merger with Wyeth in 2009 was an attempt to replace lost revenues and strengthen its R&D pipeline. Wyeth had significant expertise in biopharmaceutical products, including vaccines. Their product stream with enhanced revenues, along with planned operational efficiencies, was intended to strengthen Pfizer’s future stability, but the financial success of such a significant merger takes many years to assess. Cost cutting will likely be a drive for profit growth in the short term. Pfizer has also explored divestment as another option to grow near-term revenue. The company sold its Capsugel hard capsule asset for $2.4 billion in 2011, recently announced it had reached an agreement to sell its nutrition unit to Nestle for nearly $12 billion, and disclosed its intention to divest its animal health division. Sale of these assets not only brought in revenue, but also allowed Pfizer to increase its focus on pharmaceutical products.

In its drive to maximize profits for Lipitor and other mature assets within the pharmaceutical division, Pfizer restructured its organization with two new business units focusing on Established Products (such as international branded generics) and Emerging Markets. In 2011, the company saw a decrease of 3% from 2010 in its primary care unit, which included Lipitor sales, but an increase of 7% in its emerging market unit.

LIFE CYCLE MANAGEMENT

Since Lipitor’s launch in 1997, Warner-Lambert and Pfizer made significant life cycle management efforts to expand its labeling claims and improve the drug’s position- ing relative to other statins. More than 20,000 patients participated in 500+ clinical studies with Lipitor. Another key Pfizer effort related to clinical studies in pediatric patients with heterozygous familial hypercholesterolemia. Although this is an extremely small population, investment in these studies garnered Pfizer an additional six months of market exclusivity for the entire product based on the Hatch-Wax- man pediatric exclusivity provision. With the release of Caduet, Pfizer developed a product line extension. This combination product contains amlodipine for hypertension and atorvastatin calcium for lipid lowering. For minimal development costs, Pfizer was able to provide a convenient product and enhance sales return for two of its branded cardiovascular drugs. But the patent on this product expired in the U.S. at the same time as the Lipitor loss of exclusivity. Caduet revenue was $538 million in 2011. Hopes for another life cycle management option for Lipitor as an OTC product seem remote based on Merck’s previous efforts to achieve non-prescription status for Zocor (simvastatin) over concerns about a patient’s ability to discern the need for this treatment.

MAXIMIZING Lipitor SALES

Pfizer pressed on in their attempts to maximize sales for Lipitor before its patent expired. While many companies make significant cut backs in sales expenditures to aging assets, Pfizer continued to invest heavily in sales promotion for Lipitor. This included physician detailing, professional journal advertising, sampling, and direct to consumer advertising (DTCA). Over its product life, Lipitor has been the most heavily advertised prescription drug in the U.S. IMS Health noted that Lipitor ranks first in DTC spending since 2008, and last year, Lipitor was the most heavily promoted drug on television and greatest for overall DTCA spending. Although Pfizer’s TV advertising spending decreased 14% from 2010, Nielsen indicated that in 2011 Pfizer invested more than $150 million on TV ads for Lipitor in the U.S. Its overall advertising spending was in excess of $270 million in 2010 and $220 million for 2011. This was a significant expenditure for a product with a looming patent expiry. Pfizer invested more heavily in DTCA for its other products than any other company last year, spending more than $1 billion.

FACING GENERIC COMPETITION

A pay-to-delay negotiation with Ranbaxy in 2008 resulted in a delay of a generic competitor to Lipitor from June to Nov 2011. Pfizer also signed Watson to be its authorized generic partner, although Pfizer retains significant profit (estimated 70% of the price) from this arrangement for Watson to sell this Pfizer-manufactured atorvastatin product. For six months, these were the only two companies able to compete with Pfizer for atorvastatin sales. Pfizer also negotiated with Mylan to allow a generic launch of Caduet as of November 30, 2011. As of the end of this May, competition sharply increased with multiple new competing companies launching generic atorvastatin products and falling prices for the product.

In an unprecedented maneuver in 2006, Merck lowered its price for branded Zocor to below Teva’s simvastatin during the 180-day exclusivity period, thus hoping to retain patient share. Pfizer also did not idly sit by and watch its sales erode in 2011-2012. They instigated several new strategies to retain as significant a market share as possible. These included negotiated rebates with the insurance providers and pharmacy benefit managers, such as Medco, Coventry Health Care Inc., and United Healthcare to reduce costs of Lipitor to less than competing generic atorvastatin for six months. In November 2012, United Healthcare announced the co-pay for branded Lipitor would be less for Lipitor than generic atorvastatin until May 2012. Pfizer directly appealed to patients in a program known as “Lipitor for You.” Patients would receive Lipitor for $4 a month, enabling them to save up to $75 in co-pays per month. The company also arranged direct prescription sales to patients at prices competitive with generics, and for a specialty pharmacy company to dispense Lipitor by mail and bill payers.

In addition, Pfizer sought support from other health professionals by paying pharmacies to mail information to their patients about the $4 copay card. Despite the cost cutting measures, it is estimated by analyst Dr. Anderson from Sanford Bernstein that Pfizer’s profit for a 90-day supply of Lipitor would be $100. Although this is a substantial reduction from its previous estimated profit margin of $250 for a three- month prescription, it enabled Pfizer to retain a larger patient share during this 180-day exclusivity period.

Pfizer was unable to weather the major negative impact of its loss of Lipitor exclusivity, suffering a 19% decline in earnings, 7% decrease in revenue, and a 42% decline in Lipitor global sales from 1Q2012 compared to 1Q2011. On a more positive note, they retained $383 million in U.S. sales. Pfizer’s market share of approximately 30% at the end of 180-day exclusivity exceeded expectations. Ranbaxy’s estimated earnings were $600 million, and they have more than 50% market share in generic atorvastatin. Watson seemed to have the greatest struggle in this three-way competition.

Now that the May 29, 2012, deadline has been crossed, more generic atorvastatin products have been launched. One can expect more significant price completion and a falling market share for Pfizer. During its 180- day war Pfizer displayed some innovative strategies for retained value before falling off the patent cliff for Lipitor. It will be interesting to see how many of these techniques are deployed with other near-term patent expiries like Actos notes?