Pharmaceutical companies often use patient longitudinal data to answer a specific business question or to track patient treatments over time. Different types of longitudinal data are used and the sources of data can be retail pharmacy prescription claims, hospitalized patient billings and medical claims data, as well as various surveys and patient diaries. The specific type of data required will vary depending upon the business questions asked.

For example, questions regarding uses of a drug with multiple disparate indications may require medical claims data to answer some questions while physician administered drugs for hospitalized patients require another. Longitudinal pharmacy prescription data are used to:

- Calculate patient compliance and persistency on a medication.

- Track sources of business (switches, new-to-therapy, concomitant therapy).

- Determine sequence of alternative drug therapies.

- Uncover patient types being started on or removed from a drug.

These are only a fraction of the important business questions that can be asked and answered by these data sources. The predominant uses of longitudinal data tend to be those used to inform pharma of what has already happened—important, yes, to assess past activity and determine what could be done differently and better moving forward.

But, these data should also be used to drive the proactive strategic and tactical management of products. To do so, one needs to know what questions to ask. It is also helpful to have a mechanism by which additional insights can be obtained about patients in the data set based upon their prescription filling behaviors and demographics. And, it is even better to be able to link the patients back to their prescribing physicians to generate additional opportunities for pharma.

To best demonstrate these more robust, proactive capabilities of patient longitudinal data, it is helpful to consider two example business scenarios:

1. Quantify Patient and Physician Causes of Poor Drug Persistency

Pharmaceutical companies dedicate enormous amounts of resources into generating new patient starts but comparatively little in truly understanding and intervening on the causes of therapy discontinuation. Those that do take steps typically focus on patient interventions with prescription (Rx) fill reminders and patient education efforts. However, it is also useful to understand the financial return-on-investment of specific patient aids, education programs, Rx reminders, etc.—as well as if there are physician-based contributors to poor persistency.

Longitudinal Data Solution:

- Use longitudinal database to identify 5,000 highly persistent patients and 5,000 patients with short persistency with therapy of interest.

- Field a quantitative research survey to these patients using their pharmacy as an intermediary to understand what patient aids are being used, what drug instructions are received, patient understanding of therapy, etc.

- Note: Prior qualitative and/or secondary research can help inform about available resources and issues, which should be explored in patient quantitative research.

- Compare and contrast the survey results from the two disparate patient persistency groups to identify correlations and to control for key patient demographics (e.g., age, sex, insurance type, co-pay and average income of patient zip code).

- Analysis can quantify the financial benefit (additional Rx refills) of prolonged persistency associated with specific patient aids, education programs, etc.

- Link high and low persistency patients back to their prescribing physicians and segment physicians based upon their relative mix of persistent therapy patients.

- Some physicians will clearly have a higher proportion of highly compliant patients while others will have a greater share of poorly compliant patients.

- Field quantitative market research survey to sub-groups of physicians from the high and low persistency groups to determine the physician-centric contributors to poor patient persistency.

- Office resources, nurse instruction, physician beliefs and attitudes, etc.

An approach similar to this makes pharmacy Rx longitudinal data a very useful forward-looking strategic resource. It also enables quantification in prescription or financial terms of variables that can negatively or positively affect prescription filling. Some of these contributing variables may be beyond a pharma company’s control (patient income, age, gender, physician staff, etc.), but others, such as a patient’s out-of-pocket expense or a physician’s misperceptions about a brand are certainly actionable. In addition, by linking specific patient prescription behaviors back to their prescribing physicians, interventional efforts can be more cost-effectively targeted to physicians where the benefits can be realized across many of their patients.

2. Design Co-Pay Assistance that Drives Incremental Business While Maximizing ROI

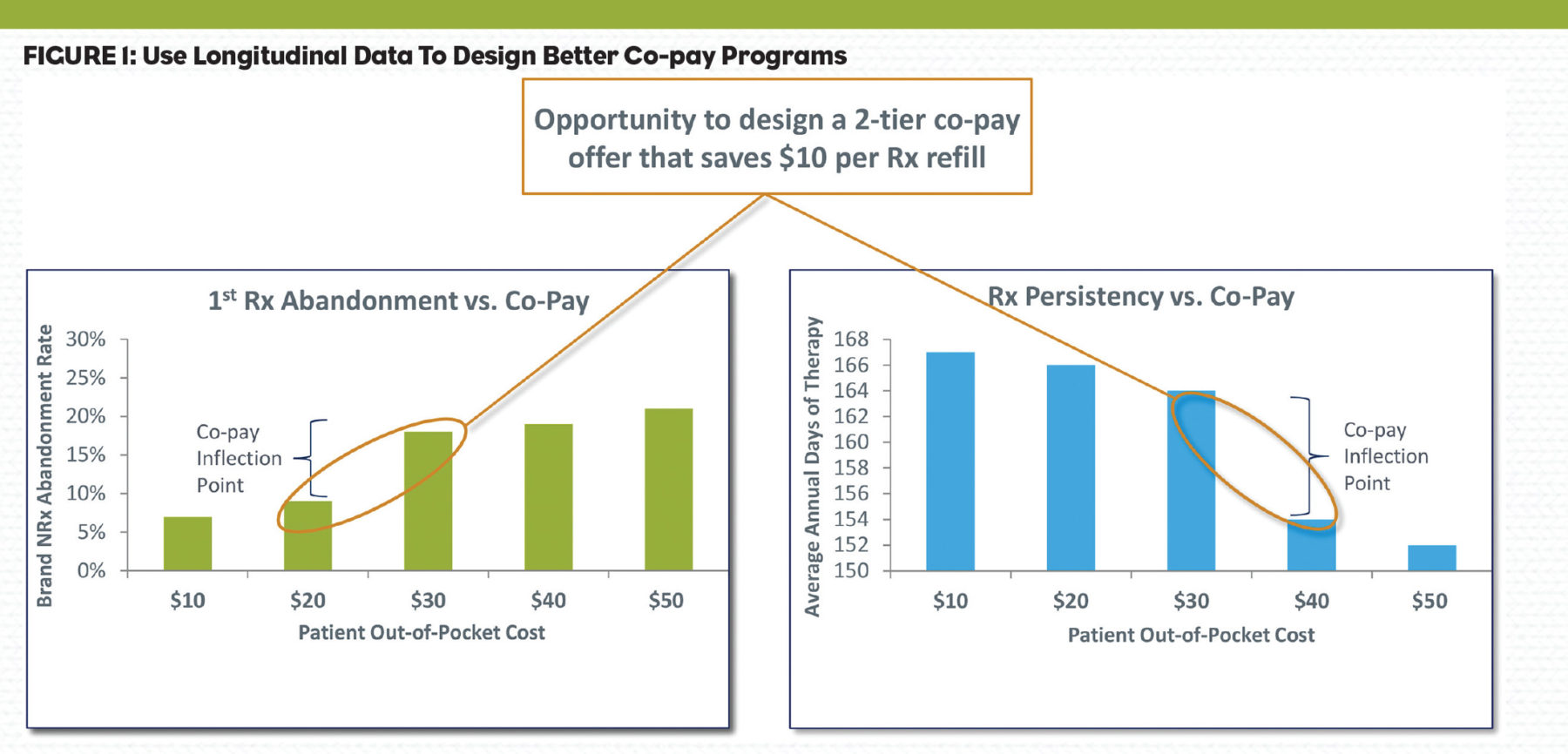

Many companies employ co-pay card programs to alleviate patient financial hurdles associated with insurance coverage and formularies. Pharmaceutical managers can assume this patient out-of-pocket responsibility may be contributing to prescription reversals and discontinuation. But often, little analysis is performed to precisely quantify this hypothesis. The end result is a co-pay offer that may be modeled on an existing competitive offer and/or a desire to get patient out-of-pocket responsibility down to some pre-determined level. Unfortunately, this offer may not be optimal for a specific brand. Furthermore, any analysis of the offer is typically restricted to patients who actually fill their prescriptions and have co-pay redemptions—and may not include patients who abandon their first prescription, which can be a very significant number (Figure 1).

Longitudinal Data Solution:

- Determine first Rx abandonment rates associated with various patient out-of-pocket costs.

- Determine the average persistency associated with various patient out-of-pocket costs.

- Note: Analog product(s) can be analyzed for brands not yet launched.

- Assess the Rx abandonment and persistency of competitive brand prescriptions with versus without co-pay card redemptions.

- Identify any differences in persistency associated with the specialty of prescribing physician.

- Assess above abandonment and persistency metrics by major managed care payers.

Sometimes patients are more willing to pay more for a product they know works, but show less of that willingness to pay before they have tried the product. This can create an opportunity to reduce excess redemption expenses.

Insights such as these can help pharmaceutical companies design the co-pay offer best for them at launch, adjust it appropriately post-launch as certain strategic objectives are met, and then actively manage the program to maximize ROI. Of course there are additional measures of co-pay program performance that can be used to rigorously assess and improve their ROI. Assessing “spillover” by analyzing total new patient starts for a brand at the physician level and comparing to physician’s co-pay card redemption volume is one such opportunity.

These examples highlight just two of the uses of longitudinal data that take this resource from primarily a reporting and tracking tool to a valuable brand management planning resource. Some other example questions that can be answered with a partner skilled in longitudinal data analysis include:

- How do various starting doses on a drug correlate to therapy discontinuation?

- Could higher starting doses cause side effects that result in discontinuation?

- Which physicians aggressively titrate doses upwards to treat conditions (efficacy focused) vs. those who are less aggressive and perhaps more concerned with avoiding side effects?

- Which physicians go to a certain drug class for therapy earliest in their patients’ treatment?

- Which PCPs are prescribing for patients prior to them being prescribed a brand by a specialist?

- Helps create a relationship network of physicians based upon patient movement.

- Among prescribers for a brand, which are actively switching patients from a competitor?

- For a diagnostic product, which physicians have the most unique patients filling certain prescriptions (not the same, as most prescriptions can be affected by duration of therapy)?

- Is total Rx cost reduced for patients after they start on a brand, indicating an improvement in health?

- How does patient compliance and persistency compare for a brand vs. a competitor?

- Does it vary by managed care plan?

In addition, the ability to field large scale quantitative market research to patients whose prescription filling behavior is already known (persistency, prior therapies, etc.) is immensely powerful. These specific patient types can be linked to their prescribing physicians, which opens a whole new avenue for market segmentation and target prioritization to pharma marketers. It is indeed time to get more value from longitudinal data.