About a year ago, Stephen Dodge wrote a thoughtful article about CRM tools for Medical Science Liaisons (MSLs). In the article, Stephen shared the results of a survey to determine MSLs’ opinion of the state-of-the-art CRM tool for their profession. After almost 40 responses, he identified three key issues for MSLs:

- 98% believed that CRM tools should be easier to use

- 82% said they needed access to customer profiles

- 78% requested compatibility with smartphones and tablets

Additionally, out of the nine CRM tools mention, Veeva was the top ranked over other popular tools such as Salesforce.

In our research, nearly every MSL team—including BMS, Merck, Novartis and others—is using some kind of CRM tool, including Salesforce and Veeva. Most often, these tools are procured by Commercial and extended to Medical Affairs. However, CRM tools were designed for sales and may not always capture metrics which reflect the value of Medical Affairs. For example, the standard metrics within CRM tools for sales (average contract size, sales cycle and win rate) are associated with financial value and do not make sense for Medical Affairs.

As Stephen asked in his article, think about “the very best MSL CRM tool you’ve seen or could envision, what are the features most important to you?” Or stated differently, what is the unmet need for software tools for MSL teams?

In our view, the unmet need is for quantitative and qualitative metrics associated with medical value for the organization.

Metrics that Matter to MSLs

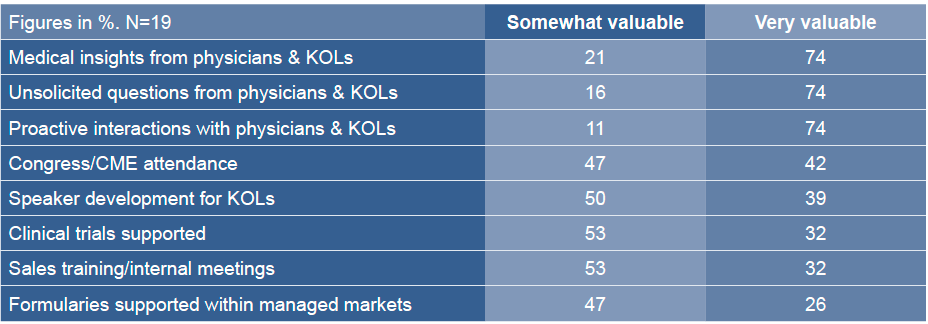

There are metrics that are consistently used across the pharmaceutical industry that assess the more usual measures such as: Visits to KOLs, presentations delivered, research support, medical marketing support, people on advisory boards and papers published in medical journals. Study results from Best Practices LLC (“Roles Resourcing and Management of MSLs,” Best Practices, LLC, Jan 2012) indicate the kind of information that is routinely captured as companies try to elicit as full a picture as possible of what their MSLs contribute to the company (Figure 1).

Figure 1: Quantitative Metrics Rated by Value

Qualitative measures are usually self-reported by MSLs, supported by feedback from managers as well as internal and external customers. Identifying a mixture of both quantitative and qualitative metrics is important to get a full picture of the MSL role, how they perform and what their value is to the business. This is best done with a combination of metrics on a CRM as well as a manager discussion or review in which performance is assessed versus objective plans and KPIs are evaluated.

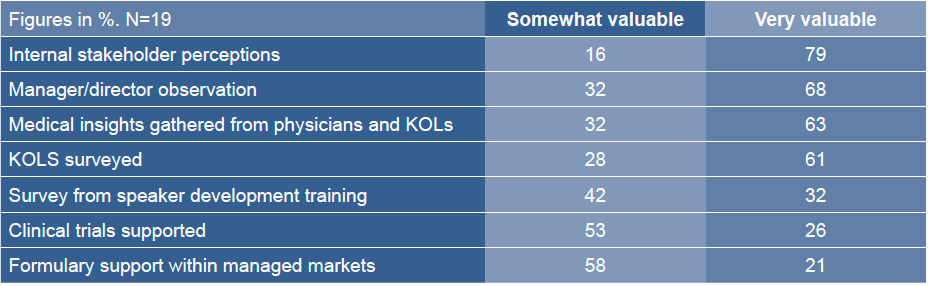

Qualitative metrics are therefore common and Figure 2, using the same Best Practices, LLC data, shows how the same pharma executives perceived the value of various widely used qualitative metrics.

Figure 2: Quantitative Metrics Rated by Value

It is well understood that “internal stakeholder perceptions” are critical and, in Figure 2, the senior pharma executives surveyed gave this as the most valuable qualitative MSL metric ahead of manager/director observation.

As another example, medical value may include scientific data and insights related to the clinical environment, clinical studies, competitive landscape, new molecules, patient pathways or treatment approaches. Taken together, these insights can help identify key trends and issues across regions and may be filtered into medical and other discussions to assess and adapt scientific objectives, activity plans and future strategies.

It is important for MSL managers to contextualise any metrics and to describe the qualitative outcomes of such relationships and why this is important for the short-, medium- and long-term success of the company. This will contribute to the information required to support the value of this function.