Pharmaceutical marketers are held increasingly more accountable for demonstrating how marketing investments translate directly into sales. While an emphasis on return on investment (ROI) is commonplace, finding and appropriately using the metrics necessary for analyzing tactics can be a daunting task. Effective metrics aren’t just nice to have. For the pharma industry, they provide critical information to help companies determine the impact on awareness, prescription volume, patient behavior and outcomes.

When it comes to evaluating the effect on prescription volume, quantitative analysis is particularly applicable and yields the most precise computation of ROI. By combining traditional matched-panel research with an in-store experimental design, analysts can evaluate actual pharmacy-provided prescription data to determine the success of pharmacy-delivered initiatives. In addition to providing actionable data that drives and supports future decisions, an appropriate measurement strategy also helps brands achieve a higher return.

Rewriting The Script For Pharma Marketing

Changes in the way that patients access product information and shifts in healthcare delivery methods are among the numerous drivers that are continually changing the way pharma marketers do business. Strategists can now employ a number of tactics including direct-to-consumer (DTC) advertising, marketing to healthcare providers, sampling and continuing education programs. In-pharmacy strategies, however, deliver unique opportunities for high-quality assessment of results, especially for brands focused on patient acquisition and awareness.

“There are few places pharmaceutical marketers can get a quantifiable dollar-for-dollar measure on their ROI,” says Bill Liebman, president of Retail Intelligence, Inc., a leader in pharmaceutical marketing analysis. “However, the in-pharmacy research is one of the few places in the media plan where we can isolate sales figures, put them into an algorithm and generate a quantifiable ROI.”

With an estimated 275 million customers visiting weekly and more than 80% of all prescriptions filled in retail pharmacies, this is a powerful channel in terms of size and traffic. Addressing consumers in this setting offers a number of benefits as a media vehicle. In addition to reaching a large consumer audience, marketers are able to target messaging based on in-store placement.

Begin With The End In Mind

The business proverb of “that which can’t be measured, can’t be managed” demonstrates the importance of analyzing marketing effectiveness. It is important for today’s pharmaceutical marketers to define and deliver quantitative results that justify expenditures. Therefore, it is essential to establish metrics at the outset of any program.

When establishing measurement criteria, remember that individual brand goals may vary widely based on the stage of the drug in question. While a one-to-one return may be a minimum goal set for a new brand, more established brands desire a higher result, akin to four-to-one or even higher in certain niches. ROI is not the ultimate indicator of a program’s success, but it does provide certain benefits:

- It creates connections between efforts and impact, providing data-driven examination of marketing spends.

- It provides decision-makers with increased clarity on how and why dollars are spent.

- It causes marketers to eliminate or retool projects that are not effective.

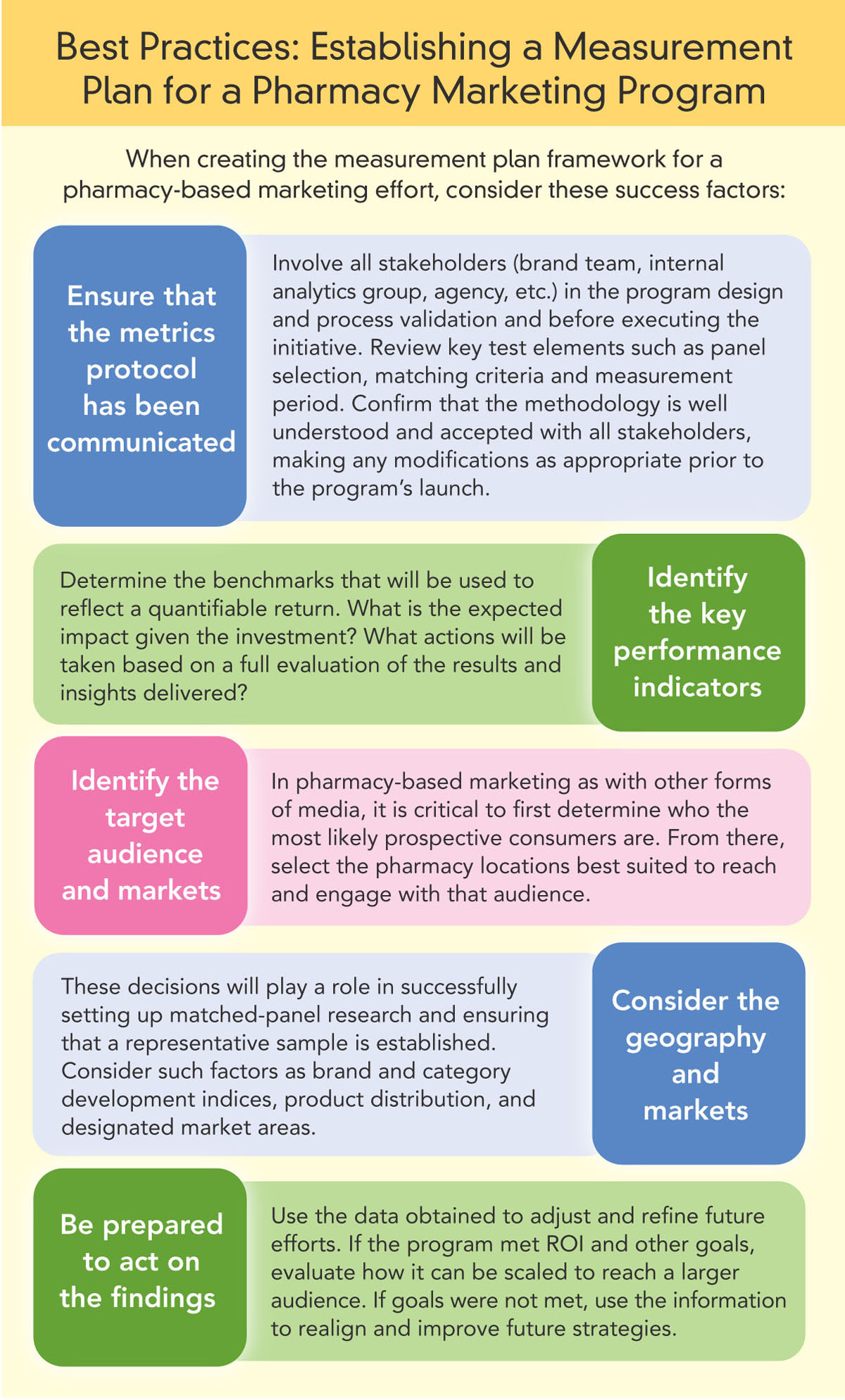

Once goals have been determined, a quality measurement plan should be put into place (see graphic below). Begin by deciding which key performance indicators should be examined. Critical success factors to consider include patient numbers, prescriptions (refill, new and total), sales and patient outcomes. While sales numbers have the most direct impact on ROI, other diagnostic metrics may include brand awareness, incidence of stores filling prescriptions, website traffic, incentive use and other factors.

Demystifying Quantitative Measurement Methodologies

Brands understand the critical importance of obtaining credible data to substantiate expenditures and returns for marketing initiatives. Obtaining this data requires a carefully crafted strategy of measurement methodologies. One of the most effective assessment models involves a combination of matched-panel and experimental design.

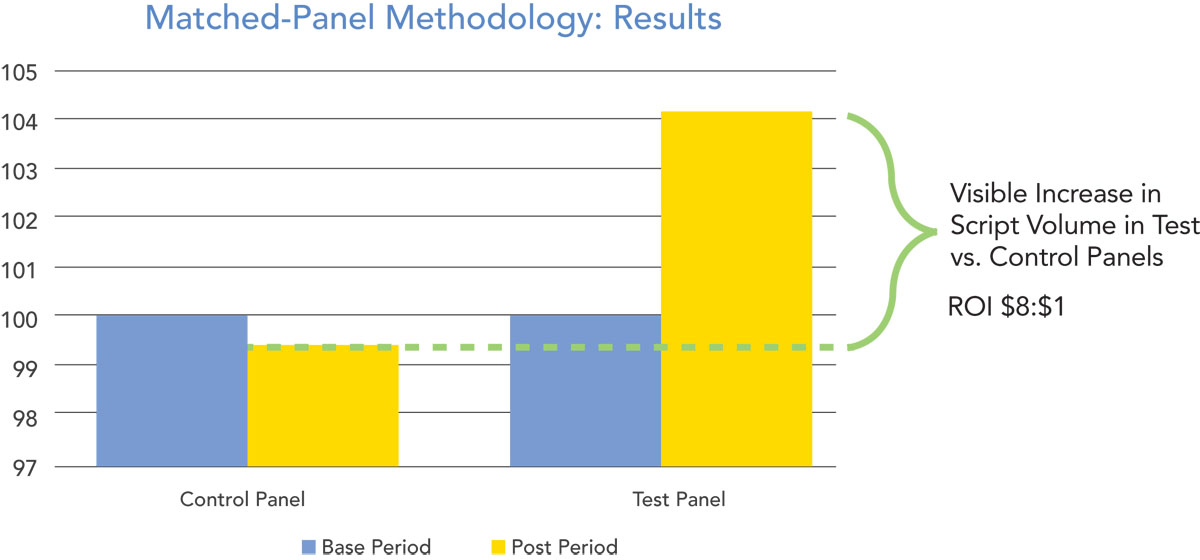

Matched-Panel Research: In matched-panel research, pharmacies are selected based upon a finite set of criteria including size, sales volume, consumer demographics and geographic location. These pharmacies are separated into carefully paired test and control panels. Prior to the execution of a consumer marketing effort, both panel groups of stores are followed for a period of six to eight weeks. The goal is to establish a baseline measurement and to ensure the compatibility of the matched panels, since the collected panel data should mirror one another.

Experimental Design: Once the base numbers have been established in both groups—the control and test stores—the marketing effort and experimental-design method is launched. With close collaboration from the individual pharmacies, detailed sales data is collected for a pre-determined period and changes in sales figures are analyzed.

Good Alone, But Better Together: The strength of the combination of matched-panel research and experimental design lies in the isolation of the variable (in-pharmacy program) to the test panel. By comparing differences between the control and test panels, researchers can determine an industry-accepted measure. “We can determine that the increased volume in the test stores is a direct result of the program,” says Liebman. “From that number, we can calculate a dollar-to-dollar ROI.”

This merging of matched-panel research and experimental design offers a level of accuracy not available in other methodologies. The unique matrix employed establishes a high confidence level in the data obtained, proving a measurement’s accuracy. Along with a significant level of accuracy, the methodology provides additional benefits including:

- Data that reveals a program’s direct impact on volume based on actual prescription sales information.

- The ability of brands to launch pilots in smaller markets before launching more expanded efforts.

- Clarity of results.

ADHD Brand: A Case Study

The matched-panel research and experimental-design technique was used to determine the effectiveness of a program for an ADHD prescription medication. Recognizing the sizeable audience that could be reached, the brand chose to deploy in-pharmacy tactics to achieve its goal of educating consumers who might be considering ADHD treatment for themselves or for their child. Matched panels were established based on geographic location, demographics and prescription volume. In the test stores, two versions of a shelf-placed information dispenser were created and placed in the store sections (pediatric analgesics or vitamins) that most closely correlated with the target audience. At the end of the test and post periods, quantitative data revealed an average lift in prescription volume of more than 4% in test versus control panels. The resultant ROI exceeded 8:1.

Don’t Count Out Quantifiable Metrics

Pharmaceutical companies have a number of options available to them when marketing their products. Because of the ability to apply quantitative data, the pharmacy is a natural channel in which to focus. To ensure a desired return and to better tailor tactics, it is important to create a metrics-driven process and culture. This includes establishing quantitative measurement strategies that identify specific and actionable data regarding sales volume. In a time when every dollar counts, in-store programs, when executed properly, provide a distinct advantage due to their ability to target consumers, deliver specific messages and determine quantifiable and specific dollar-to-dollar results.