Increased heart rates, light sweating and frequent furrowed brows often accompany discussions about payer strategy within the brand team’s marketing and business planning sessions. Dealing with payers often has the same luster as dealing with the phone company—a necessary but dreaded activity that often results in frustration and less than stellar results.

However, like most things we dread, the sinking feeling we experience has more to do with our lack of information about how the payer environment operates in reality and how we as pharma marketers can bring value to it than it being truly fearsome. Balancing what we want to achieve, which is market access for our products and brands, against what the payer wants—pharmacoeconomic value—is the tricky maneuver we need to execute.

Where to Start with Payers

Change your perspective from the point of view of selling your brand to that of buying your brand—put on the payer mentality. Payers are first and foremost looking for their best alternative(s) within a therapeutic class from both a cost and efficacy perspective—but a few key factors contribute to this evaluation. The first is the clinical profile of your brand. Objectively think about your brand and results of clinical studies. Does your product fit a clinical niche that perhaps the payer hasn’t thought about, or doesn’t know about?

For example, does the brand the payer relies on as a first line or Tier 1 therapy lack the ability to treat all of the patients with the condition they are primarily managing? Use data to identify a specific population and delivery value for a group of patients with a specific clinical profile versus attempting to compete with the established demand and contract arrangements of your competitors.

Look realistically at the demand for your brand. Do you serve a very narrow, niche market, or is your product broadly indicated? We all want to increase the volume for our brand sales, but what is the realistic total market size for your brand? Payers look at utilization and demand when putting together a formulary or preferred drug list, and part of that has to do with whether or not dealing with your brand will pay off for them. Payers pay greatest attention to high volume brands that drive their costs as well as prescriptions with a high price tag. Payers will focus their efforts on deals to manage these situations first before taking on a decision to manage low cost or low volume brands.

Look at how your brand could help a payer solve a problem through a contractual avenue. For example, the data shows that patients in your class of therapy do a lot of switching between brands. It could be advantageous to the payer to implement a step edit, requiring patients to start out on one therapy before advancing to the next. You can position your brand as the logical choice for the starting therapy due to overall tolerance, patient persistence profile and cost advantage, and lock this into a contractual agreement that benefits both you and the payer.

A good way to evaluate if this approach can work for your brand is to conduct a patient-flow analysis through the treatment pathway and determine where your product and your competitors’ products fit in the treatment paradigm. Know how often restrictions are overcome by patients for the payer you are partnering with to better inform your strategy and create common ground with the payer.

Using Data to Create Competitive Advantage

To create an effective value proposition that will get you noticed by the payers you want to do business with, you need to understand the landscape of the class of drugs in which you are playing. The good news is there is a significant amount of data available to help you develop a payer value proposition that can turn the perceived “foe” into a friend of your brand. There are three components of a good payer landscape analysis: Analysis of plan control indices, plan benefit design and payer rejection reasons.

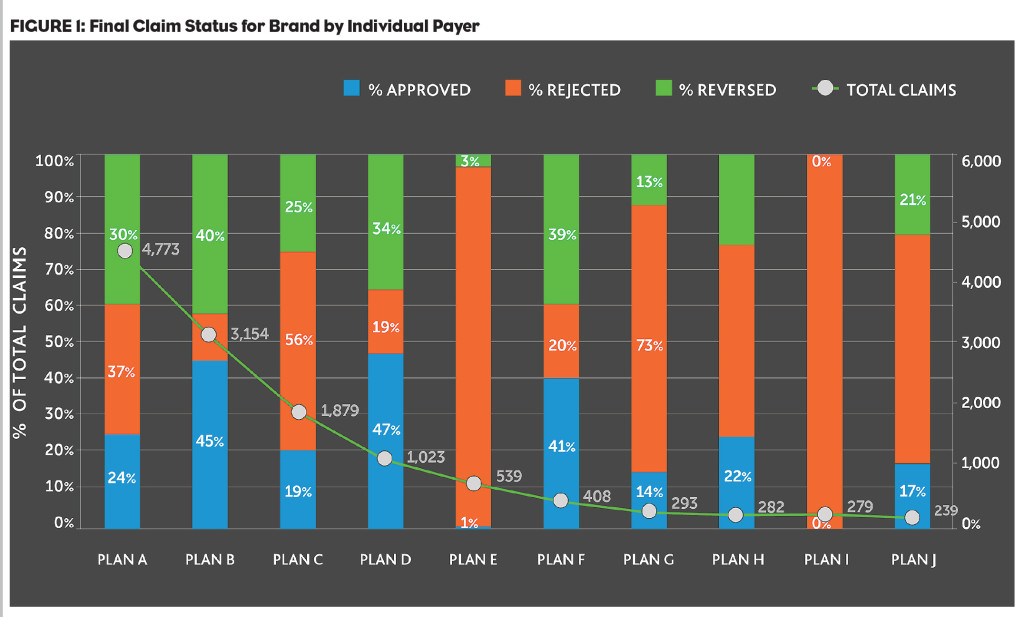

1. Plan control indices are the first component, which can help you determine how payers compare and how the benefit design impacts market opportunity for your brand. For example, in the analysis in Figure 1, the top 10 payers and PBMs are evaluated based on total volume of claims processed and the percentage of claims within each plan that is approved, rejected or reversed. You can clearly see that Plan E, a large national payer, rejects almost all claims for the brand—and at 10% of the total claims for the brand, this is a significant issue that requires deeper investigation to formulate a strategy for optimizing the position within this payer.

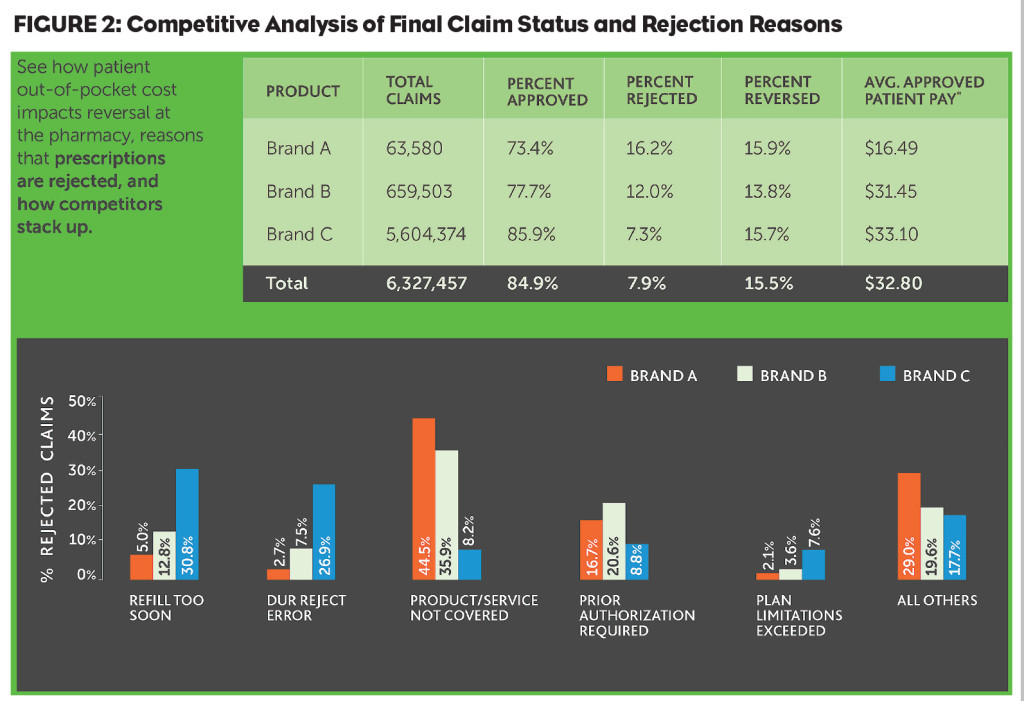

2. Plan benefit design, the second component, can help you understand how brand sales are impacted by various design factors such as co-pay amount and placement in various tier levels. In this example, we see that reversal rates for Brand C are similar to those of Brand A, despite the fact that Brand C is approved at a higher rate than Brand A. When looking at average patient pay for Brand C, we see that the price point is almost double that of Brand A, which could be a factor in the relatively higher rate of reversal.

3. Payer rejection reasons, the final component, can reveal which brands face specific challenges within the payer environment, helping you to competitively position your brand. In the example in Figure 2, Brand A faces the highest rejections for lack of coverage. Brand C’s greatest issue is refill too soon. This very top level view indicates the need for two very different payer strategies.

Strategize to Communicate Value to Payers

Once you are armed with the information you need to make a compelling value proposition for your brand, it is time to strategize about the best way to get this info to the decision makers within the payer environment. Strategies to communicate the value of your brand should be well thought out and should go beyond the negotiation table to the other parties within the payer organization who have an interest in the complete outcomes profile for your brand.

We immediately think about the pharmacy director as the key position to influence, and while they are certainly important, there may be other points of entry that offer a more open path and can ultimately influence a pharmacy director. One of these positions is the medical director. Most health plans today are focused on efficient, quality care that ultimately will keep costs down. This is different than the denial-based approach of past years, and medical directors today are as well-versed in utilization and medical economics as they are in sales and network development. The quality director is another option to explore, as his/her interests lie in managing patient populations more effectively to impact measures for accreditations.

Preparing to talk about your brand to key payer targets shouldn’t feel like you are going into battle against a formidable foe. With a thorough understanding of the payer landscape for your brand using comprehensive, integrated data sources, you can develop a winning value proposition that appeals to the clinical, contractual and/or demand needs of the payer partner you want to win over as a friend of your brand.

Sidebar: Useful Data For Conducting Payer Landscape Analyses

Prescription claims data, which represents the flow of prescription transactions between pharmacies and payers and measures the count of approved, reversed and rejected claims, is the most useful data type for conducting payer landscape analyses. This data may include what is known as “final claim status” only, or it may include the full lifecycle of transactions. Final claim status is the final disposition of the claim—approved, reversed or rejected.

This is useful information, but to understand the true landscape for your brand, lifecycle data provides a significantly enhanced picture. Lifecycle data reveals the full path of transactions that occur leading up to and including the final claim status, which lets you know exactly when and where your brand may have been switched or substituted for another brand and why.

Claims data can also provide visibility into primary and secondary payers, which aids in evaluating the effectiveness of patient assistance programs through linking all transactions associated with a specific prescription event—even though they may be paid by separate payer entities.

When evaluating claims data, look for samples that are not payer-biased. While these types of samples can offer good analogs, they are not good for tracking patients over time and across plan, name, address or practitioner changes that frequently happen on an annual basis.

In addition, good claims data will link not only retail prescription claims, but also mail-order claims to a named payer/plan. It is important to have information about plans at a very granular and local level so that you can easily pinpoint problem areas within a specific geography or employer group. Specific information with concrete examples helps you build a compelling strategy for your payer interactions.