We all know the symptoms. The slope on your total prescriptions (TRx) forecast is approaching zero. Physicians don’t have the time for details. The good managers in your company are increasingly finding excuses to skip your meetings. In short, you’ve got a flat brand.

Is this the end? Has your brand run its course and is now consigned to ride out the back slope of its lifecycle on the way to oblivion, or is it just off track? Is your brand a certified dog, or are there are problems that can be fixed and new opportunities still to be explored?

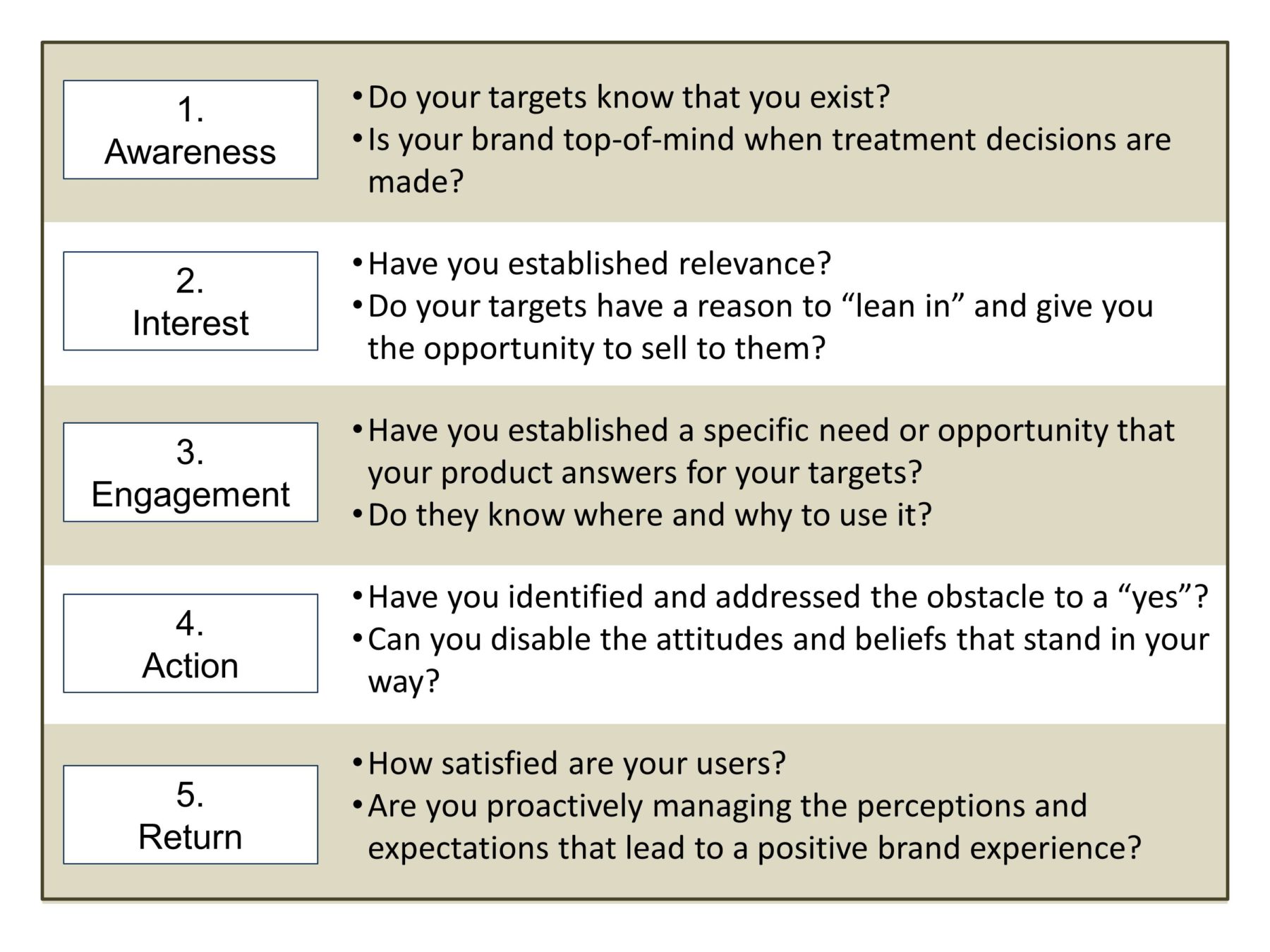

You can answer this with a simple exercise that we call the “Brand Diagnostic.” It breaks down the selling process into five discreet steps from “Awareness” to “Return,” with critical success factors for each step. For 98% of the brands we encounter, a quick review of this tool will generally reveal a major area where the selling process has left the rails, leading to the momentum loss.

If you can find your problem somewhere on this list, it’s probably fixable. To demonstrate this, I thought it might be useful to look at some of the common reasons clients give us for their product doldrums to see what we can learn from this exercise.

1. There’s a Next “New Thing” That Is Getting All of the Attention

If there really is a new thing that’s tearing up your market, what have they done to solve the challenges listed above, especially numbers one and two? Are they outgunning you on awareness? How are they establishing interest and relevance? Are there ways you can you either play off or against the approach that’s producing their success? In many cases the answer will simply lie in better execution, making sure your voice is being heard and your message is being delivered with discipline.

Beyond this, the big challenge in these situations comes when a new entrant uncovers weaknesses in your Engagement and Action steps. Usually, this happens when the reason-for-use you created for your product does not stand up to challenge, or there were lingering objections that you’ve failed to sufficiently dispatch. These can be difficult to correct after the fact, especially while under fire from an emboldened new competitor.

The solution here generally lies in dividing and conquering. Whether establishing that specific reason why the physician and/or patient wants to reach for your product, or overcoming an objection, post-launch these are better done in smaller, focused market segments. Remember, specificity is critical here, and the best way to get specific is to focus on one particular audience set or patient problem at a time.

2. It’s In a Pigeon Hole

My first question here is always, “Is it a legitimate pigeon hole and have you made the most of that opportunity?” I can’t tell you the number of times that I’ve heard clients express concerns about being niched, but when I ask them how much of that dreaded niche they control too often the answer is, “not very much.” Remember, before you walk away from a pigeon hole, make sure you’ve cleaned it thoroughly.

Second, pigeon holes are often just a convenient way for a physician to say no. When they tell you, “I save it for my patients with aspirin allergies,” or “I only use it in patients who complain about sleep,” they’re really saying “I have reasons for not using it in all of my cases.” See item No. 4 above and figure out what you need to do to clear the way for a broader, “yes.”

3. It’s The Victim of Misconceptions or Misinformation

There’s nothing more frustrating than sitting in market research and hearing a physician say that he or she already knows all about your product, and then goes on to demonstrate, if not complete ignorance, glaring gaps in their knowledge. What’s worse, the physician who thinks she or he already knows everything is not likely to make the time to learn what she or he doesn’t know.

The focus here again is on the Engagement step and establishing specificity that your physician can’t ignore. We recently did this very successfully by opening up clinical trial data for one client’s product to reveal details in the study population that aligned with what physicians were seeing in every day practice.

“Forget about general claims,” we said, “let us show you what happened in patients with depressive symptoms,” “people with disabling symptoms upon awakening,” or “people whose symptoms disrupt sleep.” Suddenly we were talking about specific patients the physicians knew and specific challenges they were dealing with every day. Instead of general misconceptions, they now had a very relevant reason to think of our client’s product, and prescribing data responded accordingly.

4. Your Reps Are on Cruise Control

It’s the old adage in pharmaceutical marketing that your most important audiences are often those within your own company. We see it all the time after the excitement (and incentives) of the launch period have worn off and the sales reps can become comfortable just harvesting the business they’ve already developed, especially if they have multiple products in their bag.

This goes back to item No. 3 above, Engagement, but in this case it’s your reps you need to engage. They have to see needs and opportunities in new places, and have a clear direction on how to leverage those needs and opportunities for new scrips. New publications and revised sales aids are often the default in these situations, but regardless of the tactic, the key is what a client friend of mine likes to call, “the hook.” (I can still hear him saying, “All we need is a good story and a solid hook.”) Whether the data are old or new, the sales message on the latest Android device or a photocopy piece of paper, a specific new hook for a rep is as important as a specific new patient application is for a physician.

5. Your Launch Weaknesses Have Finally Caught Up

This is the toughest of the flat-brand challenges to deal with, because it forces you to face the fact that your own oversights and wishful thinking during launch have come home to roost. In these cases we generally find either a poor messaging strategy or a messaging strategy that was poorly executed. This puts you in a situation where you’ve cleaned the market of your low hanging fruit without establishing the strong engagement and convictions you need to sustain the brand over the long term, so there’s no foundation for further growth. When this happens, there’s nowhere to go but down.

If there’s a silver lining in this instance, it lies in the fact that weak launches make weak impressions, so there are fewer lingering negatives to correct. This situation calls for a brand relaunch that includes a thorough interrogation of your market observations and assumptions, in other words, going back to get it right from the start. But don’t overdo it. The key to a successful relaunch is simplicity and executability.

The other opportunity in these situations is that, human nature being what it is, you are almost always likely to find a few physicians and/or patients who have developed their own strong convictions about your product. Their experiences can be productive jumping off points for your re-boot, so you need to know who they are and learn how to spread their experience to your broader audience.

So here you see five very typical flat-brand scenarios, and in every case we can point to specific gaps in the Awareness-Return continuum that have caused the brand to stall. Just as in medicine, diagnosis here can constitute the better part of the cure.

That doesn’t mean the solution is going to be easy, but it does suggest that a cure is possible and likely rewarding. Lifecycle and re-branding work may not have the same cache as a big brand launch, but it is where some of the most fundamental and interesting marketing takes place. There are few better ways to establish one’s credibility as a marketing strategist than to become known as a “fixer.” And there are few better ways to become a successful fixer than to understand this connection between the reasons for a brand’s failure and its opportunities for redemption.