With 92% of covered workers now facing a tiered cost-sharing formulary for prescription drugs, patient out-of-pocket (OOP) costs have become more important than ever. It’s no surprise then, that coupon and co-pay programs have become standard promotional resources for both small-molecule and large-molecule pharma brands. But today’s programs are complex and require a serious investment of resources. Managing them skillfully is both art and science. This article introduces what we’ve found to be five imperatives for coupon and co-pay program success. But first, some of the back story…

A Brief Review

By the latest count, there are now more than 560 co-pay offset programs, an increase of nearly 35% in less than two years. Why the rapid expansion? If drugs represent only a small fraction of U.S. healthcare costs, why is it so important to find ways to reduce patient OOP costs?

Part of the answer is that drug costs make up an outsized portion of patient OOP costs. While drugs represent only about 11% of total healthcare costs, they represent a whopping 43% of patient OOP costs (by far the largest share of patient OOPs). As a result, patients are extremely sensitive to drug co-pays, and they respond positively to co-pay reduction programs.

And patients aren’t the only stakeholders that appreciate coupons and co-pay programs. Doctors like them, too, and believe they benefit patients. According to recent research, two-thirds of physicians agree that co-pay cards improve patients’ adherence to treatment regimens. For an excellent view into the prescriber perspective, one need look no further than a 2013 article by Matthew Mintz, MD. Here’s Dr. Mintz’s real-world view:

“Generics make up the vast majority of medications prescribed. However, many of my patients need branded medications because generics are not available (inhalers for asthma and COPD) or generics alone are not enough (diabetes in particular). Even with excellent insurance, co-pays for branded medications can be difficult for patients, especially when multiple medications are needed. Data shows that out-of-pocket costs for patients can lead to non-adherence. Thus, I (and many physicians) welcome this benefit for our patients. I will use a coupon card any time: 1) I feel a branded product is in the best interest of my patient and 2) a coupon is available.”

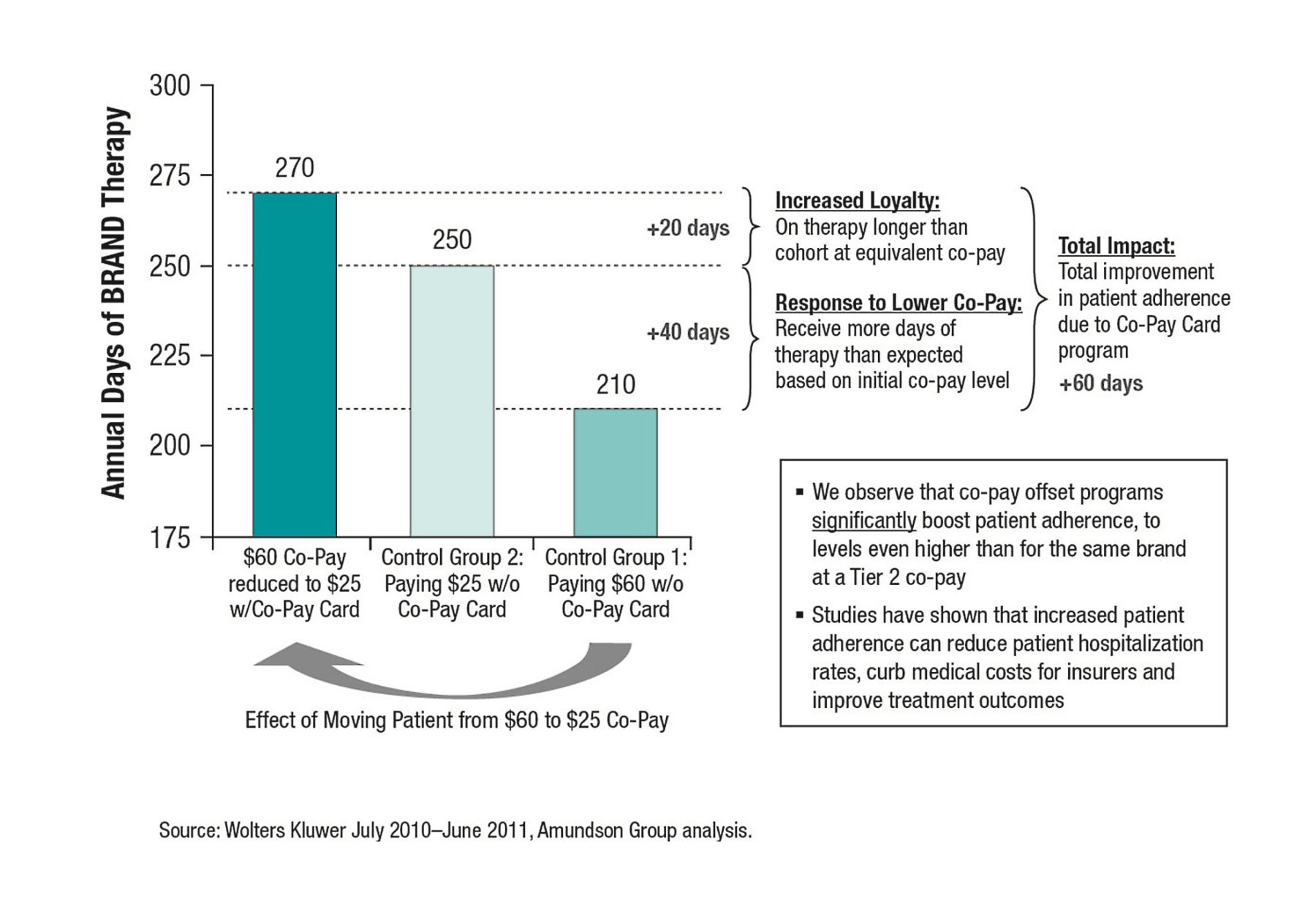

But patient and physician preferences aren’t the only drivers of the growth in co-pay programs. Lots of solid research shows that reducing drug co-pays increases adherence, improves clinical outcomes and can even reduce total healthcare spending. For just one example, consider the data in Figure 1, from Amundsen Group. It demonstrated that co-pay offset programs boosted patient adherence by 60 days, to levels even higher than for the same brand at a Tier 2 co-pay.

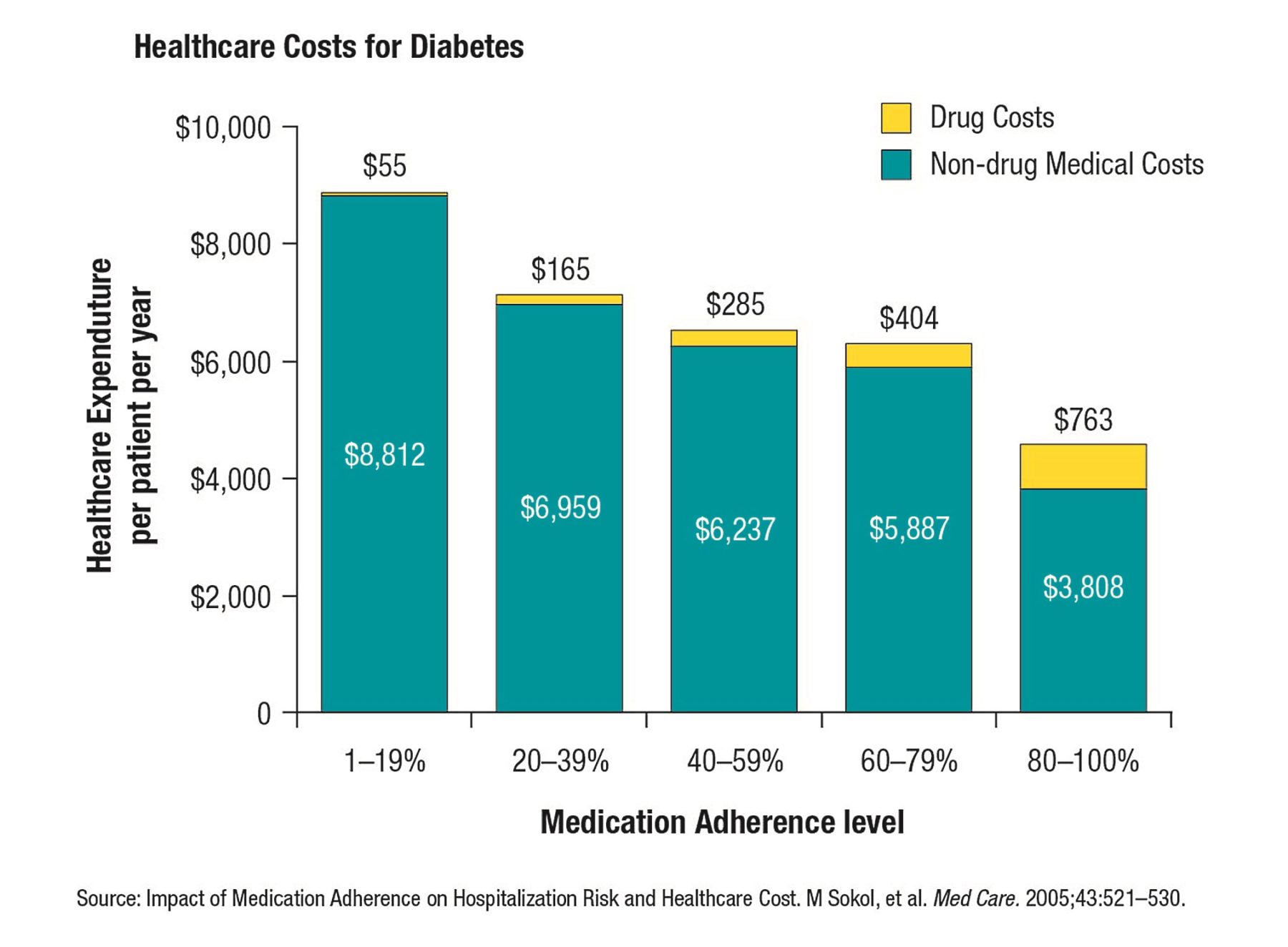

Furthermore, as shown in Figure 2, in chronic diseases a higher level of medication adherence results in increased drug costs (of course) but can actually reduce overall medical costs.

Controversies and Questions

However, not all healthcare stakeholders are convinced of the value of coupon and co-pay offset programs. Some PBMs and payers suggest that these programs lead to less generic utilization. And while that may be true in some cases, let’s be clear that only about 3% of brands with co-pay programs have direct generic competition. As a matter of fact, most co-pay card utilization is for high preferred brand co-pays, not for Tier 3 brands. Real-life data shows that coupons are most frequently used by patients taking the least expensive brands for employers and insurers.

The battle with PBMs and payers isn’t the only issue facing these programs. There’s still an open question about whether co-pay reduction programs may be offered to consumers insured under health insurance policies purchased through the federal- or state-sponsored exchanges under the Affordable Care Act. The availability of co-pay coupons for consumers who purchased their qualified health plans (QHPs) from an exchange was overtly validated by former Health and Human Services Secretary Kathleen Sebelius in her October 30, 2013 letter to Congressman James McDermott, in which she said the following: “The Department of Health and Human Services does not consider QHPs, other programs related to the Federally facilitated marketplace, and other programs under Title 1 of the Affordable Care Act to be federal healthcare programs.” But the final chapter on this question is yet to be written.

In the meantime, despite the controversies and questions, patients still need and want drug co-pay support. And most MDs still agree that co-pay programs improve adherence. And the data is still the data: Reducing drug co-pays increases adherence, improves clinical outcomes and can even reduce total healthcare spending. So coupon and co-pay programs continue to flourish.

The challenge for marketers today is to manage their coupon and co-pay programs in a way that optimizes patient care while maximizing ROI. And that’s where we’ll spend our time in this series.

Imperatives for Coupon and Co-pay Program Success

Coupon and co-pay programs have lots of moving parts, and are nearly always implemented in competitive markets that have even more moving parts. It’s not easy to get everything right. Over the coming months we’ll delve into what we’ve found to be five imperatives for coupon and co-pay program success: Optimal offer development, channel selection, field execution, outcomes measurement and budgeting & finance. If you can get these five right, you’re well on your way to winning!

Sources:

“Attitudes to Co-pay Cards” MM&M (2014)

Center for Medicare & Medicaid Services (CMS) Healthcare Payment Study (2011)

“Impact of Medication Adherence on Hospitalization Risk and Healthcare Cost” Medical Care (2005)

Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2000-2013 (2013)

“One Physician’s View on Drug Co-pay Cards” PM360 (2013)

Wolters Kluwer, July 2010 – June 2011, Amundsen analysis (2012)

Wolters Kluwer Pharma Solutions, Amundsen analysis (2013)

Zitter Health Insights Co-Pay Offset Monitor (2012-2014)